Official Massachusetts Abt Template

Key takeaways

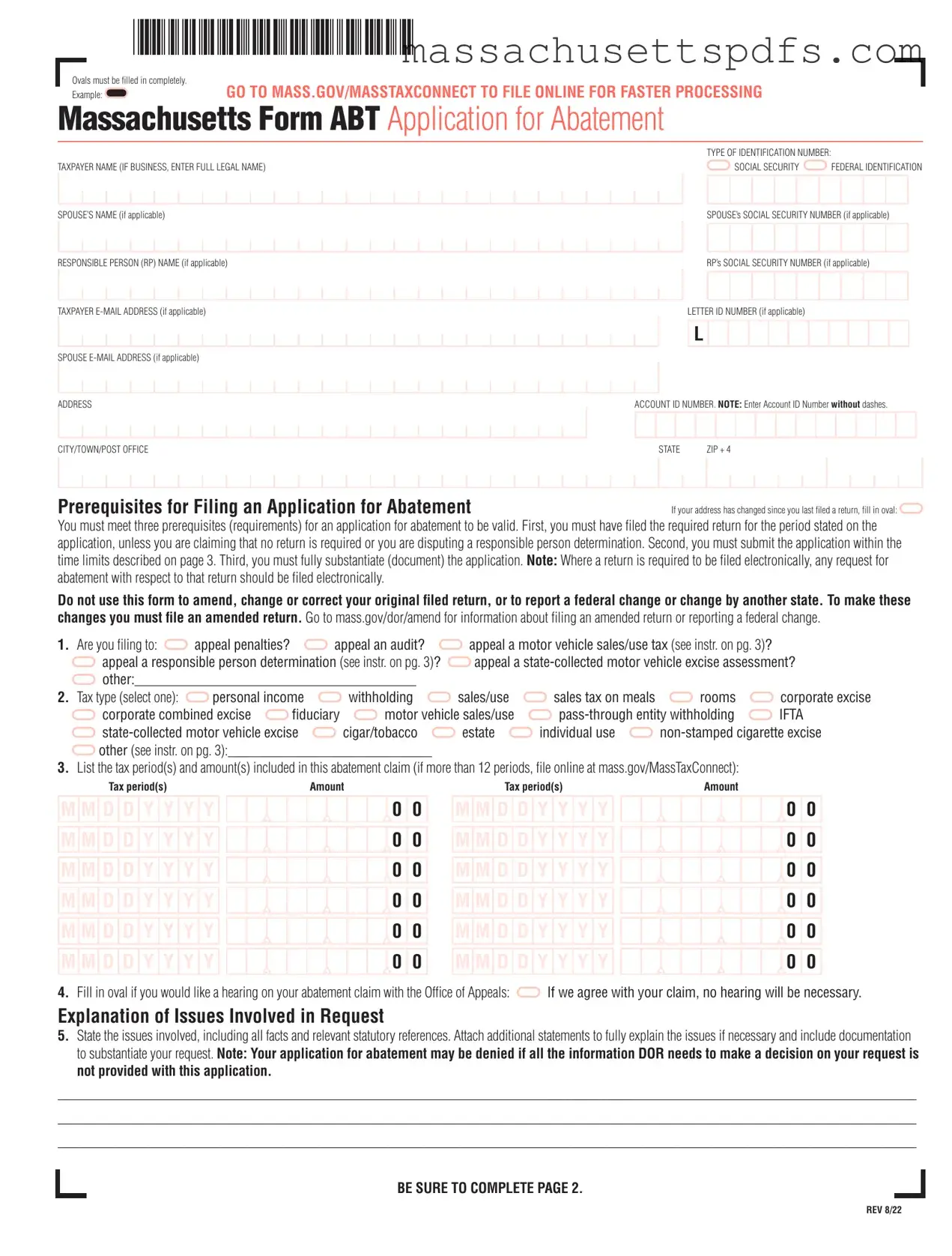

Complete the Ovals: Ensure that all ovals on the Massachusetts Abt form are filled in completely. This is crucial for processing your application efficiently.

Eligibility Requirements: You must meet three prerequisites for your abatement application to be valid. First, you must have filed the required return for the period in question. Second, fully substantiate your application with appropriate documentation. Lastly, submit the application within the specified time limits.

Do Not Amend Returns: This form is not intended for amending or correcting original filed returns. If you need to make such changes, you must file an amended return instead.

Provide Detailed Explanations: Clearly state the issues involved in your request and attach any necessary documentation. Incomplete applications may be denied due to insufficient information.

Consent for Processing: By submitting the application, you give consent for the Commissioner of Revenue to act on it after six months. You may withdraw this consent at any time.

Time Limits: Be mindful of the time limits for filing your application. Generally, you have three years from the return filing date, two years from the tax assessment date, or one year from the date the tax was paid to submit your application.

Documents used along the form

The Massachusetts Abatement Application (Form ABT) is a crucial document for taxpayers seeking to challenge tax assessments. Alongside this form, several other documents may be necessary to support your claim or provide additional context. Below is a list of commonly used forms and documents that complement the ABT form.

- Form DR-1: Office of Appeals Form - This form is used to request a hearing before the Office of Appeals regarding disputes related to tax assessments. It allows taxpayers to formally present their case and seek resolution.

- Form 84: Application for Relief From Joint Income Tax Liability - Taxpayers seeking innocent spouse relief must complete this form. It provides a mechanism for one spouse to request relief from joint tax liabilities incurred during the marriage.

- Form MV-AB2: Affidavit – Rescission of Sale of a Motor Vehicle - This affidavit is necessary when disputing sales tax related to a rescinded vehicle sale. It must be submitted along with supporting documentation, such as the bill of sale and registration.

- Amended Return - If you need to correct or change information from a previously filed return, an amended return must be filed. This document is essential for accurately reflecting your tax situation.

- New York Bill of Sale Form: This document is essential for transferring ownership of personal property in New York. To learn more about how to fill out this form, visit PDF Templates.

- Power of Attorney - This document grants another individual the authority to act on your behalf regarding tax matters. It is particularly useful if you wish to have someone represent you in discussions with the Department of Revenue.

Utilizing the appropriate forms and documents can streamline the abatement process and enhance the chances of a favorable outcome. Ensure that all submissions are complete and accurate to avoid delays or denials.

Document Information

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The Massachusetts Form ABT is used to apply for an abatement of various taxes. |

| Governing Laws | The application is governed by MGL ch 58A, § 6 and MGL ch 62C, § 37. |

| Prerequisites | Applicants must have filed the required return, substantiate their claim, and submit within time limits. |

| Filing Online | For faster processing, applicants can file online at mass.gov/masstaxconnect. |

| Hearing Request | Applicants can request a hearing on their abatement claim with the Office of Appeals. |

| Power of Attorney | Taxpayers can appoint an attorney-in-fact to represent them before the Department of Revenue. |

| Documentation Required | Applicants must provide all relevant facts and documentation to substantiate their request. |

| Interest and Penalties | Interest may accrue on unpaid amounts, and penalties may be abated in certain cases. |

Popular PDF Forms

Massachusetts Dsb Application - List up to five current and relevant projects managed by the prime applicant or joint-venture members.

In addition to providing all necessary information regarding the sale and purchase of recreational vehicles, the California RV Bill of Sale form ensures a smooth transaction and can be easily accessed through resources like https://californiapdf.com/editable-rv-bill-of-sale for those looking to create a legally binding document.

Sales Tax Exemption Certificate Massachusetts - Applicants are encouraged to read the instructions for each section carefully before submission.

Guide to Writing Massachusetts Abt

Filling out the Massachusetts Abatement (ABT) form requires careful attention to detail. Each section must be completed accurately to ensure your application is processed smoothly. Follow these steps to fill out the form correctly.

- Begin by entering the taxpayer name. If this is a business, provide the full legal name.

- Choose the type of identification number. You can select either Social Security or Federal Identification.

- If applicable, enter the spouse’s social security number and name.

- If applicable, provide the responsible person's name and their social security number.

- Fill in the letter ID number if you have one.

- Complete the address, including city, town, state, and ZIP code.

- If your address has changed since your last return, mark the appropriate oval.

- Indicate if you are filing to dispute penalties, an audit, or other specific issues.

- Select the tax type from the provided options.

- List the tax periods and amounts included in your abatement claim. If you have more than 12 periods, attach a separate statement.

- Mark the oval if you want a hearing regarding your abatement claim.

- If you are filing for a reduction in certain taxes without having withheld or collected them, mark the appropriate oval.

- Clearly state the issues involved in your request. Attach additional statements and documentation if necessary.

- Mail the completed form to the Massachusetts Department of Revenue at the specified address.

- Complete the second page of the form as required.

- Sign the form to declare that the information is true and complete.

- If applicable, fill out the Power of Attorney section to authorize someone to represent you.

After completing these steps, ensure all necessary documentation is attached. Double-check your entries for accuracy before mailing the application to avoid delays in processing.

Similar forms

- IRS Form 843: This form is used to request an abatement of penalties and interest on federal taxes. Similar to the Massachusetts Abt form, it requires taxpayers to substantiate their claims with relevant documentation.

- IRS Form 1040X: This is the Amended U.S. Individual Income Tax Return. It allows taxpayers to correct errors on previously filed returns, similar to how the Massachusetts Abt form addresses disputes regarding tax assessments.

- Massachusetts Form 84: This form is for requesting relief from joint income tax liability. Like the Abt form, it involves providing detailed information about the taxpayer's situation and supporting documentation.

- IRS Form 911: This form is used to request a delay in the collection of taxes due to financial hardship. It parallels the Abt form by allowing taxpayers to present their case for relief.

- Massachusetts Form ST-5: This form is used to claim an exemption from sales tax. It requires taxpayers to provide justification, similar to the requirements in the Abt form for substantiating claims.

- IRS Form 8822: This form is for changing an address with the IRS. While not a tax dispute form, it shares the need for accurate information and timely submission, akin to the Abt form's prerequisites.

- Massachusetts Form M-990: This is an application for abatement of property tax. It requires detailed information about the property and reasons for the abatement, similar to the Abt form's requirements.

- Colorado Bill of Sale Form: When transferring ownership of personal property, utilize the helpful Colorado bill of sale form guidelines for accurate documentation.

- IRS Form 1040: The standard individual income tax return form. Taxpayers must provide comprehensive information, much like the Abt form requires for tax disputes.

- Massachusetts Form MA-AB: This form is specifically for abatement requests related to real estate taxes. It parallels the Abt form in its focus on providing justification for the abatement request.