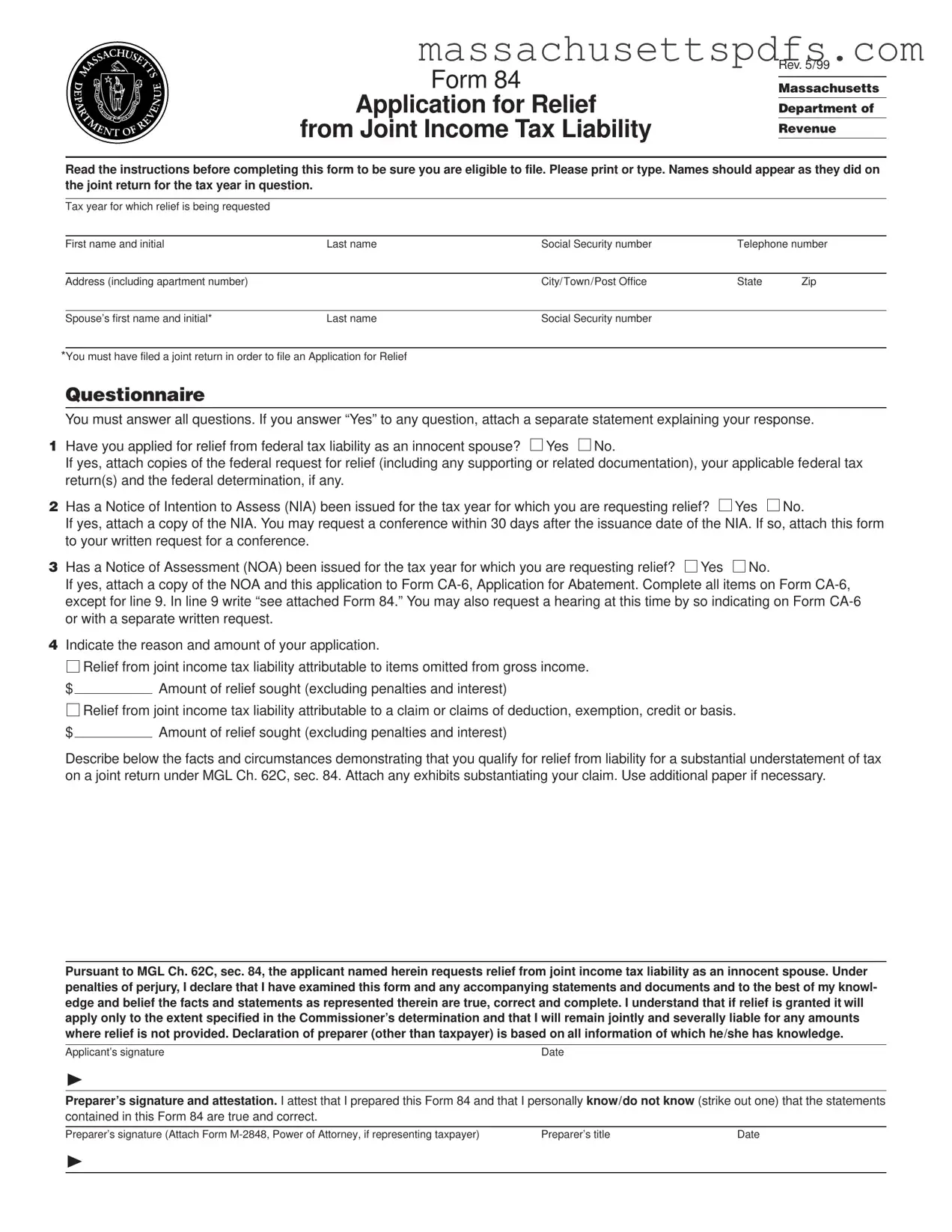

Official Massachusetts 84 Template

Key takeaways

Here are some key takeaways about filling out and using the Massachusetts Form 84:

- Eligibility is crucial: Before completing the form, ensure you meet the eligibility requirements outlined in the instructions.

- Accurate information is essential: Print or type your name exactly as it appears on the joint tax return for the relevant tax year.

- Complete all questions: Answer every question on the form. If you respond “Yes” to any, provide a detailed explanation on a separate sheet.

- Attachments matter: Include all necessary documents, such as copies of any federal requests for relief and relevant tax returns.

- Timing is key: Submit the form within the specified time frame after receiving a Notice of Intention to Assess (NIA) or a Notice of Assessment (NOA).

- Understand your liability: Even if relief is granted, you remain jointly liable for any amounts not covered by the determination.

- Keep copies: Retain copies of everything you submit, including the completed Form 84 and any attachments.

- Seek assistance if needed: If you have questions or need help, consider contacting the Department of Revenue or a tax professional.

Documents used along the form

The Massachusetts Form 84 is an important document for individuals seeking relief from joint income tax liability. When filing this form, applicants often need to provide additional documentation to support their claims. Below is a list of other forms and documents that may be used in conjunction with Form 84, along with a brief description of each.

- Form CA-6: Application for Abatement - This form is used to request a reduction in tax liability after a Notice of Assessment (NOA) has been issued. It allows taxpayers to contest the assessment and provides an avenue for hearing requests.

- Notice of Intention to Assess (NIA) - This notice informs taxpayers of the state's intention to assess additional taxes. If received, it’s crucial to respond within 30 days, often requiring the attachment of Form 84 for relief requests.

- Colorado Bill of Sale Form: For those needing to document their transactions, utilize the detailed Colorado bill of sale form guidelines to ensure all legal aspects are properly addressed.

- Notice of Assessment (NOA) - This document indicates that the Department of Revenue has assessed additional taxes owed. It serves as a basis for filing Form CA-6 if the taxpayer disagrees with the assessment.

- Federal Innocent Spouse Relief Application - If a taxpayer has applied for relief from federal tax liability as an innocent spouse, copies of this application and any related documentation must be attached to Form 84.

- Federal Tax Returns - Applicants should include copies of their federal tax returns for the relevant years. These documents provide context and evidence regarding the tax situation.

- Federal Determination Notice - This notice is issued by the IRS if relief is granted at the federal level. Including it with Form 84 strengthens the case for state-level relief.

- Exhibits or Supporting Documents - Any additional documents that substantiate the claim for relief should be attached. This may include financial statements or other relevant evidence.

- Written Request for Conference - If a conference is desired following the issuance of an NIA, a written request must be submitted. This document should accompany Form 84.

- Form M-2848: Power of Attorney - If a preparer is representing the taxpayer, this form grants them the authority to act on the taxpayer’s behalf and must be included with Form 84.

Understanding these accompanying forms and documents is crucial for anyone navigating the complexities of tax relief in Massachusetts. Properly completing and submitting the relevant paperwork can significantly impact the outcome of your application for relief from joint income tax liability.

Document Information

| Fact Name | Fact Description |

|---|---|

| Purpose | The Massachusetts Form 84 is used to apply for relief from joint income tax liability, particularly in cases where one spouse claims to be an innocent spouse. |

| Governing Law | This form operates under Massachusetts General Laws Chapter 62C, Section 84, which outlines the conditions for granting tax relief. |

| Eligibility | To be eligible, the applicant must have filed a joint return and must demonstrate that they did not know about the substantial understatement of tax. |

| Filing Deadline | If a Notice of Intention to Assess (NIA) has been issued, the application must be submitted within 30 days of the NIA's issuance. |

| Attachments Required | Applicants must attach relevant documents such as copies of federal claims for relief, federal tax returns, and any Notices of Assessment or Intention to Assess. |

| Substantial Understatement | A substantial understatement is defined as exceeding $200 for omitted gross income items or $500 for claims of deduction, exemption, or credit without basis. |

| Joint Liability | Even if relief is granted, the applicant remains jointly liable for any amounts not covered by the relief determination. |

| Notice of Determination | A written notice of determination will be issued to the applicant, specifying the extent of any relief granted. |

Popular PDF Forms

Florida Lost Title - A signed letter from the lienholder must accompany the application if the title is not held by them.

To facilitate a smooth transaction when selling or purchasing a vehicle, it is essential for both parties to download and fill out the form before finalizing the deal. This form ensures that all necessary details are provided, thus minimizing the chance of disagreements in the future.

Massachusetts Aca 1202 - Claims paid must reflect qualifying services to meet the criteria for Section 1202.

Guide to Writing Massachusetts 84

Filling out the Massachusetts 84 form is an important step for individuals seeking relief from joint income tax liability. After completing the form, you will need to submit it along with any required documentation to the Massachusetts Department of Revenue. This process ensures that your request for relief is considered appropriately.

- Obtain the form: Download or print the Massachusetts 84 form from the official Massachusetts Department of Revenue website.

- Provide your information: Fill in your first name, middle initial, last name, Social Security number, telephone number, address (including apartment number), city/town/post office, state, and zip code. Ensure that your name matches the one on the joint return for the tax year in question.

- Fill in your spouse's information: Enter your spouse’s first name, middle initial, last name, and Social Security number. Remember, this form is only for those who filed a joint return.

- Answer the Application for Relief Questionnaire: Respond to all questions. If you answer “Yes” to any question, attach a separate statement explaining your answer. This section requires you to disclose if you have applied for federal tax relief, received any Notices of Intention to Assess (NIA), or Notices of Assessment (NOA).

- Indicate the reason for your application: Specify the reasons for seeking relief and the amount of relief sought for items omitted from gross income and claims of deductions, exemptions, credits, or basis. Fill in the corresponding dollar amounts.

- Describe your circumstances: Provide a detailed account of the facts and circumstances that support your request for relief. Attach any relevant documents or exhibits that substantiate your claim. Use additional paper if necessary.

- Sign the form: Both you and your preparer (if applicable) need to sign and date the form. Ensure that all information is accurate and complete to the best of your knowledge.

- Prepare for submission: Gather all necessary attachments, including any federal claims for relief, and ensure everything is in order.

- Mail the application: Send the completed Form 84 along with all attachments to the address specified on the NIA or the Massachusetts Department of Revenue, Customer Service Bureau, PO Box 7031, Boston, MA 02204.

Similar forms

The Massachusetts Form 84 is an important document for those seeking relief from joint income tax liability. Here are ten other documents that are similar in purpose or function:

- IRS Form 8857 - This is the federal equivalent of the Massachusetts Form 84. It allows individuals to request relief from joint tax liability as an innocent spouse at the federal level.

- Form CA-6 - This is the Massachusetts Application for Abatement. It is used to request a reduction of an assessed tax amount, and it can be filed alongside Form 84 when seeking relief after an assessment.

- IRS Form 1040 - The standard individual income tax return form. While not directly for relief, it is the basis for joint returns and necessary for establishing tax liability.

- IRS Form 8379 - This form allows injured spouses to request their portion of a joint refund when their spouse owes past debts, similar to how Form 84 seeks to protect innocent spouses.

- Massachusetts Form 1 - This is the Massachusetts resident income tax return. It is essential for filing taxes and can be referenced when determining joint liability issues.

- IRS Form 8862 - This form is used to claim the Earned Income Tax Credit after it has been denied in previous years, which can relate to issues of tax liability and relief.

- Massachusetts Form M-2848 - This is the Power of Attorney form. It allows a representative to act on behalf of a taxpayer, similar to how one might need representation when filing for relief.

- New York DTF-84 (Application for Qualified Empire Zone Enterprise Sales Tax Certification): Similar to the aforementioned forms, the New York DTF-84 allows businesses in designated Empire Zones to apply for sales tax benefits, making it essential for those looking for tax advantages in New York, more information can be found at nydocuments.com/.

- IRS Form 1040-X - This is the Amended U.S. Individual Income Tax Return. It is used to correct errors on a previously filed return, which can be relevant if errors lead to a request for relief.

- IRS Publication 971 - This publication provides information on innocent spouse relief, helping individuals understand the criteria and process, similar to the guidance provided with Form 84.

- Massachusetts Department of Revenue Notices - Notices such as the Notice of Intention to Assess (NIA) or Notice of Assessment (NOA) are critical documents that inform taxpayers of their tax status and can trigger the need for Form 84.