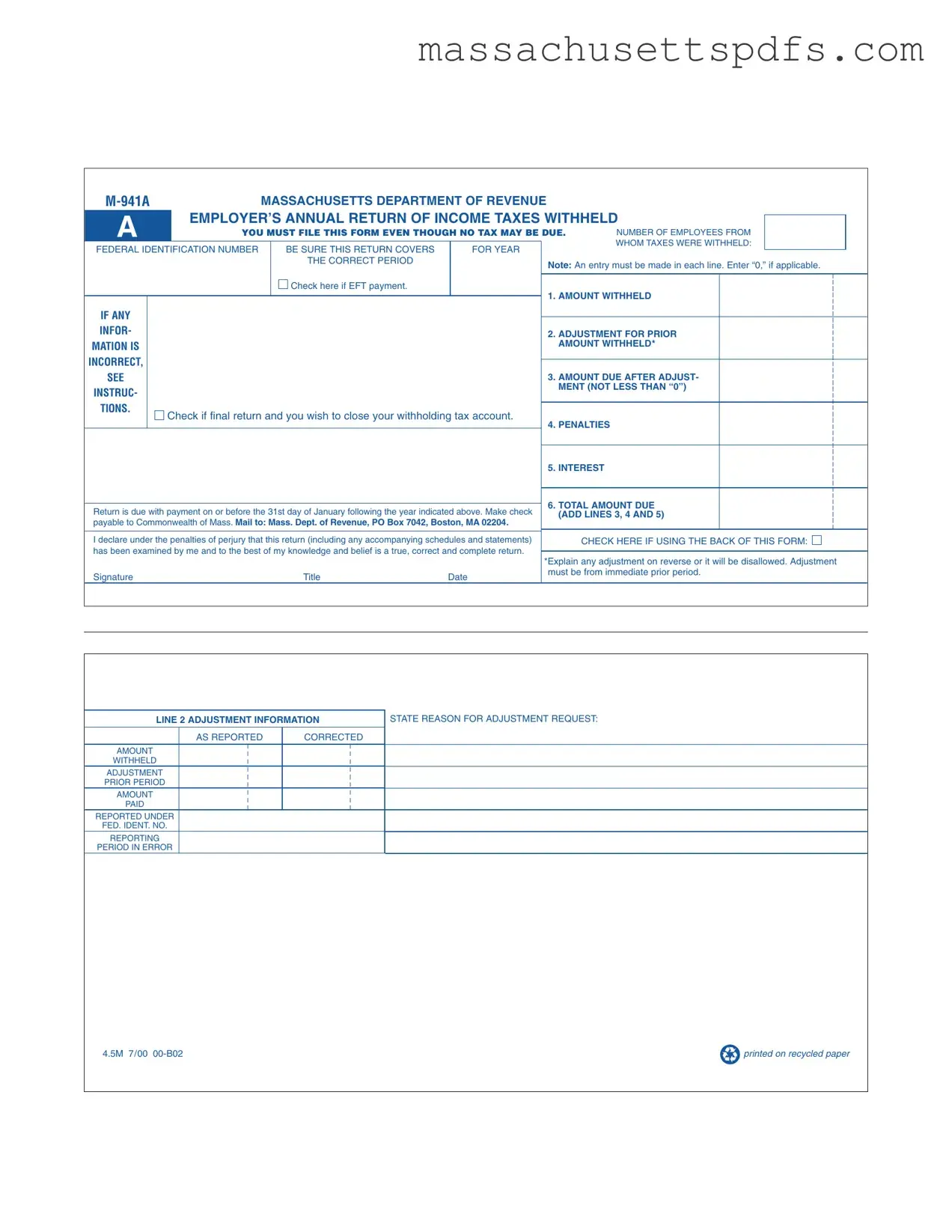

Official Massachusetts M 941A Template

Key takeaways

Here are some key takeaways about filling out and using the Massachusetts M 941A form:

- Mandatory Filing: You must file the M 941A form even if no taxes are due.

- Employee Count: Report the number of employees from whom taxes were withheld.

- Correct Year: Ensure that the form covers the correct tax year.

- Complete Information: Fill in every line of the form. If a line does not apply, enter “0.”

- Payment Deadline: Submit the form and payment by January 31st of the following year.

- Make Payments Payable: Checks should be made out to the Commonwealth of Massachusetts.

- Adjustments: If there are adjustments, explain them on the reverse side of the form.

- Penalties and Interest: Include any penalties and interest when calculating the total amount due.

Following these guidelines will help ensure that your filing is accurate and timely.

Documents used along the form

The Massachusetts M 941A form is essential for employers to report income taxes withheld from employees. However, it is often accompanied by several other forms and documents that provide additional information or fulfill related requirements. Understanding these documents can help ensure compliance and avoid penalties.

- Form M-941: This is the quarterly return of income taxes withheld. Employers must file this form each quarter to report the amount of tax withheld from employees' wages during that period.

- Form M-942: This form is used for the annual reconciliation of withholding tax. It summarizes the total amount withheld for the year and reconciles any discrepancies reported in the quarterly filings.

- Bill of Sale Form: To properly document asset transfers, consult our helpful guide on the Colorado bill of sale that outlines necessary steps for seamless transactions.

- Form W-2: Employers must issue this form to employees by January 31 each year. It reports the total wages paid and taxes withheld, providing employees with the necessary information for their personal tax returns.

- Form W-3: This is the transmittal form for W-2s submitted to the Social Security Administration. It summarizes the information from all W-2 forms issued by an employer during the year.

- Form 1099: If an employer pays independent contractors, this form must be issued to report payments made. It helps the IRS track income from non-employee sources.

- Form 941: This federal form is used to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. Employers must file it quarterly with the IRS.

By ensuring that all necessary forms and documents are accurately completed and submitted, employers can maintain compliance with state and federal regulations. This proactive approach not only minimizes the risk of penalties but also fosters a transparent relationship with employees regarding their tax obligations.

Document Information

| Fact Name | Details |

|---|---|

| Purpose of Form | The M-941A form is used by employers in Massachusetts to report income taxes withheld from employees. Filing this form is mandatory, even if no taxes are due. |

| Filing Deadline | Employers must submit the M-941A form along with any payment by January 31st of the year following the reporting period. |

| Governing Law | This form is governed by Massachusetts General Laws, Chapter 62B, which outlines the requirements for withholding tax returns. |

| Adjustment Information | If there are any adjustments to the amounts reported, employers must explain these on the reverse side of the form to ensure they are not disallowed. |

Popular PDF Forms

Sales Tax Exemption Certificate Massachusetts - Additional documentation, such as IRS exemption certificates, may be required for nonprofits.

The California Vehicle Purchase Agreement form is a legal document that outlines the terms and conditions of a vehicle sale between a buyer and a seller in California. It serves to protect both parties by detailing important information such as the vehicle's price, condition, and payment method. Understanding this form is essential for anyone involved in buying or selling a vehicle in the state, and you can find a template for it at My PDF Forms.

Ma Form M-3 - The form comes with a comprehensive set of instructions to guide users.

Guide to Writing Massachusetts M 941A

Completing the Massachusetts M 941A form is essential for employers who have withheld income taxes from their employees. This form must be filed even if no taxes are due. Follow these steps to ensure accurate completion and submission.

- Begin by entering the number of employees from whom taxes were withheld.

- Provide your federal identification number.

- Ensure the form covers the correct year for which you are reporting.

- Fill in the business name, if applicable.

- Enter the business address, including city, state, and zip code.

- On line 1, input the amount withheld for the reporting period.

- If there are any adjustments from prior periods, complete line 2 with the adjustment amount and provide a brief explanation on the reverse side.

- Calculate the amount due after adjustment on line 3, ensuring it is not less than zero.

- On lines 4 and 5, enter any applicable penalties and interest.

- Add lines 3, 4, and 5 to determine the total amount due and write it on line 6.

- Check the box if this is your final return and you wish to close your withholding tax account.

- Sign and date the form, declaring under penalties of perjury that the information is accurate.

- Make your payment by check, payable to the Commonwealth of Mass.

- Mail the completed form and payment to: Mass. Dept. of Revenue, PO Box 7042, Boston, MA 02204.

After completing these steps, ensure you keep a copy of the form and payment for your records. It’s important to file the M 941A by the deadline to avoid any potential penalties.

Similar forms

The Massachusetts M 941A form is an important document for employers regarding income tax withholding. Several other forms share similarities with the M 941A in terms of purpose and content. Below is a list of eight such documents:

- IRS Form 941: This is the federal equivalent of the M 941A, used by employers to report income taxes withheld from employee wages. Both forms require information on the number of employees and the total amount withheld.

- IRS Form 944: Designed for smaller employers, this form allows for annual reporting of withheld taxes instead of quarterly. Like the M 941A, it summarizes withholding for the year and requires the total amount withheld.

- Massachusetts Form 1: This is the personal income tax return for residents. It includes information about income and taxes owed, similar to how the M 941A details withheld amounts for employees.

- Massachusetts Form 3: This form is for fiduciaries and estates, reporting income and taxes. It parallels the M 941A in that it summarizes tax information for a specific period.

- IRS Form W-2: Employers use this form to report wages paid and taxes withheld for each employee. Both forms involve reporting on employee income and tax withholdings.

- IRS Form W-3: This is a summary form that accompanies W-2s, providing total earnings and withholding amounts. It shares a similar reporting function with the M 941A.

- Massachusetts Form M-990T: This form is for unrelated business income tax and requires reporting of income and taxes, akin to the M 941A's focus on withholding.

- New York Bill of Sale Form: This crucial document verifies the transfer of ownership for personal property and provides protection for both parties involved. For a practical example and to ensure a secure transaction, you can access the PDF Templates.

- Massachusetts Form 1099-MISC: This form is used to report payments made to independent contractors. While it targets different types of payments, it also deals with tax reporting similar to the M 941A.