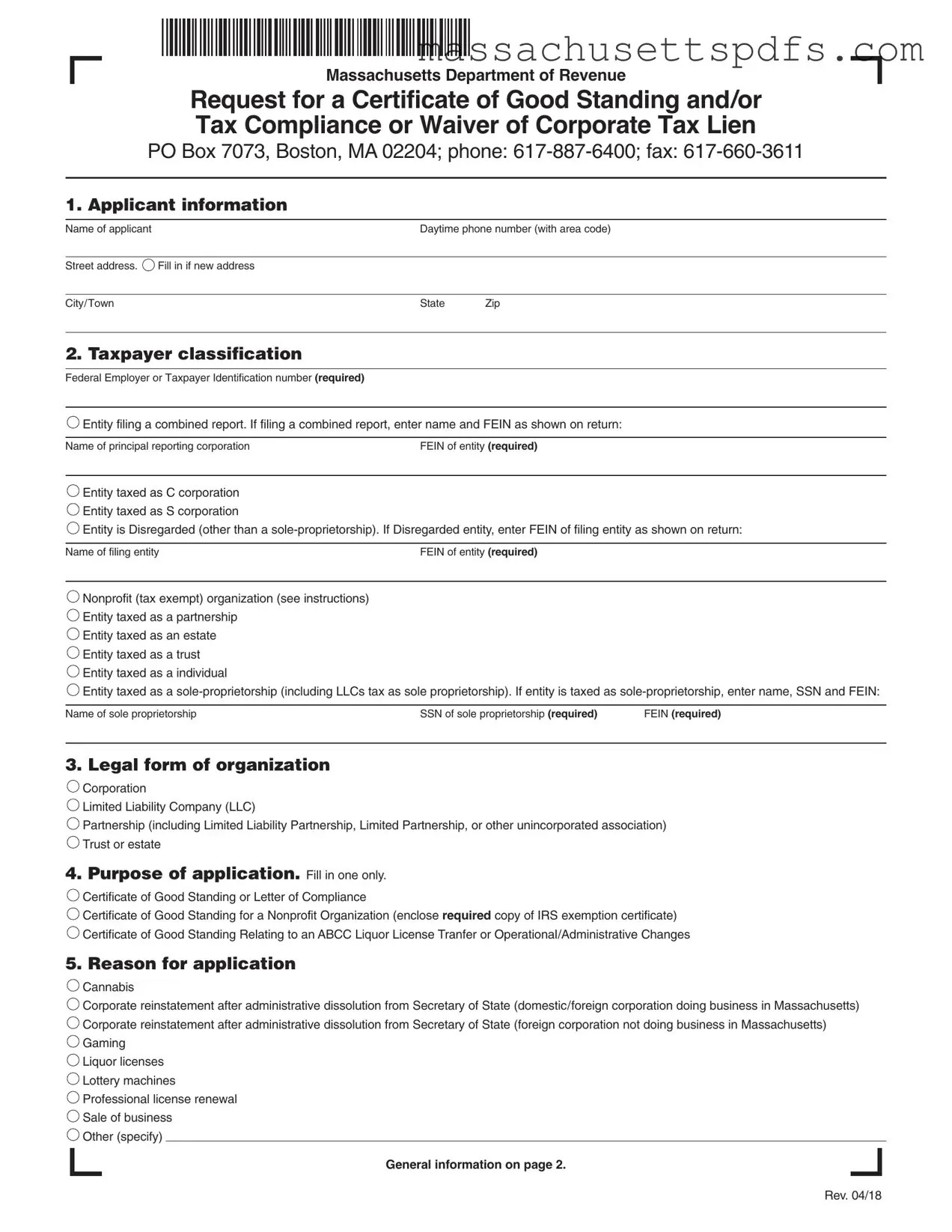

Official Massachusetts Certificate Tax Template

Key takeaways

When filling out the Massachusetts Certificate Tax form, it’s essential to be thorough and accurate. Here are some key takeaways to keep in mind:

- Complete Applicant Information: Ensure that you fill in your name, daytime phone number, and address correctly. If you have a new address, make sure to update it.

- Taxpayer Classification: Identify your entity type accurately. This includes options such as C corporation, S corporation, partnership, or sole proprietorship.

- Legal Form of Organization: Clearly indicate whether your organization is a corporation, LLC, partnership, trust, or estate.

- Purpose of Application: Select only one purpose for your application, such as requesting a Certificate of Good Standing or a Letter of Compliance.

- Reason for Application: Specify the reason for your application, which could range from corporate reinstatement to professional license renewal.

- Transfer of License: If you are transferring a liquor license, provide the buyer's name and address, along with relevant tax identification numbers.

- Person to Receive Response: Decide who should receive the response. You can choose to have it sent to the taxpayer or another designated person, but ensure that proper authorization is included.

- Affidavit and Signature: Sign the affidavit under penalties of perjury. This declaration confirms your responsibility for applicable taxes, and it is a required step.

Finally, for a faster process, consider using the online application. Remember, missing information can lead to delays, so double-check all entries before submission.

Documents used along the form

The Massachusetts Certificate Tax form is a crucial document for businesses seeking compliance and good standing with the state's tax regulations. Alongside this form, several other documents may be required to ensure a smooth application process. Below is a list of forms and documents commonly used in conjunction with the Massachusetts Certificate Tax form.

- Form 3: Partnership Return of Income - This form is necessary for partnerships to report income, deductions, and credits. If a partnership has not filed this form for the last two years, it must be submitted with the Certificate Tax application.

- IRS Exemption Certificate - Nonprofit organizations must provide this certificate to confirm their tax-exempt status. It is essential for obtaining a Certificate of Good Standing for nonprofits.

- Power of Attorney - If someone other than the taxpayer is handling the application, a Power of Attorney document is needed. This grants authority to that person to act on behalf of the taxpayer.

- Corporate Tax Returns - Recent tax returns may be required to demonstrate compliance with state tax obligations. These documents provide a snapshot of the entity's financial health.

- Sales Tax Registration Certificate - Businesses involved in sales must present this certificate to show they are registered to collect sales tax in Massachusetts.

- Liquor License Transfer Application - If the application involves transferring a liquor license, this document must be completed and submitted as part of the process.

- Affidavit of Taxes - This affidavit confirms that the applicant is responsible for all applicable taxes. It is a declaration under penalty of perjury, reinforcing the seriousness of the application.

- New York Boat Bill of Sale - This essential document records the transfer of ownership of a boat, ensuring a clear understanding between buyer and seller. You can find a useful template for this form at PDF Templates.

- Asset List - If applying for a Waiver of Corporate Tax Lien, an asset list detailing the items to be sold is required. This document helps assess the value of the assets involved.

Having these documents ready can help streamline the application process and prevent delays. It is important to ensure all information is accurate and complete to facilitate a successful outcome. Should you need further assistance, don't hesitate to reach out to the appropriate authorities or consult a professional.

Document Information

| Fact Name | Details |

|---|---|

| Purpose of the Form | The Massachusetts Certificate Tax form is used to request a Certificate of Good Standing, Tax Compliance, or a Waiver of Corporate Tax Lien. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 62C, Section 47. |

| Required Information | Applicants must provide their name, contact information, and Federal Employer Identification Number (FEIN) when completing the form. |

| Legal Entity Types | The form accommodates various entity types, including corporations, LLCs, partnerships, and nonprofits. |

| Application Processing | Incomplete applications can lead to delays. Ensure all required information is filled out accurately. |

| Online Submission | The fastest way to obtain a Certificate is through the online application available on the Massachusetts Department of Revenue website. |

| Affidavit Requirement | Applicants must sign an affidavit declaring responsibility for various taxes, including withholding and corporate taxes. |

Popular PDF Forms

Massachusetts B - Following instructions ensures that patients receive their imagery promptly.

When considering a Power of Attorney form in New York, it is crucial to familiarize yourself with the proper procedures and implications of this document to ensure your decisions are honored in the future. For detailed guidance on how to fill out this important legal form, you can visit https://nydocuments.com, which provides valuable resources and information that can help simplify the process.

How to File a Countersuit in Civil Court - Ensure to provide the policy number for any involved auto insurance.

Guide to Writing Massachusetts Certificate Tax

To fill out the Massachusetts Certificate Tax form, you will need to gather specific information about your business and its tax status. Completing this form accurately is essential for processing your request efficiently.

- Applicant Information: Provide your name, daytime phone number, street address, city/town, state, and zip code. If you have a new address, fill that in.

- Taxpayer Classification: Enter your Federal Employer or Taxpayer Identification number. Specify if you are filing a combined report and provide the name and FEIN of the principal reporting corporation. Select the appropriate classification for your entity, such as C corporation, S corporation, or nonprofit organization.

- Legal Form of Organization: Indicate whether your organization is a corporation, LLC, partnership, trust, or estate.

- Purpose of Application: Choose one purpose for your application, such as a Certificate of Good Standing or a Letter of Compliance.

- Reason for Application: Select the reason for your application from the provided options, like corporate reinstatement or liquor licenses.

- Sale/Transfer of License: If applicable, fill in the name of the buyer, address of the DBA location, and any tax identification numbers filed for your entity.

- Person to Receive Response: Indicate where the results should be sent, providing the name, phone number, fax number, and mailing address of the recipient.

- Affidavit: Declare your company's responsibility for applicable taxes, such as withholding or sales/use tax. Sign and date the application.

Once you have completed the form, review it for accuracy. Missing information can delay processing. Consider submitting your application online for quicker results.

Similar forms

- Certificate of Good Standing: Similar to the Massachusetts Certificate Tax form, this document verifies that a business entity is compliant with state regulations and is authorized to operate. It is often required for businesses seeking to establish credibility with clients or partners.

- Trailer Bill of Sale: This form is essential for the transfer of trailer ownership and provides legal proof of the transaction. To learn more about this important document, visit californiapdf.com/editable-trailer-bill-of-sale.

- Tax Compliance Certificate: This certificate confirms that a business has met all tax obligations. Like the Massachusetts form, it is essential for businesses applying for loans or permits, ensuring they are in good standing with tax authorities.

- Articles of Incorporation: This foundational document establishes a corporation's existence. It shares similarities with the Massachusetts Certificate Tax form in that both require detailed information about the business entity and its compliance status.

- Operating Agreement: For LLCs, this document outlines the management structure and operational procedures. It parallels the Massachusetts Certificate Tax form in its focus on organizational details and compliance requirements.

- Business License Application: This application is necessary for obtaining a license to operate legally. Like the Massachusetts form, it requires specific information about the business and its compliance with local regulations.

- Partnership Agreement: This document governs the relationship between partners in a business. It is similar to the Massachusetts Certificate Tax form in that both require disclosure of tax identification numbers and compliance with tax regulations.

- IRS Form 990: Nonprofits use this form to report financial information to the IRS. It aligns with the Massachusetts Certificate Tax form in that both require transparency regarding financial practices and tax compliance.

- State Tax Registration Form: This form registers a business with the state tax authority. It is akin to the Massachusetts Certificate Tax form, as both documents are crucial for ensuring that a business meets state tax obligations.