Official Massachusetts 3 Template

Key takeaways

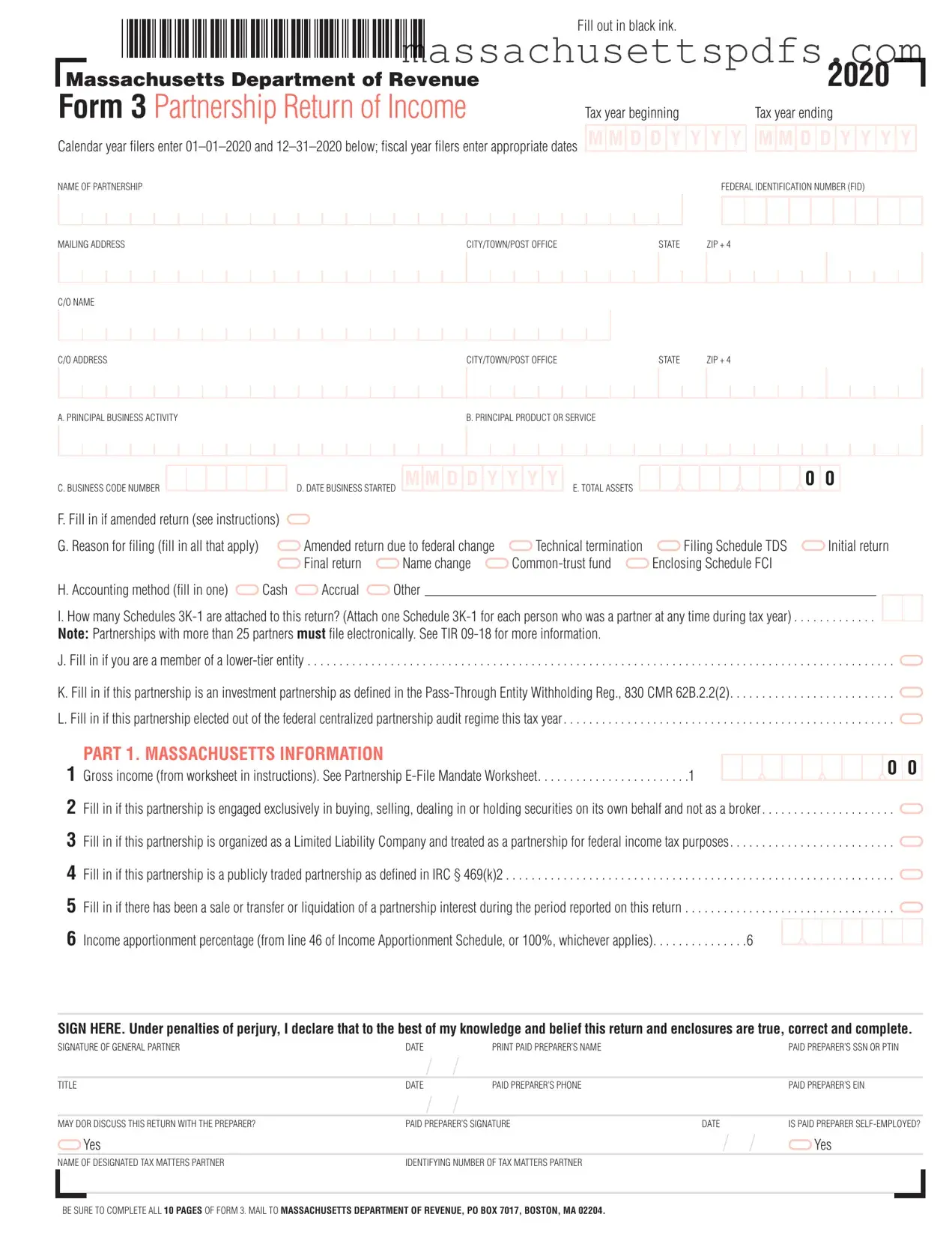

When completing the Massachusetts Form 3, it is essential to use black ink. This ensures that the information is clear and legible, which is crucial for processing.

Partnerships must indicate their federal identification number and provide accurate details about their business activities. This includes the name of the partnership, mailing address, and principal business activity.

It is important to attach a Schedule 3K-1 for each partner involved during the tax year. This document provides necessary details about each partner's share of income, deductions, and credits.

If the partnership has more than 25 partners, electronic filing is required. This is a significant requirement that helps streamline the filing process.

Before submitting the form, verify that all sections are complete and accurate. Incomplete forms can lead to delays or issues with the Massachusetts Department of Revenue.

Documents used along the form

The Massachusetts Form 3 is a crucial document for partnerships operating within the state, serving as the partnership’s income tax return. Alongside this form, various other documents may be necessary to ensure compliance with state tax regulations and to provide a comprehensive overview of the partnership's financial activities. Below is a list of commonly used forms and documents that often accompany the Massachusetts Form 3.

- Schedule K-1 (Form 1065): This form is issued to each partner in the partnership, detailing their share of the partnership’s income, deductions, and credits. It is essential for partners to report their individual tax liabilities accurately.

- California RV Bill of Sale: Essential for documenting the sale of recreational vehicles, this form ensures a smooth transfer of ownership while adhering to legal requirements. For more details, visit https://californiapdf.com/editable-rv-bill-of-sale.

- Schedule TDS: This schedule is used to report the Massachusetts tax withheld on income distributed to non-resident partners. It ensures that the state receives its due taxes on income earned within its jurisdiction.

- Income Apportionment Schedule: This document is necessary if the partnership conducts business in multiple states. It helps determine how much of the partnership’s income is taxable in Massachusetts based on its operations in other states.

- Schedule CMS: This schedule is used to claim various credits available to the partnership, such as those for taxes paid to other jurisdictions. It can help reduce the overall tax burden on the partnership.

- Schedule CRS: This form is utilized for reporting the recapture of credits previously claimed. If the partnership's circumstances change, it may need to repay some of the credits it received in prior years.

- U.S. Form 1065: This is the federal partnership return that outlines the partnership's income, deductions, gains, and losses. It serves as the foundation for the Massachusetts Form 3 and is required for federal tax compliance.

- Form 8825: This form reports income and expenses from rental real estate activities. If the partnership has rental properties, this form will provide the necessary details to calculate income or loss from these activities.

- Form 4797: This document is used to report the sale of business property. If the partnership sells or exchanges property, this form is essential for reporting any gains or losses.

- Federal Identification Number (FID) Documentation: This number is crucial for tax purposes and must be included in various forms. It identifies the partnership to the IRS and state tax authorities.

- Operating Agreement: While not a tax form, this internal document outlines the management structure and operational guidelines of the partnership. It is important for legal clarity and can be referenced in tax filings.

In summary, the Massachusetts Form 3 and its accompanying documents play a vital role in ensuring that partnerships fulfill their tax obligations accurately and comprehensively. Each form serves a specific purpose, contributing to a clearer understanding of the partnership's financial activities and ensuring compliance with both state and federal regulations. It is essential for partnerships to maintain accurate records and complete all necessary forms to avoid complications in the tax filing process.

Document Information

| Fact Name | Details |

|---|---|

| Form Purpose | The Massachusetts 3 Form is used for reporting partnership income and expenses for tax purposes. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 62. |

| Filing Method | Partnerships with more than 25 partners must file the form electronically. |

| Tax Year | Tax year filers must indicate the beginning and ending dates of the tax year on the form. |

| Business Information | Partnerships must provide their name, federal identification number, and mailing address. |

| Principal Business Activity | Partnerships must describe their principal business activity and product or service. |

| Accounting Method | Filing requires the partnership to indicate their accounting method: cash, accrual, or other. |

| Schedules Required | Each partnership must attach a Schedule 3K-1 for every partner who was part of the partnership during the tax year. |

| Signature Requirement | The form must be signed by a general partner, declaring the accuracy of the information provided. |

| Mailing Address | Completed forms must be mailed to the Massachusetts Department of Revenue, PO Box 7017, Boston, MA 02204. |

Popular PDF Forms

Massachusetts Aca 1202 - Subspecialty designations require clear documentation for eligibility.

When engaging in the transaction of an all-terrain vehicle, it is crucial to have the proper documentation in place to prevent any misunderstandings. The process is made easier with the New York ATV Bill of Sale form, which can be obtained from reliable sources like PDF Templates. This legal document not only signifies the transfer of ownership but also protects the interests of both parties involved.

Sales Tax Exemption Certificate Massachusetts - The application requires details of any asset transfers associated with a tax lien waiver.

Guide to Writing Massachusetts 3

Filling out the Massachusetts Form 3 is a crucial step for partnerships to report their income, deductions, and other pertinent information. Once completed, the form must be submitted to the Massachusetts Department of Revenue, along with any required schedules. Below are the steps to ensure you fill out the form correctly.

- Use black ink to complete the form.

- Enter the tax year dates at the top of the form. For calendar year filers, input 01-01-2020 and 12-31-2020.

- Fill in the name of the partnership and its Federal Identification Number (FID).

- Provide the mailing address, including city, state, and ZIP code. If applicable, include the name and address of the contact person.

- Complete sections A through L, detailing the principal business activity, product or service, business code number, and date the business started.

- Indicate total assets and whether this is an amended return, along with the reason for filing.

- Select the accounting method used (cash, accrual, or other).

- Specify the number of attached Schedules 3K-1, ensuring one is included for each partner.

- Complete the income and deduction sections, including gross income and ordinary income or loss.

- Fill in any applicable adjustments and ensure all calculations are accurate.

- Sign and date the form as the general partner, and provide the paid preparer’s information if applicable.

- Double-check that all 10 pages of Form 3 are completed before mailing.

- Send the completed form to the Massachusetts Department of Revenue at PO Box 7017, Boston, MA 02204.

Similar forms

The Massachusetts Form 3 is a tax return specifically for partnerships operating in the state. It has some similarities with other tax documents. Below is a list of eight documents that share characteristics with the Massachusetts Form 3, along with an explanation of those similarities.

- U.S. Form 1065: This is the federal tax return for partnerships. Like Form 3, it reports income, deductions, gains, and losses, and requires information about partners.

- Schedule K-1: Attached to Form 1065, this schedule details each partner's share of income, deductions, and credits. Similar to the Massachusetts Form 3, it provides essential information on partnership distributions.

- Form 1120: This is the corporate income tax return. While Form 3 is for partnerships, both documents require detailed financial information and share a similar structure in reporting income and expenses.

- Form 1065-B: This is used for electing large partnerships. It parallels Form 3 in that both require information about partnership activities and partner distributions, although Form 1065-B is specifically for larger entities.

- Colorado Bill of Sale Form: For those looking to formalize sales transactions, the essential Colorado bill of sale documentation guide serves as a critical resource.

- Form 990: Nonprofit organizations use this form to report their financial information. Like Form 3, it provides transparency about the organization's income, expenses, and activities, but for nonprofit entities.

- Form 1040 Schedule C: Sole proprietors use this form to report income or loss from a business. Both forms capture income and expenses, although Schedule C is for individual business owners rather than partnerships.

- Form 1120-S: This is the tax return for S corporations. Similar to Form 3, it is designed for pass-through entities and requires reporting of income, deductions, and distributions to shareholders.

- Form 941: Employers use this form to report payroll taxes. While primarily focused on employment taxes, both forms require accurate reporting of financial data and are essential for tax compliance.