Official Massachusetts 2G Template

Key takeaways

Filling out and using the Massachusetts 2G form requires careful attention to detail. Below are key takeaways to ensure a smooth process.

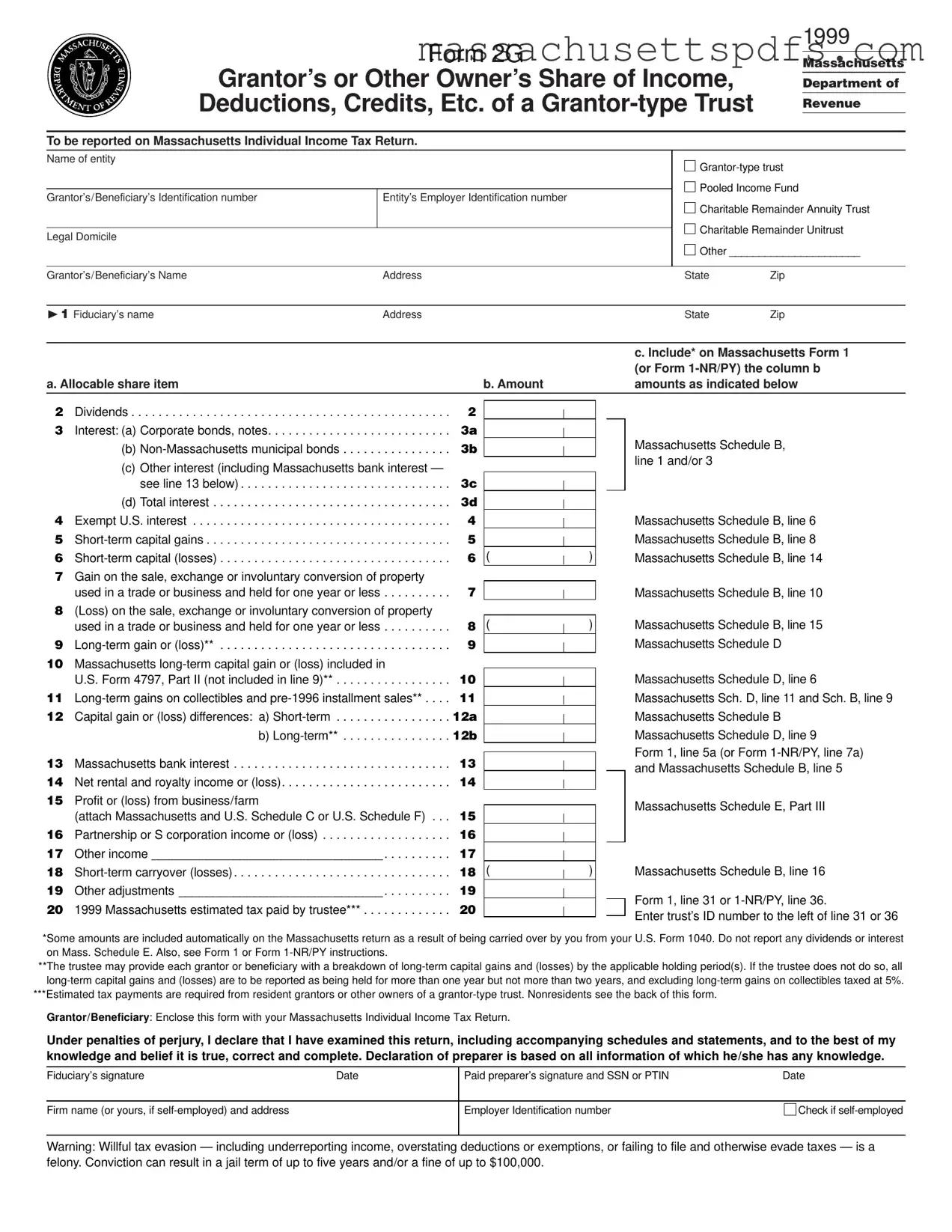

- The Massachusetts 2G form is used to report a grantor-type trust's income, deductions, and credits on the Massachusetts Individual Income Tax Return.

- It is essential to provide accurate identification numbers for both the grantor/beneficiary and the trust entity.

- All income and deductions must be reported as specified in the form, including dividends, interest, and capital gains.

- Trustees are responsible for filing the form and sending a copy to the grantor or owner for their records.

- Grantors must include trust income when calculating their estimated tax payments.

- Supporting documents, such as Schedule D for long-term capital gains, should be attached to the form.

- Nonresidents may have different withholding requirements, and trustees must ensure compliance with applicable rates.

- Extensions for filing can be requested using Form M-8736, which must be submitted by the original due date.

- A consolidated filing option is available for those required to submit multiple 2G forms, streamlining the process.

- The completed form is generally due by April 18, 2000, or on the 15th day of the fourth month after the close of the fiscal year for fiscal filers.

Completing the Massachusetts 2G form accurately is vital for compliance and to avoid potential penalties. Take your time to review all information before submission.

Documents used along the form

The Massachusetts 2G form is essential for reporting income, deductions, and credits related to grantor-type trusts. Alongside this form, several other documents are often required to ensure accurate tax reporting and compliance. Below is a list of related forms and documents that may be necessary for grantors and beneficiaries.

- Form 1: This is the Massachusetts Individual Income Tax Return. Grantors and beneficiaries use it to report their total income, including income from grantor-type trusts.

- Form 1-NR/PY: This form is for non-residents and part-year residents. It allows them to report income earned in Massachusetts, including income from grantor-type trusts.

- Schedule B: This schedule is used to report interest and dividends. It details the sources and amounts of these types of income, which are often reported on Form 2G.

- Schedule D: This document is for reporting capital gains and losses. It is crucial for grantors and beneficiaries who have long-term or short-term capital transactions.

- New York ATV Bill of Sale: To properly document the sale or purchase of an all-terrain vehicle in New York, it's essential to complete the PDF Templates to ensure both parties have an accurate record of the transaction.

- Form 2-ES: This is the Estimated Income Tax Payment Voucher. It is used for making estimated tax payments, particularly for grantors who may have tax liabilities from trust income.

- Form M-8736: This form is the Application for Extension of Time to File Fiduciary, Partnership, or Corporate Trust Returns. It allows for a six-month extension to file Form 2G, if necessary.

- Consolidated Form 2: This is used when multiple Form 2G filings are required. It allows for a consolidated submission, streamlining the process for trusts with multiple grantors or beneficiaries.

Each of these forms plays a significant role in the tax reporting process for grantor-type trusts in Massachusetts. It is important to ensure that all relevant documents are completed accurately and submitted on time to avoid any potential issues with the Massachusetts Department of Revenue.

Document Information

| Fact Name | Detail |

|---|---|

| Form Purpose | This form is used to report the income, deductions, and credits of a grantor-type trust on the Massachusetts Individual Income Tax Return. |

| Governing Laws | The form is governed by the Internal Revenue Code Sections 671 through 678 and Massachusetts General Laws Chapter 62, Section 10. |

| Filing Requirement | The trustee must file Form 2G and send a copy to the grantor or owner, who is responsible for reporting the trust's income. |

| Due Date | Form 2G is generally due on or before April 18, 2000, or the 15th day of the fourth month after the close of the fiscal year for fiscal filers. |

Popular PDF Forms

University of Massachusetts Amherst Transcript Request - The information collected on this form is essential for the accurate processing of your request.

Mechanical Lien on Property - This form can help clarify any disputes related to vehicle ownership and liens.

When engaging in the sale of a recreational vehicle, it is essential to complete the California RV Bill of Sale form to ensure all legal requirements are met. This document can be easily accessed at https://californiapdf.com/editable-rv-bill-of-sale/, where sellers and buyers can provide necessary details that protect their interests during the transaction.

Who Is Exempt From Ifta - A fee is required for the decal order, which is necessary for vehicle identification.

Guide to Writing Massachusetts 2G

Completing the Massachusetts 2G form is an important step for grantors or beneficiaries of a grantor-type trust. After filling out this form, you will need to submit it along with your Massachusetts Individual Income Tax Return. This ensures that all income, deductions, and credits associated with the trust are properly reported.

- Obtain the Form: Download the Massachusetts 2G form from the Massachusetts Department of Revenue website or acquire a physical copy.

- Fill in the Entity Information: Provide the name of the grantor-type trust, the identification numbers, and the legal domicile. If applicable, check the appropriate box for Pooled Income Fund, Charitable Remainder Annuity Trust, or Charitable Remainder Unitrust.

- Enter Grantor/Beneficiary Details: Write the name, address, state, and zip code of the grantor or beneficiary.

- Fiduciary Information: Fill in the fiduciary’s name and address, including state and zip code.

- Complete Income and Deductions: For each income and deduction category listed (such as dividends, interest, capital gains, etc.), enter the corresponding amounts in the appropriate columns.

- Include Other Income: If there are other income sources not listed, specify them in the designated area.

- Report Estimated Tax Paid: If applicable, enter the amount of estimated tax paid by the trustee in line 20.

- Sign and Date the Form: The fiduciary must sign and date the form. If a paid preparer helped, they should also sign and provide their identification number.

- Attach Supporting Documents: Ensure that all necessary supporting schedules and documents are attached, such as Schedule D for long-term capital gains.

- Submit the Form: Mail the completed Form 2G along with your Massachusetts Individual Income Tax Return to the address provided on the form.

Similar forms

- Form 1 - Massachusetts Individual Income Tax Return: This form is used by individuals to report their income, deductions, and credits. Similar to Form 2G, it requires detailed financial information to calculate tax liability.

- Form 1-NR/PY - Massachusetts Non-Resident/Part-Year Resident Income Tax Return: Like Form 2G, this form is for individuals who are not full-time residents of Massachusetts. It captures income, deductions, and credits applicable to non-residents or part-year residents.

-

New York DTF-84 Form: This form is essential for businesses aiming to obtain Qualified Empire Zone Enterprise (QEZE) Sales Tax Certification. For more details, you can visit https://nydocuments.com, where further information regarding the certification and its benefits is available.

- Massachusetts Schedule B: This schedule is used to report interest and dividends. It parallels the income reporting requirements of Form 2G, which also includes various types of income from trusts.

- Massachusetts Schedule D: This document reports capital gains and losses. Similar to Form 2G, it breaks down long-term and short-term gains, ensuring accurate tax reporting for investment income.

- Form 2-ES - Estimated Income Tax Payment Vouchers: This form is used to make estimated tax payments. Like Form 2G, it addresses the tax obligations of grantors and beneficiaries, ensuring they meet their estimated tax requirements.