Official Massachusetts 127 Template

Key takeaways

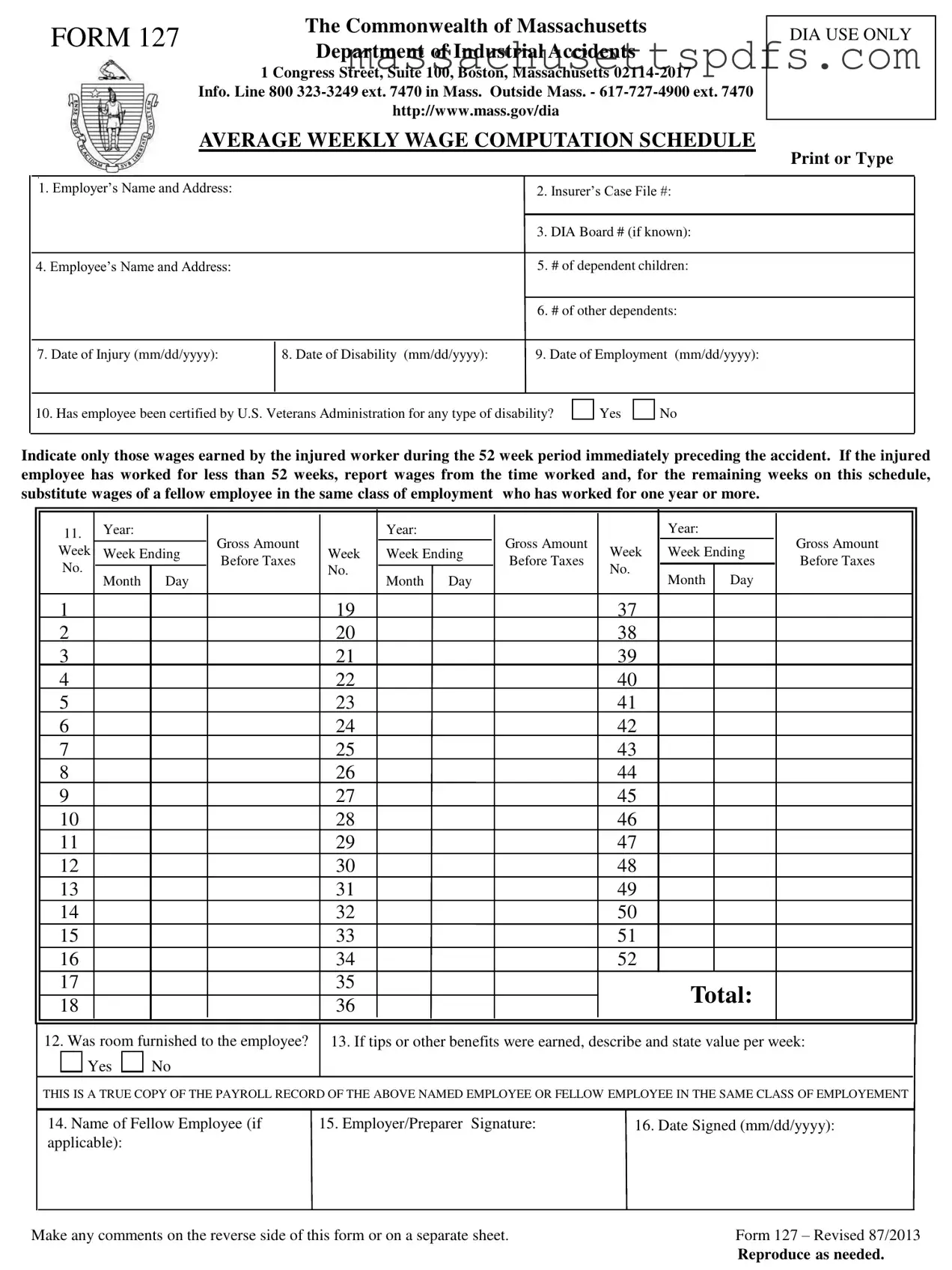

Filling out the Massachusetts 127 form is a critical step for ensuring accurate compensation for injured workers. Here are key takeaways to keep in mind:

- Accurate Information is Essential: Ensure that all information, including names, addresses, and dates, is filled out correctly. Any inaccuracies can delay processing.

- Report Wages Carefully: Only include wages earned during the 52 weeks prior to the injury. If the employee worked less than a year, substitute wages from a fellow employee in the same role.

- Include All Dependents: Clearly state the number of dependent children and other dependents. This information can affect the compensation calculation.

- Document Benefits: If the employee received tips or other benefits, describe these on the form. This can impact the overall wage calculation.

- Sign and Date: Ensure that the employer or preparer signs and dates the form. An unsigned form may be considered incomplete.

- Use the Reverse Side: Utilize the back of the form or a separate sheet for any additional comments or necessary clarifications.

Taking these steps can help streamline the process and ensure that the injured worker receives the benefits they are entitled to. Prompt and accurate completion of the form is crucial.

Documents used along the form

The Massachusetts 127 form is essential for calculating an employee's average weekly wage following a workplace injury. Alongside this form, several other documents are commonly utilized in the process. Each of these documents plays a critical role in ensuring that claims are processed accurately and efficiently.

- Form 104: This form is used to report the details of the injury, including the circumstances surrounding the incident. It provides the necessary context for the claim and helps establish the connection between the injury and the workplace.

- California RV Bill of Sale: Essential for documenting the sale of a recreational vehicle in California, this legal form helps to ensure a smooth transfer of ownership and can be accessed at https://californiapdf.com/editable-rv-bill-of-sale/.

- Form 130: This document serves as a notice of the employee's claim for benefits. It outlines the specifics of the claim, including the type of benefits requested, and must be submitted to the insurer.

- Form 132: This form is used to report the employee's medical expenses related to the injury. It includes details about the medical treatment received and is essential for reimbursement purposes.

- Form 113: This is a wage verification form that employers complete to confirm the employee's earnings. It helps ensure that the average weekly wage is calculated accurately based on the employee's actual income.

- Form 101: This form is a request for a hearing if there are disputes regarding the claim. It initiates the process for resolving issues between the employee and the insurer or employer.

Each of these forms complements the Massachusetts 127 form, contributing to a comprehensive approach to managing workplace injury claims. Properly completing and submitting these documents can significantly impact the outcome of a claim, ensuring that employees receive the benefits they are entitled to.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts 127 form is used to compute the average weekly wage of an employee who has been injured on the job. This information is crucial for determining benefits under workers' compensation. |

| Governing Law | This form is governed by the Massachusetts General Laws, specifically Chapter 152, which pertains to workers' compensation regulations. |

| Information Required | Employers must provide specific details, including the employee's name, address, and the dates related to the injury and employment. It also requires information about dependents. |

| Wage Reporting | The form requires reporting wages earned by the injured worker during the 52 weeks prior to the injury. If the employee worked for less than 52 weeks, substitute wages from a fellow employee in the same job class. |

| Additional Benefits | Employers must indicate if the employee received tips or other benefits, along with their estimated weekly value. This helps in accurately calculating the average weekly wage. |

| Certification | The form includes a section to confirm whether the employee has been certified by the U.S. Veterans Administration for any type of disability, which may impact their compensation. |

Popular PDF Forms

Massachusetts St 13 - The certification reassures small business owners of their standing under Massachusetts tax law.

To facilitate a smooth transaction, it is important to have the proper documentation in hand, such as the New York ATV Bill of Sale form. This form not only captures essential details about the sale but also helps protect both parties involved. For easy access to these necessary documents, you can find various options, including a reliable one at PDF Templates.

Ma 355s - This form is specific to the 2011 tax year and must be filed accurately for compliance.

Informal Probate Massachusetts - The form allows petitioners to seek the appointment of a personal representative.

Guide to Writing Massachusetts 127

Filling out the Massachusetts 127 form is a straightforward process that requires accurate information about the employee, their wages, and other relevant details. After completing the form, it must be submitted to the appropriate department for processing. Ensure that all sections are filled out clearly to avoid any delays.

- Begin by entering the Employer’s Name and Address in the designated field.

- Next, fill in the Insurer’s Case File # if you have it.

- If known, provide the DIA Board #.

- Enter the Employee’s Name and Address.

- Indicate the number of dependent children.

- Specify the number of other dependents.

- Record the Date of Injury in the format mm/dd/yyyy.

- Fill in the Date of Disability using the same format.

- Provide the Date of Employment in mm/dd/yyyy format.

- Answer whether the employee has been certified by the U.S. Veterans Administration for any type of disability by selecting Yes or No.

- List the wages earned by the injured worker during the 52-week period preceding the accident. If the employee worked less than 52 weeks, substitute wages from a fellow employee in the same class of employment who has worked for one year or more.

- For each week, enter the Year, Week Ending date, and Gross Amount Before Taxes for weeks 1 through 52.

- Indicate whether room was furnished to the employee by selecting Yes or No.

- If applicable, describe any tips or other benefits earned and state their value per week.

- Complete the section for the Name of Fellow Employee if relevant.

- Sign the form as the Employer/Preparer.

- Finally, enter the Date Signed in mm/dd/yyyy format.

Make any additional comments on the reverse side of the form or on a separate sheet as needed. Ensure all information is accurate before submission.

Similar forms

The Massachusetts 127 form is primarily used for calculating an employee's average weekly wage in the context of workers' compensation claims. Several other documents serve similar purposes in various contexts. Below is a list of seven documents that share similarities with the Massachusetts 127 form:

- Wage Verification Form: This document is often used by employers to verify an employee's earnings for loan applications or financial aid. Like the Massachusetts 127 form, it requires detailed wage information over a specific period.

- California Vehicle Purchase Agreement: This crucial legal document outlines the sale terms between a buyer and a seller in California, ensuring clarity on aspects such as price and condition. For more detailed information, you can refer to My PDF Forms.

- Employee Earnings Record: Employers maintain this document to track an employee's wages and deductions throughout their employment. It provides a comprehensive view of earnings similar to the wage computation required by the Massachusetts 127 form.

- Workers' Compensation Claim Form: This form initiates a claim for workers' compensation benefits. It often requires wage information, just as the Massachusetts 127 form does, to determine the compensation amount.

- Income Tax Return (Form 1040): This federal tax form reports an individual’s income for the year. It includes wage information and can be used to establish average earnings, paralleling the purpose of the Massachusetts 127 form.

- Social Security Administration Earnings Record: This document outlines an individual's earnings history for Social Security benefits. It shares the focus on wage details over time, akin to the Massachusetts 127 form.

- Unemployment Benefits Application: When applying for unemployment benefits, individuals must provide wage information to assess eligibility and benefit amounts. This requirement mirrors the wage reporting aspect of the Massachusetts 127 form.

- Pay Stub: A pay stub provides a breakdown of an employee's earnings and deductions for each pay period. It serves as a real-time record of wages, similar to the historical wage data requested in the Massachusetts 127 form.