Attorney-Approved Massachusetts Deed Document

Key takeaways

When dealing with the Massachusetts Deed form, understanding the process and requirements is essential for ensuring a smooth transaction. Here are some key takeaways to consider:

- Identify the Type of Deed: Massachusetts recognizes various types of deeds, including warranty deeds and quitclaim deeds. Knowing which one suits your needs is crucial.

- Complete Required Information: The form must include the names of the grantor (seller) and grantee (buyer), the property description, and the consideration (price) paid for the property.

- Signatures Matter: The deed must be signed by the grantor. If the grantor is a business entity, an authorized representative must sign on its behalf.

- Notarization is Required: To make the deed legally binding, it must be notarized. This step ensures that the identities of the parties involved are verified.

- Filing with the Registry of Deeds: After completion, the deed should be filed with the local Registry of Deeds. This step is necessary for the transfer of ownership to be officially recorded.

- Consider Tax Implications: Be aware of any potential tax obligations, such as the Massachusetts excise tax on the transfer of real estate, which may apply when filing the deed.

Understanding these aspects can greatly facilitate the process of filling out and using the Massachusetts Deed form, ultimately ensuring compliance and clarity in property transactions.

Documents used along the form

When transferring property in Massachusetts, several forms and documents often accompany the Deed form. Each of these documents serves a specific purpose in ensuring the transaction is legally sound and properly recorded. Here’s a brief overview of some commonly used forms:

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It ensures compliance with state tax regulations.

- Power of Attorney Form: To enable trusted individuals to make decisions on your behalf, consider the comprehensive Power of Attorney form options for your legal planning needs.

- Affidavit of Title: This document certifies that the seller has the legal right to sell the property and that there are no undisclosed liens or encumbrances.

- Statement of Account: Often used to outline the financial aspects of the transaction, this statement details any outstanding balances or obligations related to the property.

- Title Insurance Policy: This policy protects the buyer against potential disputes regarding property ownership. It ensures that the title is clear and free of issues.

- Power of Attorney: If the seller cannot be present for the transaction, a Power of Attorney allows another person to act on their behalf, facilitating the signing of documents.

- Notice of Sale: This document informs interested parties that the property is being sold. It may be required in certain situations to ensure transparency.

- Certificate of Good Standing: For corporate sellers, this certificate confirms that the business is legally registered and authorized to conduct transactions in Massachusetts.

- Zoning Compliance Letter: This letter verifies that the property complies with local zoning laws, which can affect how the property can be used in the future.

- Closing Statement: This document summarizes all financial aspects of the transaction, including costs, fees, and adjustments, providing a clear picture of the final settlement.

Understanding these documents is crucial for anyone involved in a property transaction in Massachusetts. Each plays a vital role in ensuring that the transfer is executed smoothly and legally. Being well-informed can help streamline the process and avoid potential complications.

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The Massachusetts Deed form is governed by Massachusetts General Laws Chapter 183. |

| Types of Deeds | Massachusetts recognizes several types of deeds, including warranty deeds, quitclaim deeds, and fiduciary deeds. |

| Execution Requirements | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To be effective against third parties, the deed must be recorded at the local registry of deeds. |

| Consideration | Massachusetts does not require a stated consideration for a deed to be valid, but it is often included. |

| Legal Description | A clear legal description of the property must be included in the deed. |

| Transfer Tax | Massachusetts imposes a transfer tax on real estate transactions, typically paid by the seller. |

| Delivery Requirement | For the deed to be valid, it must be delivered to the grantee, either physically or constructively. |

Other Common Massachusetts Forms

Mass Bill of Sale Car - The form helps document the sale date, providing a timeline of ownership transfer.

The importance of a Hold Harmless Agreement cannot be overstated, as it serves to clarify liability limits between involved parties. By utilizing a comprehensive Hold Harmless Agreement form, individuals and organizations can effectively reduce their legal risks and ensure that all parties understand their responsibilities and protections in various transactions or agreements.

Lady Bird Deed Massachusetts - If property values rise, beneficiaries may benefit financially from your foresight.

Massachusetts Rental Application - Ask for clarification on policies regarding application approval criteria.

Guide to Writing Massachusetts Deed

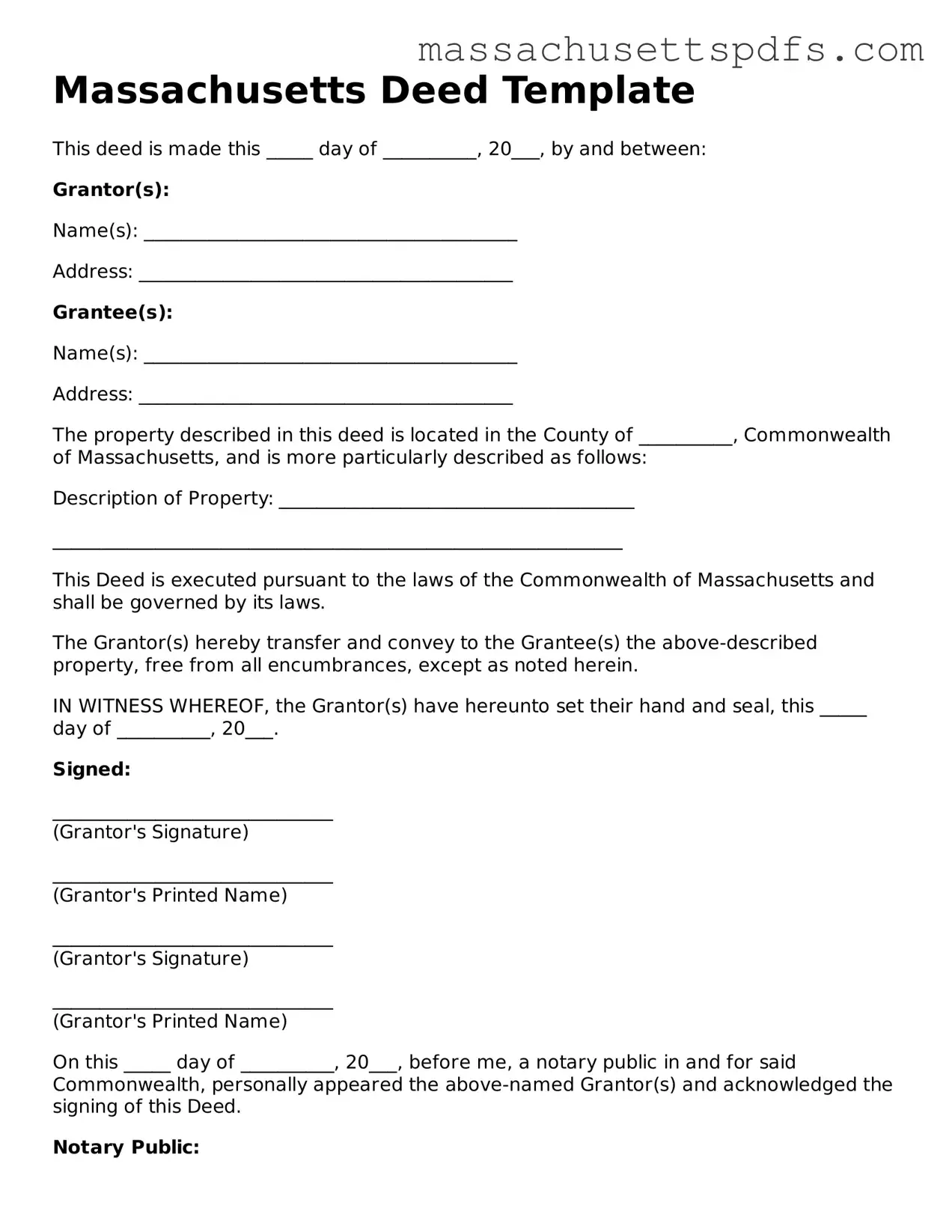

After obtaining the Massachusetts Deed form, it is essential to complete it accurately to ensure proper recording. Follow these steps to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Identify the grantor, or the person transferring the property. Provide their full name and address.

- Next, fill in the name and address of the grantee, or the person receiving the property.

- Describe the property being transferred. Include the street address, city, and any additional identifying information, such as a parcel number.

- Specify the type of deed being used, such as a warranty deed or quitclaim deed. This information is often found on the form itself.

- Indicate the consideration, or the amount paid for the property. This is usually expressed in dollars.

- Sign the form where indicated. The grantor must sign in the presence of a notary public.

- Have the signature notarized. The notary will complete their section, verifying the identity of the grantor.

- Review the completed form for any errors or omissions before submission.

- Submit the signed and notarized deed to the appropriate county registry of deeds for recording.

Similar forms

The Deed form is a crucial document in property transactions, but it shares similarities with several other legal documents. Each of these documents serves a unique purpose while often overlapping in function. Here’s a look at six documents that resemble the Deed form:

- Title Abstract: This document summarizes the history of ownership for a property. Like a Deed, it establishes who holds legal rights to the property, ensuring that the transfer of ownership is clear and undisputed.

-

Dirt Bike Bill of Sale: This form is essential for documenting the transfer of ownership for dirt bikes, ensuring that both the buyer and seller are protected during the transaction. For a comprehensive guide and to access the necessary form, visit PDF Templates.

- Bill of Sale: Used to transfer ownership of personal property, a Bill of Sale functions similarly to a Deed by documenting the sale and ensuring that the buyer receives clear title to the item. Both documents serve to protect the interests of the parties involved.

- Lease Agreement: This document outlines the terms under which one party can use another's property. While a Deed transfers ownership, a Lease Agreement allows temporary possession, yet both require clear identification of the parties and the property involved.

- Mortgage Agreement: A Mortgage Agreement is essential when a property is financed. It lays out the terms of the loan, similar to how a Deed outlines ownership rights. Both documents must be recorded to protect the interests of the parties.

- Trust Deed: This document is used in real estate transactions involving a trust. Like a Deed, it conveys property rights but does so within the framework of a trust arrangement, establishing responsibilities and rights of the trustee and beneficiaries.

- Power of Attorney: This document allows one person to act on behalf of another in legal matters. While it does not transfer ownership, it can authorize someone to execute a Deed, thus playing a critical role in property transactions.

Understanding these documents can empower individuals to navigate property transactions with confidence. Each serves a distinct purpose while sharing fundamental characteristics with the Deed form.