Attorney-Approved Massachusetts Durable Power of Attorney Document

Key takeaways

When considering a Durable Power of Attorney (DPOA) in Massachusetts, it’s essential to understand the key points that will guide you through the process. Here are seven important takeaways:

- Definition: A Durable Power of Attorney allows you to appoint someone to make decisions on your behalf, even if you become incapacitated.

- Choosing an Agent: Select a trustworthy person as your agent. This individual will have significant authority to handle your financial and legal matters.

- Specific Powers: You can specify which powers you grant to your agent. Consider including powers related to banking, real estate, and healthcare decisions.

- Durability: The "durable" aspect means the document remains effective even if you become unable to make decisions. This is a key feature of a DPOA.

- Signing Requirements: The form must be signed by you and two witnesses. In Massachusetts, the witnesses cannot be related to you or benefit from the DPOA.

- Revocation: You can revoke or change your DPOA at any time, as long as you are mentally competent. Make sure to inform your agent and any relevant institutions if you do so.

- Legal Advice: It’s wise to seek legal advice when creating a DPOA. A lawyer can help ensure that the document meets your needs and complies with Massachusetts law.

Understanding these key points can help you navigate the Durable Power of Attorney process more effectively, ensuring that your wishes are respected and your affairs are managed according to your preferences.

Documents used along the form

A Massachusetts Durable Power of Attorney form is an important legal document that allows one person to make decisions on behalf of another. However, it is often used in conjunction with several other documents to ensure comprehensive planning and protection. Below is a list of commonly associated forms and documents.

- Health Care Proxy: This document allows an individual to appoint someone to make medical decisions on their behalf if they become unable to do so. It ensures that health care preferences are respected.

- Living Will: A living will outlines an individual's wishes regarding medical treatment in situations where they cannot communicate their desires. It provides guidance to health care providers and family members.

- Will: A will is a legal document that specifies how a person's assets will be distributed after their death. It also allows for the appointment of guardians for minor children.

- Trust: A trust is a legal arrangement where one party holds property for the benefit of another. It can help manage assets during a person's lifetime and after their death, often avoiding probate.

- Advance Directive: This document combines elements of a health care proxy and a living will. It provides instructions about medical treatment preferences and designates a person to make decisions.

- Financial Power of Attorney: Similar to a durable power of attorney, this document specifically grants someone the authority to manage financial affairs, including banking, investments, and property transactions.

- Guardianship Papers: These documents are used to establish legal guardianship over an individual, typically a minor or someone unable to care for themselves. They outline the responsibilities of the guardian.

- HIPAA Release Form: This form allows an individual to authorize the release of their medical information to designated persons. It is essential for ensuring that loved ones can access necessary health information.

- Dirt Bike Bill of Sale: This legal document is vital for transferring ownership of dirt bikes in New York, ensuring that all transaction details are documented. For templates, visit PDF Templates.

- Beneficiary Designations: These are forms used to specify who will receive assets such as life insurance policies, retirement accounts, and bank accounts upon the individual's death.

Using these documents in conjunction with a Massachusetts Durable Power of Attorney can help ensure that both financial and health care decisions are made according to an individual's wishes. Proper planning can provide peace of mind and clarity for loved ones during difficult times.

Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney (DPOA) allows an individual to appoint someone to manage their financial and legal affairs, even if they become incapacitated. |

| Governing Law | The Massachusetts Durable Power of Attorney is governed by Massachusetts General Laws Chapter 201B. |

| Durability | The term "durable" means that the authority granted remains effective even if the principal becomes mentally incapacitated. |

| Principal and Agent | The person granting the authority is known as the principal, while the person receiving the authority is referred to as the agent or attorney-in-fact. |

| Execution Requirements | The DPOA must be signed by the principal and acknowledged before a notary public to be legally valid. |

| Revocation | A principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. |

| Agent's Duties | The agent has a fiduciary duty to act in the best interests of the principal and must manage the principal's affairs with care and loyalty. |

| Limitations | The DPOA cannot grant authority for certain decisions, such as those regarding health care, unless explicitly stated. |

| Filing Not Required | Unlike some legal documents, a Durable Power of Attorney does not need to be filed with any court or government agency to be effective. |

Other Common Massachusetts Forms

Nda Agreement Meaning - The agreement ensures that sensitive information remains private and secure.

For individuals looking to navigate the transaction process smoothly, a reliable resource can be found in the comprehensive Georgia bill of sale form guidelines, which detail the necessary steps and considerations for drafting a valid document. You can learn more about this by visiting the Bill of Sale site.

Massachusetts Homeschool Curriculum - Timely submission is crucial to prevent any misunderstandings with local education authorities.

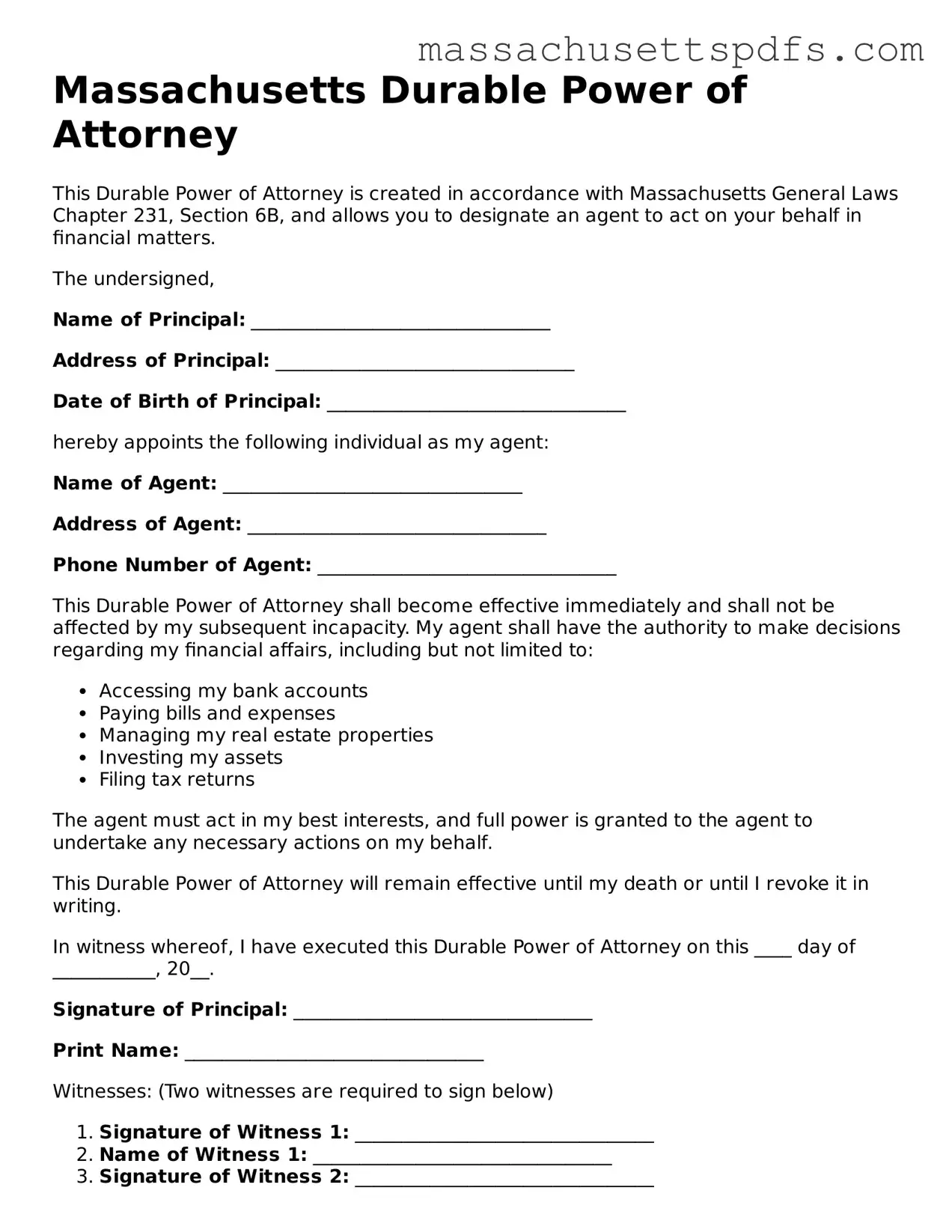

Guide to Writing Massachusetts Durable Power of Attorney

Filling out the Massachusetts Durable Power of Attorney form is an important step in ensuring that your financial matters can be managed by someone you trust in case you are unable to do so. Follow these steps carefully to complete the form correctly.

- Obtain the Massachusetts Durable Power of Attorney form. You can find it online or request a copy from a legal office.

- Read the instructions provided with the form to understand what information is required.

- Begin by filling in your full name and address in the designated section at the top of the form.

- Identify the person you are appointing as your agent. Write their full name and address in the appropriate section.

- Decide if you want to name an alternate agent. If so, fill in their name and address as well.

- Clearly specify the powers you are granting to your agent. This may include financial decisions, real estate transactions, or other specific areas.

- Sign and date the form at the bottom. Make sure to do this in the presence of a notary public.

- Have the notary public sign and stamp the form to validate it.

- Keep a copy of the completed form for your records. Provide copies to your agent and any relevant financial institutions.

Similar forms

- General Power of Attorney: This document allows one person to act on behalf of another in a broad range of matters, similar to the Durable Power of Attorney. However, it becomes invalid if the principal becomes incapacitated.

- Healthcare Power of Attorney: This form specifically grants authority to make medical decisions for someone if they are unable to do so themselves, paralleling the Durable Power of Attorney's focus on decision-making during incapacity.

- Living Will: A Living Will outlines a person's wishes regarding medical treatment in situations where they cannot communicate. It complements the Durable Power of Attorney by providing guidance for healthcare decisions.

- Do Not Resuscitate Order: For individuals seeking to make their medical wishes clear, the important Do Not Resuscitate Order form details ensure healthcare providers are aware of your preferences in critical situations.

- Financial Power of Attorney: This document focuses solely on financial matters, allowing someone to manage another's financial affairs. It serves a similar purpose to the Durable Power of Attorney but is limited to financial decisions.

- Trust Document: A trust can manage a person's assets during their lifetime and after death. While it differs in structure, it shares the goal of ensuring that a person's wishes regarding their assets are honored, much like the Durable Power of Attorney.