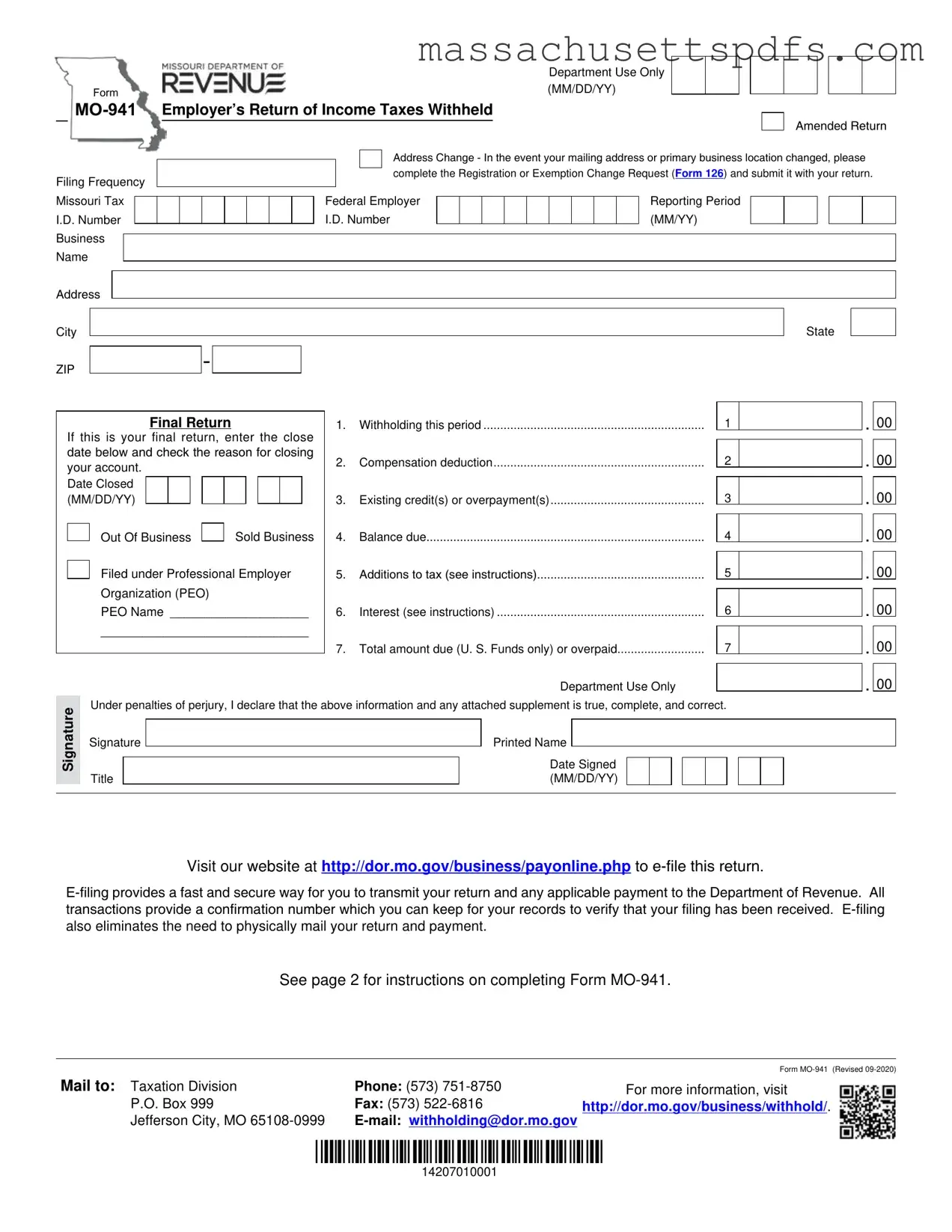

Official 941 Massachusetts Template

Key takeaways

When filling out and using the 941 Massachusetts form, there are several important points to keep in mind. Below are key takeaways that can assist in ensuring accurate completion and submission of the form.

- The form is officially known as the M-941 — Employer’s Return of Income Taxes Withheld. It is essential for reporting income taxes that have been withheld from employees' wages.

- Ensure that all required information, such as the employer's name, address, and identification number, is correctly filled out. Incomplete or incorrect information may lead to processing delays.

- Payments made during the reporting period must be accurately reflected on the form. This includes any amounts withheld from employee wages as well as any payments made to the state.

- It is crucial to follow the instructions provided with the form. These instructions outline the necessary steps for completion and submission, helping to avoid potential errors.

- Timely submission of the form is required to avoid penalties. Employers should be aware of the deadlines associated with the form to ensure compliance.

By adhering to these guidelines, employers can facilitate a smoother process when filing the 941 Massachusetts form.

Documents used along the form

When submitting the M-941 form, which is the Employer’s Return of Income Taxes Withheld in Massachusetts, it is essential to ensure that you have all necessary supporting documents ready. Below are four forms and documents that are often used in conjunction with the M-941. Each plays a crucial role in maintaining compliance with tax regulations.

- M-942 - This is the Employer’s Annual Return of Income Taxes Withheld. Employers use this form to report total income tax withheld for the entire year. It provides a summary of the M-941 filings, ensuring that all withheld amounts are accurately accounted for.

- New York Bill of Sale Form: A vital document for transferring ownership of personal property, ensuring clarity and protection during transactions. For easy access to the form, visit PDF Templates.

- M-3 - This is the Employer’s Quarterly Wage Report. Employers must submit this document to report wages paid to employees during the quarter. It includes details such as employee information and total wages, which are necessary for accurate tax calculations.

- M-1 - This form is the Massachusetts Income Tax Withholding Reconciliation. It reconciles the amounts withheld as reported on the M-941 with the actual amounts submitted. This document helps ensure that any discrepancies are identified and corrected promptly.

- W-2 Forms - These are Wage and Tax Statements provided to employees at the end of the year. They report an employee’s annual wages and the taxes withheld. Employers must distribute these forms to employees and file them with the IRS and state tax authorities.

Collecting and submitting these documents accurately is vital for compliance with tax laws. Ensure that all forms are completed correctly and submitted on time to avoid any penalties or issues with your tax filings.

Document Information

| Fact Name | Description |

|---|---|

| Form Purpose | The M-941 form is used by employers in Massachusetts to report income taxes withheld from employees' wages. |

| Filing Frequency | Employers must file the M-941 form quarterly, typically due on the last day of the month following the end of each quarter. |

| Governing Law | The M-941 form is governed by Massachusetts General Laws, Chapter 62B, which outlines the requirements for withholding income tax. |

| Who Must File | Any employer who withholds Massachusetts income tax from employee wages is required to file this form. |

| Penalties for Non-Compliance | Failure to file the M-941 form on time can result in penalties and interest on any unpaid taxes. |

| Payment Submission | Employers must include payment for the withheld taxes when submitting the M-941 form, or they may face additional penalties. |

| Record Keeping | Employers should maintain records of all wages paid and taxes withheld for at least three years for audit purposes. |

| Online Filing | The M-941 form can be filed online through the Massachusetts Department of Revenue's website, simplifying the process for employers. |

| Amendments | If an employer discovers an error after filing, they must submit an amended M-941 form to correct the information. |

Popular PDF Forms

Withholding Tax Form M-941 - The form can also alert employers to adjustments needed from prior tax periods.

Rmv Hearing Request - Additional pages may be utilized if more space is needed to detail issues or proposed resolutions.

The California RV Bill of Sale form serves as a legal document that records the sale and purchase of a recreational vehicle (RV) within the state of California. It provides essential information about the transaction, including details about the buyer, seller, and the RV itself. This form plays a crucial role in the transfer of ownership, ensuring that the process adheres to California law, making it important for sellers and buyers to utilize resources like californiapdf.com/editable-rv-bill-of-sale for a smooth transaction.

Ma Standard Deduction - Vendors are instructed to fill in the shaded areas, making it clear where specific information is required.

Guide to Writing 941 Massachusetts

Filling out the Massachusetts Form 941 is essential for employers to report income taxes withheld from employees. After completing this form, you will need to submit it to the appropriate state agency along with any required payments. Here’s a straightforward guide to help you through the process.

- Start by entering your Employer Identification Number (EIN) at the top of the form.

- Provide your business name and address, including city and zip code.

- Indicate the period covered by this return, ensuring it aligns with the quarterly reporting schedule.

- List the total amount of income taxes withheld from your employees during the reporting period.

- Report any payments made during the prior quarter that are applicable to this return.

- Fill in the total payments made for the quarter.

- Complete the section for any adjustments that may apply.

- Calculate any interest that may be due on late payments, if applicable.

- Summarize the total amount that is due for this quarter.

- Sign and date the form, confirming that all information provided is accurate.

Similar forms

- Form W-2: This document reports an employee's annual wages and the amount of taxes withheld from their paycheck. Like the M-941, it is used for reporting income tax withholding but is issued annually rather than quarterly.

- Non-Disclosure Agreement (NDA): This legal document, found at https://nydocuments.com, protects confidential information between parties, ensuring sensitive data remains private and fostering trust similar to tax compliance forms.

- Form 1099-MISC: This form is used to report payments made to independent contractors. Similar to the M-941, it also involves tax withholding but focuses on non-employee compensation.

- Form 940: This is the Employer's Annual Federal Unemployment (FUTA) Tax Return. It is related to employment taxes like the M-941, but it specifically addresses unemployment taxes rather than income tax withholding.

- Form 944: This is a simplified version of Form 941 for smaller employers. It also reports income taxes withheld, but it is filed annually instead of quarterly.

- Form 945: This form is used to report federal income tax withheld from nonpayroll payments. Like the M-941, it involves withholding, but it applies to payments other than wages.

- Form 1040-ES: This is used for estimated tax payments for individuals. While the M-941 is for employers, both documents relate to tax obligations and withholding.

- Form 8822: This form is used to notify the IRS of a change of address. While not directly related to tax withholding, it is important for ensuring that tax documents, like the M-941, are sent to the correct location.