Official Massachusetts 3M Template

Key takeaways

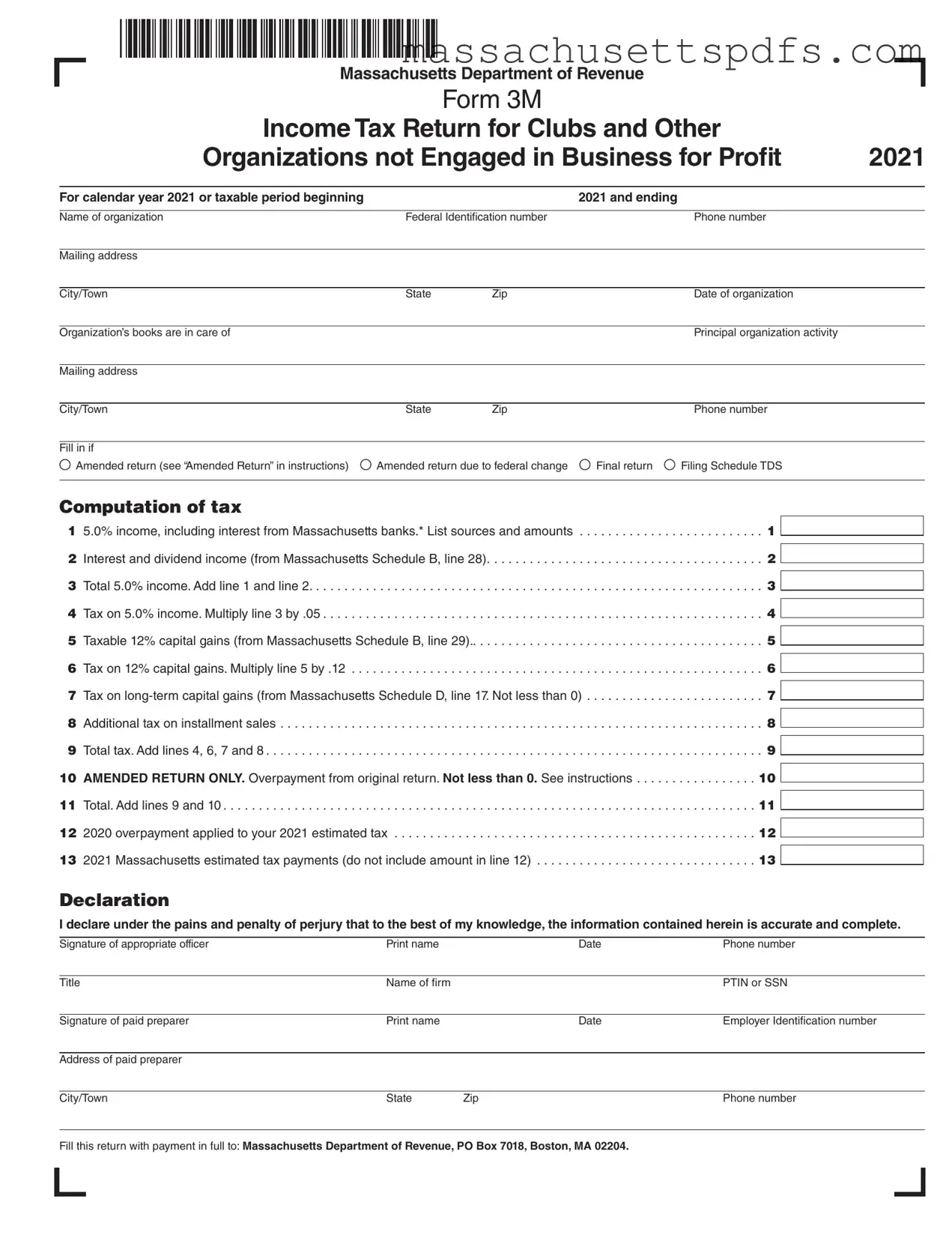

When it comes to filing the Massachusetts 3M form, there are several important points to keep in mind. This form is designed specifically for clubs and organizations that do not operate for profit. Here are six key takeaways to help you navigate the process smoothly:

- Know Your Eligibility: The 3M form is intended for clubs, labor unions, political committees, and similar organizations that primarily have taxable dividends, interest, and capital gains.

- Understand the Tax Rates: Be aware that the form assesses a 5.0% tax on income, including interest from Massachusetts banks. Make sure to accurately report all sources of income.

- Accurate Information is Crucial: Fill in all required fields carefully, including the organization’s name, federal identification number, and mailing address. Inaccurate information can lead to delays or penalties.

- Amended Returns: If you need to amend a return, check the appropriate box on the form. This is important if your filing is due to a federal change or if it’s your final return.

- Record Keeping: Keep detailed records of your income sources and amounts. This will help you when calculating your total 5.0% income and any applicable taxes.

- Filing Location: Mail your completed form and payment to the Massachusetts Department of Revenue at the specified address. Ensure that you send it to the correct PO Box to avoid misdirection.

By following these guidelines, you can ensure that your filing process is efficient and compliant with Massachusetts tax regulations. Remember, thoroughness and accuracy are your best allies when completing the 3M form!

Documents used along the form

The Massachusetts 3M form serves as an income tax return specifically designed for clubs and other organizations that are not engaged in profit-making activities. In addition to the 3M form, several other documents may be required to ensure compliance with Massachusetts tax regulations. Each of these forms plays a crucial role in providing a complete financial picture of the organization. Below is a list of commonly used forms and documents that accompany the Massachusetts 3M form.

- Form 990: This is the federal tax return for tax-exempt organizations. It provides detailed information about the organization's mission, programs, and finances. Organizations that earn more than a specified amount must file this form annually.

- California Vehicle Purchase Agreement: Essential for formalizing vehicle transactions in California, this document can be obtained easily through My PDF Forms.

- Form 990-T: This form is used by tax-exempt organizations to report unrelated business income and calculate the tax owed on that income. If a club or organization has income from activities not directly related to its exempt purpose, this form is necessary.

- Schedule B: This schedule accompanies the Form 990 and provides a detailed listing of contributors who gave more than a certain amount. It is essential for transparency and accountability regarding donations received.

- Schedule D: This schedule is also part of the Form 990 and is used to provide additional information about the organization’s financial statements. It includes details on the organization’s net assets and any significant changes in financial position.

- Form 3: This form is the Partnership Return of Income and is required for organizations that engage in business activities. If an organization has income that qualifies as business income, it must file this form instead of the 3M.

- Form 1: This is the Massachusetts Resident Income Tax Return. While not directly related to the 3M, individual members of the organization may need to file this form if they receive income from the organization that is taxable.

- Technical Information Release (TIR): These releases provide guidance on specific tax issues and are issued by the Massachusetts Department of Revenue. They can clarify how certain regulations apply to organizations filing the 3M form.

Understanding the various forms that may accompany the Massachusetts 3M form is crucial for ensuring compliance with tax obligations. Each document serves a specific purpose and contributes to a comprehensive view of the organization's financial activities. Organizations should ensure they are aware of their filing requirements to maintain their tax-exempt status and fulfill their legal obligations.

Document Information

| Fact Name | Details |

|---|---|

| Purpose | The Massachusetts 3M form is used for filing income tax returns by clubs and organizations not engaged in profit-making activities. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 62. |

| Eligibility | Only certain organizations, such as labor unions and political committees, can use this form. |

| Tax Rate | The tax rate applied to 5.0% income is 5.0%, while the tax on capital gains is 12%. |

| Amended Returns | Organizations can file an amended return if there are changes to the original submission. |

| Filing Deadline | The form must be filed by the due date for the organization's tax year, typically April 15 for calendar year filers. |

| Where to File | Submit the completed form to the Massachusetts Department of Revenue, PO Box 7018, Boston, MA 02204. |

Popular PDF Forms

Rmv Hearing Request - It plays a critical role in advocating for appropriate educational services for students.

For those seeking to understand the importance of documentation during transactions, a reliable option is the complete Colorado bill of sale form that outlines the specifics of the sale. You can find more information at the official bill of sale resource.

Informal Probate Massachusetts - It serves as a formal request for the court's intervention in estate matters.

Guide to Writing Massachusetts 3M

Completing the Massachusetts 3M form requires careful attention to detail. This form is specifically designed for clubs and organizations that are not engaged in business for profit. It is essential to provide accurate information to ensure compliance with state tax regulations. Below are the steps to fill out the form.

- Begin by entering the name of the organization at the top of the form.

- Provide the Federal Identification number of the organization.

- Fill in the phone number and mailing address, including city/town, state, and zip code.

- Indicate the date of organization.

- Specify who is in care of the organization's books by filling in the principal organization activity and their mailing address, city/town, state, zip code, and phone number.

- Check the appropriate box if this is an amended return, final return, or if it is due to a federal change.

- Complete the Computation of tax section, including lines for 5.0% income, interest and dividend income, and total tax calculations.

- Calculate the tax on 5.0% income by multiplying the total income by 0.05.

- Fill in the taxable 12% capital gains and calculate the tax on those gains.

- Continue to complete any additional lines for long-term capital gains, installment sales, and any applicable penalties.

- In the declaration section, have an appropriate officer sign and print their name, along with the date and title.

- If a paid preparer is involved, they should also sign and provide their information.

- Finally, mail the completed form and payment to the Massachusetts Department of Revenue at the provided address.

Similar forms

- Form 990: This form is used by tax-exempt organizations to provide the IRS with information about their activities, governance, and financials. Similar to Form 3M, it requires detailed reporting of income and expenditures, although Form 990 is more comprehensive and used by a broader range of organizations.

- Form 990-EZ: A simplified version of Form 990, this form is designed for smaller tax-exempt organizations. Like Form 3M, it focuses on income and expenses but is shorter and less complex, making it easier for smaller organizations to comply.

- Form 990-T: This form is filed by tax-exempt organizations that have unrelated business taxable income. It shares similarities with Form 3M in reporting income, but it specifically addresses income generated from activities not related to the organization’s primary purpose.

- New York ATV Bill of Sale: This essential document is crucial for buyers and sellers in New York to ensure a smooth transaction. For a seamless process, fill out the form by visiting PDF Templates.

- Form 1065: Used by partnerships to report income, deductions, and credits. Form 3M is similar in that both forms require reporting of income and tax calculations, though Form 1065 is tailored for partnerships, while Form 3M is for non-profit organizations.

- Form 1040: The individual income tax return form for U.S. citizens. While Form 3M is for organizations, both require taxpayers to report income and calculate taxes owed, demonstrating the fundamental principles of income reporting.

- Form 1120: This is the corporate income tax return. Similar to Form 3M, it requires reporting of income and tax calculations. However, Form 1120 is specifically for for-profit corporations, whereas Form 3M is for non-profit organizations.

- Form 941: This form is used by employers to report payroll taxes. While Form 3M deals with income tax for organizations, both forms require accurate reporting of financial data and tax obligations, highlighting the importance of compliance in different contexts.