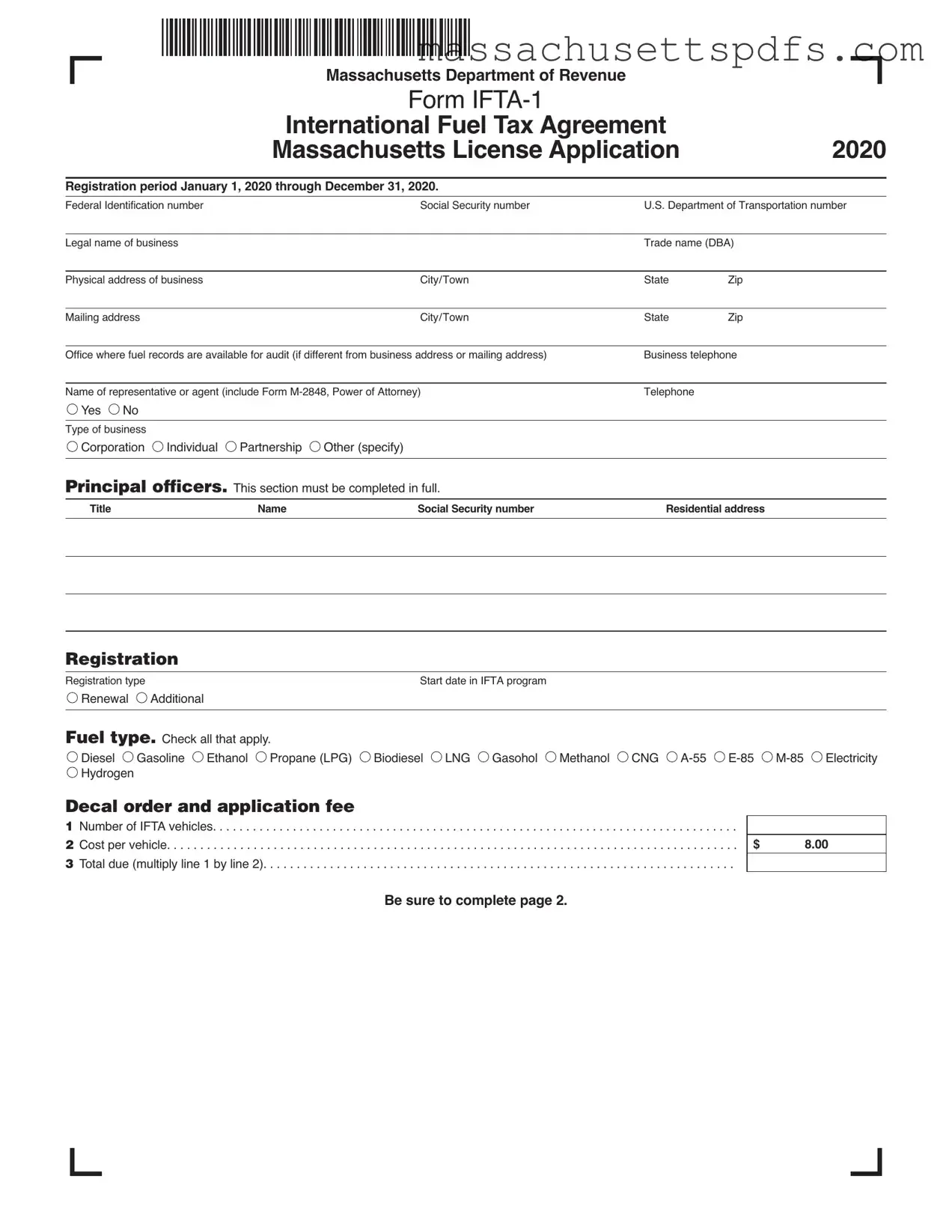

Official Massachusetts Ifta Template

Key takeaways

When filling out and using the Massachusetts IFTA form, there are several important points to consider:

- Registration Period: Ensure you are aware of the registration period, which runs from January 1 to December 31 of the applicable year.

- Accurate Information: Provide complete and accurate details about your business, including the legal name, address, and contact information. Any discrepancies can lead to delays or issues.

- Fuel Types: Clearly indicate all types of fuel used by your vehicles. This includes diesel, gasoline, and any alternative fuels. Checking all applicable boxes is crucial.

- Jurisdictions: List all jurisdictions where your vehicles will operate. This includes all states and Canadian provinces where you may travel.

- Compliance Agreement: By signing the application, you agree to comply with all reporting and payment requirements. Non-compliance can result in penalties or revocation of your IFTA license.

- Renewal Process: If you have previously held an IFTA license, ensure that you follow the renewal process correctly. This includes paying any applicable fees and providing updated information.

Understanding these key points can help ensure a smoother experience when dealing with the Massachusetts IFTA form. Proper attention to detail and compliance can prevent potential issues down the line.

Documents used along the form

The Massachusetts International Fuel Tax Agreement (IFTA) form is an essential document for businesses involved in interstate transportation. However, several other forms and documents complement this application, ensuring compliance with state and federal regulations. Below is a list of these important documents, each serving a unique purpose in the process.

- IFTA Quarterly Fuel Use Tax Return: This form is used to report fuel usage and calculate taxes owed for each quarter. It provides detailed information on miles traveled in each jurisdiction and the fuel consumed.

- IFTA Decal Application: This application is necessary for obtaining the IFTA decals that must be displayed on vehicles. It includes details about the fleet and the jurisdictions in which the vehicles will operate.

- IFTA License Renewal Application: Businesses must submit this application annually to renew their IFTA license. It confirms continued compliance with IFTA regulations and updates any changes in business operations.

- Fuel Tax Exemption Certificate: This certificate is used by certain entities to claim exemption from fuel taxes under specific circumstances. It helps ensure that eligible organizations do not pay unnecessary taxes.

- Vehicle Registration Form: This form is required to register each vehicle that will be operating under the IFTA. It includes information such as the vehicle's identification number and weight.

- Record Keeping Requirements: While not a form per se, maintaining accurate records of fuel purchases, mileage, and routes is crucial. These records must be kept for audit purposes and demonstrate compliance with IFTA regulations.

- ATV Bill of Sale: This form is vital for documenting the purchase or sale of an all-terrain vehicle in New York, providing necessary details for both parties involved. Access the form here: PDF Templates.

- State Tax Registration Form: Depending on the jurisdictions in which a business operates, this form may be needed to register for state fuel taxes. It ensures that the business is compliant with local tax laws.

- Audit Notification Form: If a business is selected for an audit, this form outlines the necessary steps and documentation required during the audit process. It helps facilitate a smooth audit experience.

Each of these documents plays a critical role in ensuring that businesses comply with the regulations surrounding fuel taxes and interstate transportation. Properly managing these forms not only aids in compliance but also streamlines operations and minimizes potential legal issues.

Document Information

| Fact Name | Description |

|---|---|

| Registration Period | The registration period for the Massachusetts IFTA form for 2020 is from January 1, 2020, to December 31, 2020. |

| Governing Law | The Massachusetts IFTA form is governed by Massachusetts Tax Law and the International Fuel Tax Agreement. |

| Decal Fees | The fee for vehicle decals is $8.00, which must be paid at the time of application. |

| Compliance Agreement | Applicants must agree to comply with all reporting, payment, and record-keeping requirements outlined in the application. |

| Delinquency Consequences | If an applicant is delinquent on fuel tax payments, Massachusetts may withhold any refunds due under the IFTA. |

Popular PDF Forms

Electrical Permit Sample - List any security systems you’re installing, detailing the number of devices involved.

In order to facilitate a smooth transaction when buying or selling an RV in California, it is important to utilize the appropriate documentation, such as the California RV Bill of Sale form. This legal document not only details the specifics of the sale, including the buyer, seller, and vehicle information, but also ensures compliance with state regulations. For those seeking a convenient way to create this essential paperwork, the editable version can be found at https://californiapdf.com/editable-rv-bill-of-sale.

Mass Dor Tax Forms - The total amount sought should be clearly stated for each reason listed on the form.

Florida Lost Title - Titles that are reported lost or stolen will require additional verification steps.

Guide to Writing Massachusetts Ifta

Completing the Massachusetts IFTA form requires careful attention to detail. This form is essential for businesses involved in the International Fuel Tax Agreement. Accurate information ensures compliance with state regulations and helps facilitate the processing of applications.

- Obtain the Massachusetts IFTA form from the Massachusetts Department of Revenue website or your local office.

- Fill in the Legal Business Name and Physical Address of your business, including city, state, and zip code.

- Provide a Mailing Address if it differs from the physical address.

- Indicate the Type of Business (e.g., Individual, Partnership, Corporation) and specify the principal officers by completing their Name, Title, Social Security Number, and Residential Address.

- List the Fuel Types you will be using by checking the appropriate boxes (e.g., Diesel, Gasoline, etc.).

- Calculate the Decal Order and Application Fee, which is $8.00 per vehicle. Total the amount due for all vehicles.

- Complete the Jurisdictions section by listing all states and Canadian provinces where your vehicles will operate.

- If applicable, indicate whether you have Bulk Storage facilities and list the jurisdictions where fuel is stored.

- Answer the Prior Registration question regarding any previous IFTA registrations.

- Read and sign the Declaration section, affirming that all information is accurate and complete.

- Submit the completed form along with the application fee to the Massachusetts Department of Revenue at the specified address.

Similar forms

The Massachusetts IFTA form serves as an essential document for fuel tax reporting and compliance. However, it shares similarities with several other important documents in the realm of transportation and taxation. Here’s a look at eight such documents:

- IRS Form 2290: This form is used for heavy vehicle use tax. Like the IFTA form, it requires detailed vehicle information and is crucial for compliance with federal tax regulations.

- State Fuel Tax Return: Many states require their own fuel tax returns, similar to the IFTA form. Both documents necessitate accurate reporting of fuel usage and tax payments.

- Commercial Driver’s License (CDL): The CDL is essential for operating commercial vehicles. While the IFTA form deals with fuel taxes, both documents emphasize compliance and regulation in the trucking industry.

- International Registration Plan (IRP) Application: This application is vital for vehicle registration across multiple jurisdictions. Like the IFTA form, it aims to simplify the regulatory process for commercial carriers operating in more than one state.

- Motor Carrier Permit: This permit is required for businesses engaged in transporting goods. Similar to the IFTA form, it ensures that carriers comply with state regulations regarding transportation.

- Motorcycle Bill of Sale Form: This essential document acts as proof of ownership transfer for motorcycles, similar to the IFTA forms, ensuring proper documentation is maintained throughout the selling process. For more details, you can visit nydocuments.com.

- Fuel Purchase Receipts: These receipts document fuel purchases and are essential for accurate reporting on the IFTA form. Both require meticulous record-keeping to ensure compliance with tax obligations.

- Quarterly Tax Returns: Many businesses must file quarterly tax returns for various taxes. Like the IFTA form, these returns require detailed reporting of income and expenses to maintain compliance with tax laws.

- Vehicle Maintenance Records: Keeping track of maintenance is crucial for operational efficiency. While not a tax document, these records can be essential during audits, similar to the requirements outlined in the IFTA form.

Understanding the connections between these documents can streamline compliance efforts and help avoid potential pitfalls in the regulatory landscape. Each document plays a critical role in ensuring that businesses operate legally and efficiently.