Official 153 Massachusetts Template

Key takeaways

Understanding the 153 Massachusetts form is crucial for corporate officers and directors who wish to opt out of workers’ compensation coverage. Here are some key takeaways to consider:

- Eligibility Criteria: Only corporate officers or directors who own at least 25% of the corporation’s stock can elect to be exempt from workers’ compensation coverage.

- Written Waiver Required: To invoke this exemption, eligible officers must provide a written waiver of their rights under the Massachusetts Workers’ Compensation Act.

- Employee Coverage: If the corporation hires any employees other than the exempt officers or directors, it must obtain workers’ compensation coverage for those employees.

- Annual Submission: The completed Form 153 should be submitted to the insurance carrier each year, prior to the renewal of any existing policy, to confirm the exemption status.

- New Form Required for Changes: If there are any changes in the status of a corporate officer or director, a new Form 153 must be filed with the Department of Industrial Accidents.

- Submission Process: The form must be sent to the Department of Industrial Accidents, Office of Investigations, to officially invoke the exemption.

By following these guidelines, corporate officers can navigate the complexities of the 153 Massachusetts form effectively. Always ensure compliance with the relevant regulations to avoid potential penalties.

Documents used along the form

The Form 153 is a crucial document for corporate officers or directors in Massachusetts seeking exemption from certain provisions of the Workers' Compensation Act. Alongside this form, several other documents may be necessary to ensure compliance with state regulations and to maintain proper business operations. Below is a list of related forms and documents that are often used in conjunction with Form 153.

- Workers' Compensation Insurance Policy: This is a mandatory document for businesses that employ individuals other than corporate officers or directors who have exercised their right to exemption. The policy provides coverage for work-related injuries and illnesses.

- Form 102: This form is used to report an employee’s injury or illness to the Department of Industrial Accidents (DIA). It is essential for initiating a claim for workers' compensation benefits.

- Form 130: This is a notice of appeal form used when a party disagrees with a decision made by the DIA regarding workers' compensation claims. It initiates the appeals process.

- Form 140: This form is a request for a hearing before the DIA. It is often used when there are disputes regarding benefits or claims that need resolution.

- Employee Acknowledgment Form: This document serves to inform employees about their rights and responsibilities under the workers' compensation system. It is important for ensuring that employees understand their coverage and claims process.

- New York Operating Agreement - Essential for LLCs, this document outlines management structure and procedures. More details can be found at https://nydocuments.com.

- Corporate Bylaws: These are internal rules governing the management of the corporation. They may outline the responsibilities and powers of corporate officers and directors, which can be relevant when discussing exemptions under Form 153.

- Annual Workers' Compensation Report: This report is submitted to the DIA to affirm that the business is compliant with workers' compensation regulations. It may also include updates on corporate officers or directors' exemption status.

Utilizing these documents effectively can help corporations navigate the complexities of Massachusetts workers' compensation laws. It is advisable to keep all records up to date and consult with legal professionals when necessary to ensure compliance and protect the interests of the business and its employees.

Document Information

| Fact Name | Fact Description |

|---|---|

| Governing Law | The form is governed by Chapter 169 of the Acts of 2002 and M.G.L. c. 152, §1(4). |

| Purpose | This form allows certain corporate officers or directors to exempt themselves from workers' compensation insurance requirements. |

| Eligibility | Corporate officers or directors must own at least 25% of the corporation's stock to qualify for exemption. |

| Waiver Requirement | Eligible officers must provide a written waiver of their rights under the Massachusetts Workers' Compensation Act. |

| Submission | The completed form must be submitted to the Department of Industrial Accidents for the exemption to take effect. |

| Employee Coverage | If the corporation hires any employees other than the exempt officers or directors, it must obtain workers' compensation coverage for them. |

| Signature Limit | All eligible corporate officers must sign the form, but there can be no more than four signatures. |

Popular PDF Forms

Informal Probate Massachusetts - Petitioners are instructed to note the qualifications of the nominee for personal representative.

Mass Dor Tax Forms - Fill out the tax year for which you are seeking relief from tax liability.

To facilitate a smooth transaction, using the New York Boat Bill of Sale form is essential, as it clearly outlines the details of the sale and protects both parties involved. For those looking to obtain the necessary documentation, visit PDF Templates to access the form conveniently and start the process without any hassles.

Massachusetts Harassment Prevention Order - The information provided will be used by law enforcement to enforce the court’s decision.

Guide to Writing 153 Massachusetts

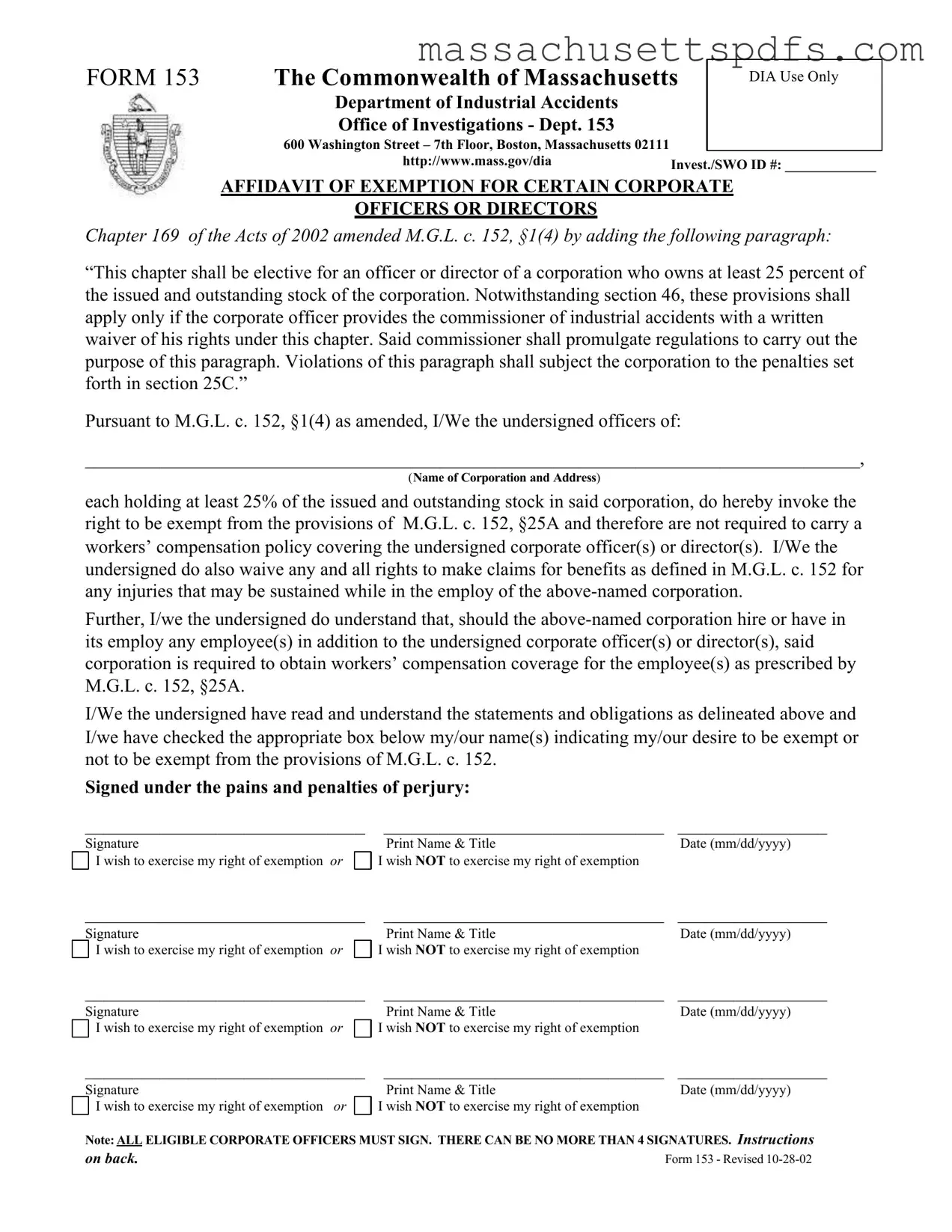

Completing the Massachusetts Form 153 is a straightforward process, but attention to detail is crucial. This form allows corporate officers or directors who own at least 25% of the company’s stock to exempt themselves from certain workers’ compensation requirements. Follow these steps carefully to ensure that the form is filled out correctly.

- Obtain the Massachusetts Form 153 from the Department of Industrial Accidents website or any relevant source.

- Fill in the Name of Corporation and Address section at the top of the form.

- Enter the Invest./SWO ID # if applicable, in the designated space.

- Each eligible corporate officer or director must print their name and title in the appropriate sections provided.

- Indicate whether you wish to exercise your right of exemption or not by checking the corresponding box below your name.

- Sign the form in the designated signature area. Ensure that all signatures are completed by eligible corporate officers.

- Fill in the Date (mm/dd/yyyy) next to each signature.

- Make sure that no more than four signatures are included on the form.

- Review the completed form for accuracy and completeness.

- Submit the completed form to the Department of Industrial Accidents at the address provided on the form.

After submission, keep a copy of the completed form for your records. If there are any changes in the status of corporate officers or directors, a new Form 153 must be filed. This process ensures compliance with Massachusetts regulations regarding workers’ compensation exemptions.

Similar forms

The Form 153 in Massachusetts, which serves as an affidavit of exemption for certain corporate officers or directors from workers' compensation insurance, shares similarities with several other documents. Each of these documents pertains to exemptions or waivers related to workers' compensation or corporate governance. Below is a list of these documents and their similarities to Form 153:

- Form 1 - Application for Exemption from Workers' Compensation Insurance: This form allows employers to apply for an exemption from the requirement to carry workers' compensation insurance. Like Form 153, it requires the submission of specific information and signatures from corporate officers who meet certain criteria.

- Form 2 - Waiver of Rights to Workers' Compensation Benefits: This document is used by employees to waive their rights to claim workers' compensation benefits under specific circumstances. Similar to Form 153, it involves a voluntary relinquishment of rights and requires signatures to validate the waiver.

- Colorado Divorce Settlement Agreement Form: To finalize your divorce proceedings, utilize the essential Colorado Divorce Settlement Agreement form to ensure all terms are clearly outlined and legally binding.

- Form 3 - Corporate Resolution for Exemption: This form is a formal declaration by a corporation's board of directors to exempt certain officers from workers' compensation coverage. It parallels Form 153 in that it involves a corporate decision and must be signed by authorized individuals within the corporation.

- Form 4 - Notice of Exemption from Coverage: This document notifies the relevant authorities about a corporation's decision to exempt certain officers from workers' compensation insurance. It is similar to Form 153 in that it serves as an official communication regarding exemptions.

- Form 5 - Certification of Corporate Officer Status: This form certifies that an individual is a corporate officer and meets the criteria for exemption. Like Form 153, it requires verification of ownership and status within the corporation.

- Form 6 - Employee Exemption Request Form: This document allows employees to request an exemption from workers' compensation coverage based on specific qualifications. It shares the same purpose as Form 153, which is to establish eligibility for exemption based on ownership stakes in the corporation.