Attorney-Approved Massachusetts Articles of Incorporation Document

Key takeaways

When filling out the Massachusetts Articles of Incorporation form, several important points should be kept in mind. These takeaways can help ensure a smooth process for establishing your business.

- Understand the purpose: The Articles of Incorporation serve as the foundational document for your corporation. They outline essential information about your business, including its name, purpose, and structure.

- Choose a unique name: The name of your corporation must be distinguishable from existing businesses registered in Massachusetts. Conduct a name search through the Secretary of the Commonwealth's website to avoid conflicts.

- Designate a registered agent: Your corporation must have a registered agent in Massachusetts. This person or business is responsible for receiving legal documents on behalf of your corporation.

- File with the appropriate fee: When submitting your Articles of Incorporation, include the required filing fee. The fee varies depending on the type of corporation you are forming, so check the latest fee schedule.

Documents used along the form

When forming a corporation in Massachusetts, the Articles of Incorporation serve as the foundational document. However, several other forms and documents are often required or recommended to ensure compliance with state regulations and to facilitate smooth operations. Below is a list of such documents, each playing a crucial role in the incorporation process.

- Bylaws: These are the internal rules governing the management of the corporation. Bylaws outline the roles and responsibilities of directors and officers, the process for holding meetings, and the procedures for making decisions.

- Initial Report: This document provides the state with information about the corporation's officers and directors shortly after incorporation. It helps ensure that the state has up-to-date contact information.

- Employer Identification Number (EIN): Issued by the IRS, this number is essential for tax purposes. It allows the corporation to hire employees, open bank accounts, and file tax returns.

- State Tax Registration: Corporations must register with the Massachusetts Department of Revenue to comply with state tax obligations. This includes sales tax, income tax, and other applicable taxes.

- Business Licenses and Permits: Depending on the nature of the business, various licenses or permits may be required at the local, state, or federal level to legally operate.

- Shareholder Agreements: If there are multiple shareholders, this agreement outlines the rights and obligations of each party, including how shares can be bought or sold and how disputes will be resolved.

- New York Lease Agreement: Ensure you are aware of the important details within this legal document, which includes rent, lease duration, and responsibilities of both parties. For complete guidance, refer to PDF Templates.

- Minutes of Organizational Meeting: After incorporation, the initial meeting of the board of directors should be documented. These minutes capture decisions made, such as appointing officers and adopting bylaws.

- Annual Report: Corporations in Massachusetts are required to file an annual report with the Secretary of the Commonwealth. This report updates the state on the corporation's status and any changes in its structure.

Each of these documents plays a vital role in establishing and maintaining a corporation in Massachusetts. Ensuring that all necessary forms are completed accurately and submitted on time can help avoid legal complications and foster a successful business environment.

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Law | The Massachusetts Articles of Incorporation are governed by Massachusetts General Laws, Chapter 156D. |

| Purpose | The form is used to legally establish a corporation in Massachusetts. |

| Filing Requirement | Filing the Articles of Incorporation with the Secretary of the Commonwealth is mandatory. |

| Minimum Information | The form requires the corporation's name, purpose, and address of the principal office. |

| Director Information | At least one director's name and address must be included in the filing. |

| Initial Registered Agent | The form must designate a registered agent to receive legal documents on behalf of the corporation. |

| Filing Fee | A filing fee is required upon submission of the Articles of Incorporation. |

Other Common Massachusetts Forms

Moped Bill of Sale Massachusetts - Acts as a record for any warranties or guarantees provided by the seller.

The Arkansas Hold Harmless Agreement is a legal document that protects one party from liability for certain actions or events, ensuring that they will not be held responsible for damages or injuries caused by the other party. This agreement is commonly used in various situations, including rental agreements, events, and construction projects. To gain a clearer understanding of this essential legal tool, you can refer to the Hold Harmless Agreement form, which can help individuals and businesses safeguard themselves against unforeseen risks.

Are Employee Handbooks Required - Understand your roles and responsibilities to foster a healthy work environment.

Massachusetts Salary Comfirmation Letter - The form can help mitigate fraud claims in employment applications.

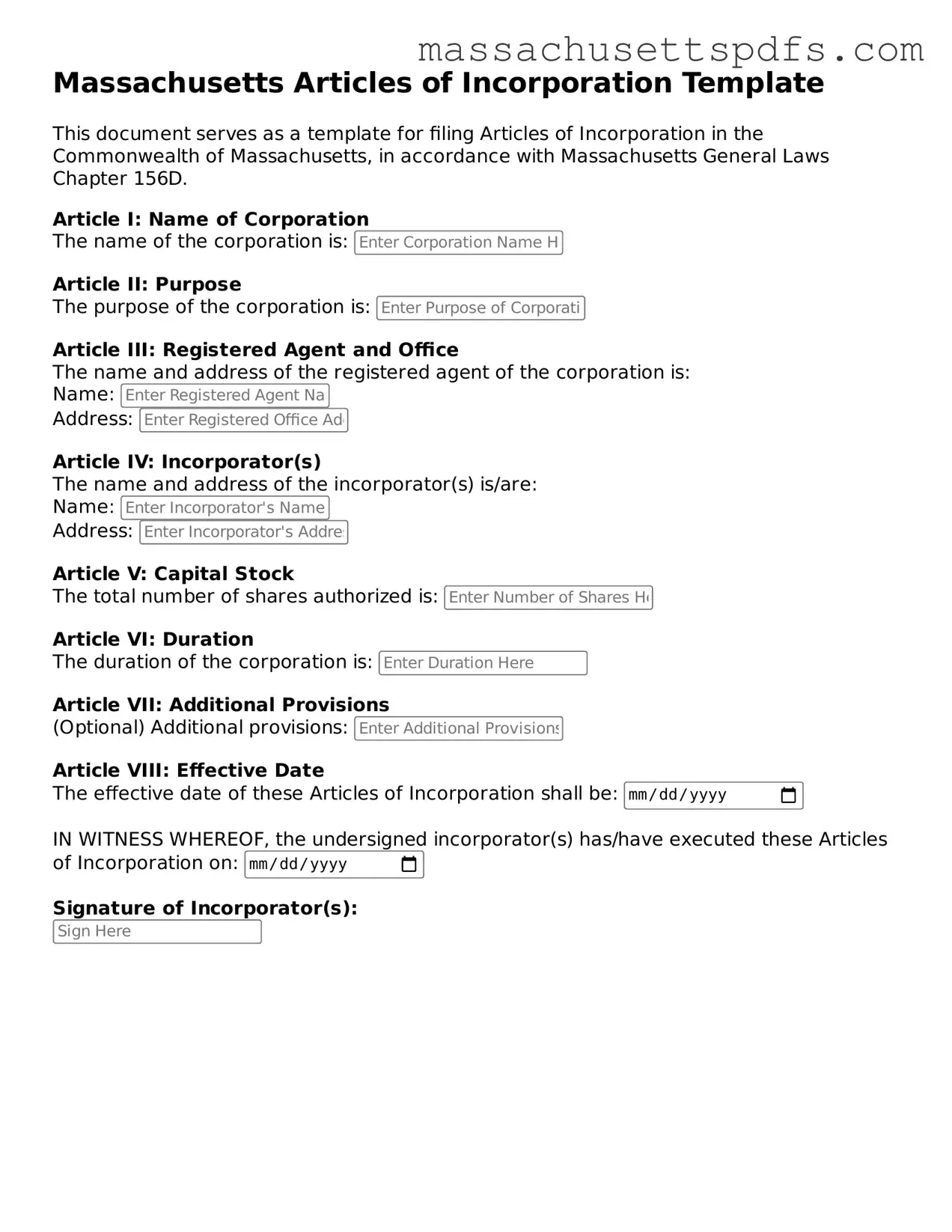

Guide to Writing Massachusetts Articles of Incorporation

After completing the Massachusetts Articles of Incorporation form, you will submit it to the Secretary of the Commonwealth. This step is crucial for officially establishing your corporation in Massachusetts. Make sure to review the form for accuracy before submission, as any errors can delay the process.

- Visit the Massachusetts Secretary of the Commonwealth's website to access the Articles of Incorporation form.

- Provide the name of your corporation. Ensure it is unique and complies with Massachusetts naming requirements.

- Enter the principal office address. This should be a physical address where the corporation will conduct its business.

- List the purpose of your corporation. Be clear and specific about the business activities you intend to pursue.

- Identify the initial directors. Include their names and addresses. A minimum of one director is required.

- Specify the number of shares the corporation is authorized to issue. Include any classes of shares if applicable.

- Designate a registered agent. This person or entity will receive legal documents on behalf of the corporation.

- Provide the incorporator's name and address. This is the person who is filling out and signing the form.

- Review the completed form for any errors or omissions.

- Submit the form along with the required filing fee to the Secretary of the Commonwealth.

Similar forms

Bylaws: Like the Articles of Incorporation, bylaws outline the rules and procedures for the governance of a corporation. They specify how meetings are conducted, how officers are elected, and the rights of shareholders.

Operating Agreement: This document is similar in that it governs the internal management of a limited liability company (LLC). It details the roles of members, decision-making processes, and profit distribution.

Partnership Agreement: This agreement outlines the terms of a partnership, similar to how Articles of Incorporation set the foundation for a corporation. It defines each partner's responsibilities, profit sharing, and dispute resolution methods.

Certificate of Formation: This document is akin to the Articles of Incorporation as it officially establishes a business entity. It includes basic information about the business, such as its name, address, and purpose.

Shareholder Agreement: This agreement is similar because it outlines the rights and obligations of shareholders. It addresses issues like share transfers, voting rights, and management responsibilities.

Power of Attorney: Essential for delegating authority, a comprehensive Power of Attorney document ensures that someone you trust can make decisions on your behalf in legal and financial matters.

Business License: While not a governance document, a business license is necessary for legal operation, similar to how Articles of Incorporation are essential for establishing a corporation. Both are required to operate within legal frameworks.