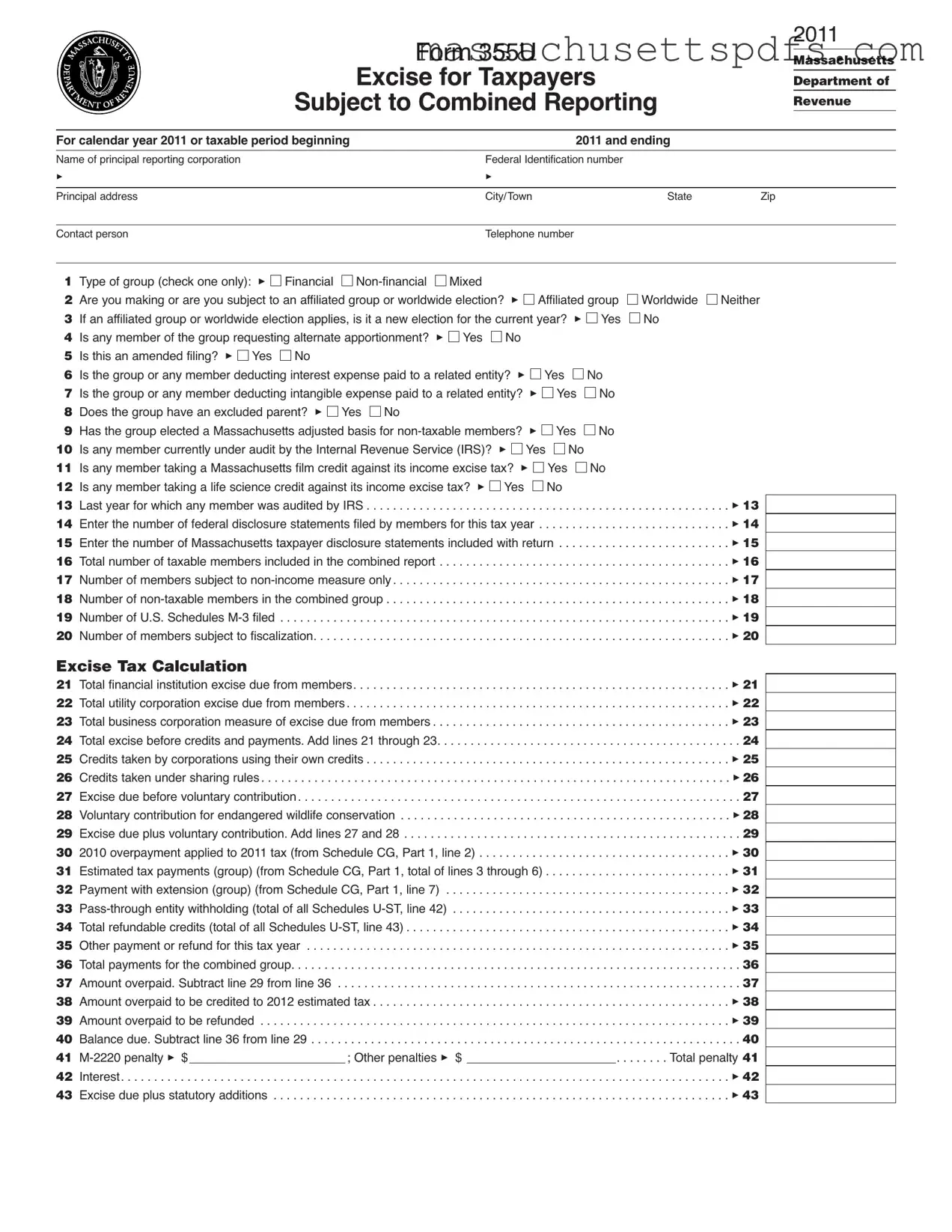

Official Massachusetts 355U Template

Key takeaways

Filling out and using the Massachusetts 355U form requires careful attention to detail. Here are key takeaways to keep in mind:

- Identify Your Group Type: Check the appropriate box to indicate whether your group is financial, non-financial, or mixed.

- Election Status: Clearly state if you are making an affiliated group or worldwide election. If applicable, indicate if it is a new election for the current year.

- Amended Filings: If this is an amended filing, ensure you mark the corresponding box.

- Interest and Intangible Expenses: Confirm whether any group member is deducting interest or intangible expenses paid to a related entity.

- Excluded Parent: Determine if the group has an excluded parent and mark accordingly.

- Audit Status: Indicate if any member is currently under audit by the IRS.

- Credits: Report any Massachusetts film or life science credits being claimed by group members against their income excise tax.

- Accurate Calculations: Ensure all excise tax calculations are accurate, including total excise due before credits and payments.

Completing the form accurately can prevent delays and potential penalties. Review each section carefully before submission.

Documents used along the form

The Massachusetts 355U form is an essential document for taxpayers subject to combined reporting. However, several other forms and documents often accompany it to ensure compliance with tax regulations. Below is a list of these related documents, each serving a specific purpose in the tax filing process.

- Form 355: This is the Massachusetts Corporate Excise Tax Return, which corporations must file to report their income and calculate their tax liability. It provides a comprehensive overview of a corporation's financial situation.

- Form 355S: This form is specifically for S corporations in Massachusetts. It allows these entities to report their income and deductions while ensuring they comply with state tax laws.

- Form 355U Schedule CG: This schedule is used to report the combined group’s estimated tax payments and any overpayments applied to the current tax year. It ensures accurate accounting of payments made by the group.

- Form M-3: This federal form is required for corporations with total assets of $10 million or more. It provides detailed information about a corporation's financial position and is crucial for reconciling federal and state tax obligations.

- Form U-ST: This form is used for pass-through entities to report withholding tax on income distributed to non-resident members. It ensures that appropriate taxes are withheld and reported to the state.

- Form 941: This is the Employer's Quarterly Federal Tax Return. While not specific to Massachusetts, it is important for businesses to report payroll taxes, which can affect overall tax liability.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Businesses often use it to report payments made to independent contractors and other non-employees.

- New York DTF-84 Form: The DTF-84 form is an application for Qualified Empire Zone Enterprise (QEZE) Sales Tax Certification, allowing businesses to access sales tax benefits in Empire Zones. For more information, visit nydocuments.com.

- Form 4868: This is the Application for Automatic Extension of Time to File U.S. Individual Income Tax Return. Taxpayers may use it to request an extension, providing additional time to file their returns without incurring penalties.

- Schedule C: This form is used by sole proprietors to report income or loss from a business. It is important for individuals who operate their businesses independently and need to report their earnings accurately.

Each of these forms plays a vital role in the overall tax filing process, ensuring that businesses and corporations comply with both state and federal regulations. Understanding their purposes can help taxpayers navigate the complexities of tax reporting more effectively.

Document Information

| Fact Name | Description |

|---|---|

| Form Purpose | The Massachusetts 355U form is used for taxpayers subject to combined reporting, specifically for corporate excise tax purposes. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 63, which outlines the corporate excise tax requirements. |

| Filing Requirement | Taxpayers must file Form 355U if they are part of a combined group for the tax year. |

| Contact Information | Taxpayers are required to provide a principal address and a contact person's details on the form. |

| Election Options | The form allows taxpayers to indicate if they are making an affiliated group or worldwide election, which affects tax calculations. |

| Amended Filings | Taxpayers can indicate if the filing is an amended return, which is important for accurate record-keeping. |

| Deduction Queries | The form includes questions about deductions for interest and intangible expenses paid to related entities, impacting tax liability. |

| Audit Status | Taxpayers must disclose if any member of the group is currently under audit by the IRS, which can influence tax positions. |

| Credit Information | Members can report various tax credits, including film and life science credits, which may reduce their excise tax due. |

Popular PDF Forms

University of Massachusetts Amherst Transcript Request - This transcript request is intended for former and current students of UMass Lowell.

When purchasing an RV in California, it's important to have the appropriate documentation to ensure a smooth transaction. The California RV Bill of Sale form serves as a legal document that records the sale and purchase of a recreational vehicle (RV) within the state of California, and you can find a convenient version of this form at californiapdf.com/editable-rv-bill-of-sale/. This form provides essential information about the transaction, including details about the buyer, seller, and the RV itself, and plays a crucial role in the transfer of ownership, ensuring that the process adheres to California law.

Massachusetts Dsb Application - Provide the name and location of the project related to this application.

Guide to Writing Massachusetts 355U

Filling out the Massachusetts 355U form requires attention to detail and accuracy. This form is essential for taxpayers subject to combined reporting. Make sure you have all necessary information ready before you begin. Follow these steps to complete the form correctly.

- Enter the name of the principal reporting corporation.

- Provide the federal identification number.

- Fill in the principal address, including city, state, and zip code.

- List the contact person's name and telephone number.

- Check the appropriate box for the type of group: Financial, Non-financial, or Mixed.

- Indicate if you are making or are subject to an affiliated group or worldwide election by checking the relevant box.

- If applicable, specify whether this is a new election for the current year.

- State if any member of the group is requesting alternate apportionment.

- Indicate if this is an amended filing.

- Check if the group or any member is deducting interest expense paid to a related entity.

- Check if the group or any member is deducting intangible expense paid to a related entity.

- Indicate if the group has an excluded parent.

- Check if the group elected a Massachusetts adjusted basis for non-taxable members.

- State if any member is currently under audit by the IRS.

- Provide the last year for which any member was audited by the IRS.

- Enter the number of federal disclosure statements filed by members for this tax year.

- Enter the number of Massachusetts taxpayer disclosure statements included with the return.

- Provide the total number of taxable members included in the combined report.

- Indicate the number of members subject to non-income measure only.

- Enter the number of non-taxable members in the combined group.

- State the number of U.S. Schedules M-3 filed.

- Indicate the number of members subject to fiscalization.

- Calculate the total financial institution excise due from members.

- Calculate the total utility corporation excise due from members.

- Calculate the total business corporation measure of excise due from members.

- Add lines 21 through 23 for total excise before credits and payments.

- List any credits taken by corporations using their own credits.

- List any credits taken under sharing rules.

- Calculate the excise due before voluntary contribution.

- Enter any voluntary contribution for endangered wildlife conservation.

- Add lines 27 and 28 for excise due plus voluntary contribution.

- Enter the 2010 overpayment applied to the 2011 tax.

- Provide the estimated tax payments for the group.

- Enter the payment with extension for the group.

- List the total pass-through entity withholding.

- Enter the total refundable credits.

- List any other payment or refund for this tax year.

- Calculate the total payments for the combined group.

- Determine the amount overpaid by subtracting line 29 from line 36.

- Indicate the amount overpaid to be credited to the 2012 estimated tax.

- Enter the amount overpaid to be refunded.

- Calculate the balance due by subtracting line 36 from line 29.

- List any penalties and interest.

- Finally, calculate the excise due plus statutory additions.

Similar forms

Form 355: This is the standard corporate excise tax return for Massachusetts businesses. Like Form 355U, it requires detailed financial information and is used for tax reporting, but it is not specifically for combined reporting groups.

- New York Bill of Sale Form: A crucial document for verifying the transfer of personal property ownership, ensuring protection for both parties involved in the transaction. For more details, visit PDF Templates.

Form 355S: This form is designed for S corporations in Massachusetts. Similar to Form 355U, it focuses on tax obligations but caters to a different type of corporate structure, emphasizing pass-through taxation.

Form 1120: The federal corporate tax return, Form 1120, is used by corporations to report income, gains, losses, and deductions. Like Form 355U, it involves comprehensive financial disclosures but is filed at the federal level.

Form 1065: This is the U.S. Return of Partnership Income. Similar to Form 355U, it is used to report income, deductions, and credits for partnerships, which are often subject to different tax treatment than corporations.

Schedule M-3: This schedule is used by corporations to reconcile financial accounting income with taxable income. Like Form 355U, it is intended for corporate entities and provides detailed reporting requirements.

Form 990: Nonprofit organizations use this form to report their financial information to the IRS. While it serves a different purpose, it shares similarities with Form 355U in that both require detailed financial disclosures and compliance with tax regulations.

Form 941: This is the Employer's Quarterly Federal Tax Return. It reports income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks. While it focuses on payroll taxes, it is similar to Form 355U in terms of its role in compliance and reporting obligations for businesses.