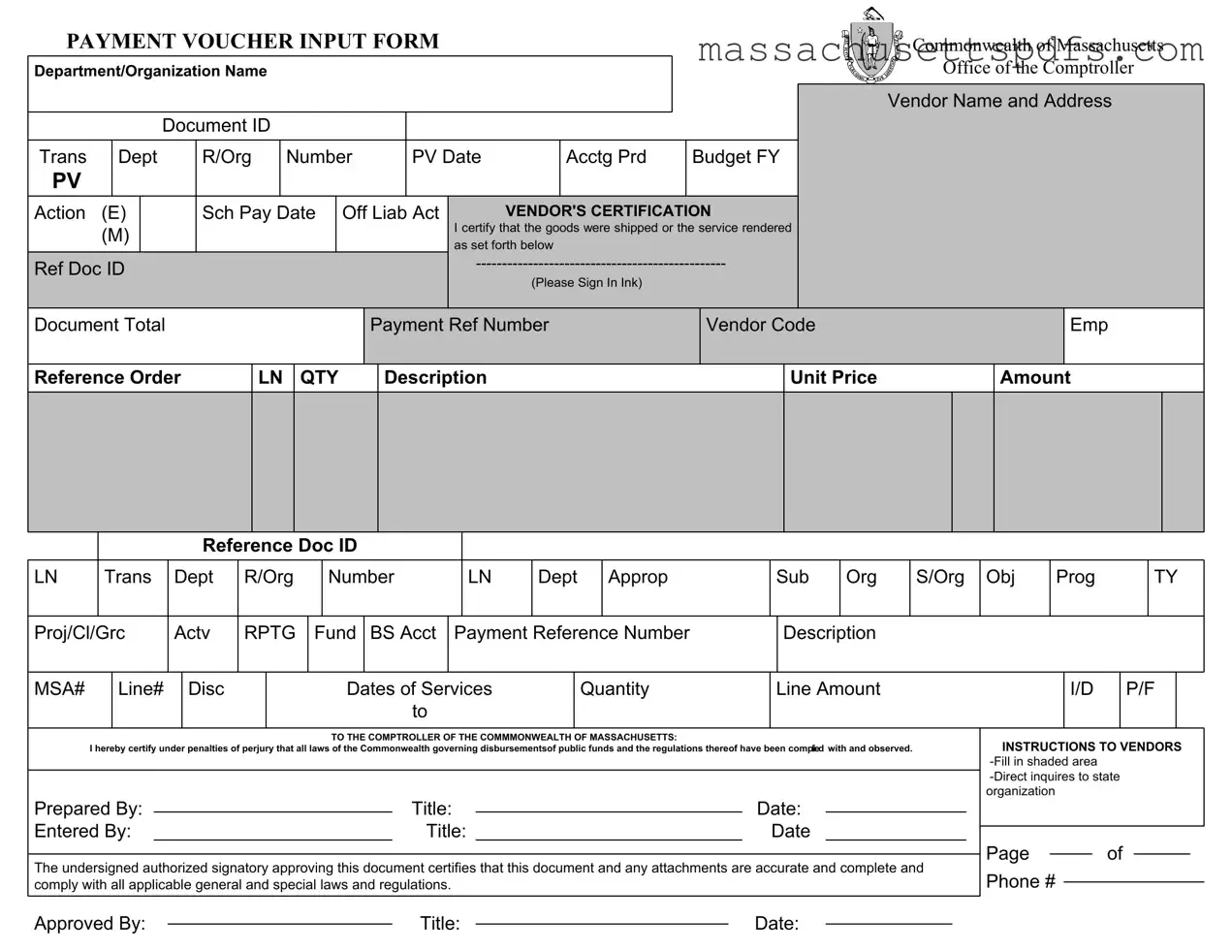

Official Massachusetts Payment Voucher Template

Key takeaways

When filling out and using the Massachusetts Payment Voucher form, keep the following key takeaways in mind:

- Complete All Required Fields: Ensure that every shaded area of the form is filled in accurately. This includes the Department/Organization Name, Document ID, and Vendor Name and Address.

- Certification is Crucial: The vendor must sign the form in ink, certifying that the goods were shipped or services rendered as stated. This step is essential to validate the payment request.

- Compliance with Regulations: The authorized signatory must confirm that all applicable laws and regulations have been followed. This includes ensuring that public funds are disbursed in accordance with state laws.

- Check for Accuracy: Before submitting, double-check all entries for accuracy and completeness. Any errors could delay processing or result in payment rejection.

Documents used along the form

The Massachusetts Payment Voucher form is a crucial document for processing payments to vendors for goods or services provided to state agencies. However, it often works in conjunction with other forms and documents to ensure a smooth and compliant payment process. Below is a list of related documents that you may encounter.

- Invoice: This document details the goods or services provided by the vendor, including quantities and prices. It serves as a request for payment and is often submitted alongside the Payment Voucher.

- W-9 Form: Vendors must complete this form to provide their Taxpayer Identification Number (TIN) to the state. It ensures that the vendor is properly registered for tax purposes.

- Purchase Order (PO): This document is issued by the state agency to authorize a purchase. It outlines the terms of the purchase, including quantities, pricing, and delivery details.

- Contract Agreement: A legal document that outlines the terms and conditions agreed upon by the state agency and the vendor. It provides a framework for the services or goods to be delivered.

- Non-disclosure Agreement (NDA): A legal document crucial for protecting shared confidential information. By signing an NDA, parties can ensure their sensitive data is kept private, fostering trust in collaborations. For more details on NDA forms, visit https://nydocuments.com/.

- Certification of Compliance: This document certifies that the vendor complies with all applicable laws and regulations, including labor laws and safety standards.

- Direct Deposit Authorization Form: If the vendor opts for electronic payments, this form allows the state to deposit funds directly into the vendor's bank account.

- Expense Reimbursement Form: Used by state employees to claim reimbursement for expenses incurred while conducting official business. This form may accompany the Payment Voucher if employee-related costs are involved.

- Supporting Documentation: Any additional documents that support the Payment Voucher, such as receipts, delivery confirmations, or other relevant paperwork. These documents provide transparency and justification for the payment.

Understanding these related documents can help streamline the payment process and ensure compliance with state regulations. Always ensure that all forms are filled out accurately and submitted in a timely manner to avoid delays in payment.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts Payment Voucher form is used to request payment for goods and services provided to state agencies. |

| Governing Law | This form is governed by the Massachusetts General Laws, specifically Chapter 7, Section 4B, which outlines the procedures for disbursement of public funds. |

| Vendor Certification | Vendors must certify that the goods were shipped or services rendered by signing the form in ink, ensuring accountability. |

| Required Information | Essential details include vendor name, document total, payment reference number, and accounting period, among others. |

| Approval Process | An authorized signatory must approve the document, certifying its accuracy and compliance with applicable laws. |

Popular PDF Forms

Informal Probate Massachusetts - Decedents’ financial arrangements are reflected through required bond details.

For those looking to establish a formal transaction, a reliable source for a comprehensive bill of sale is crucial. This document facilitates the transfer of ownership and ensures that both parties are protected during the sale. For more information, you can visit this helpful bill of sale guide that outlines key considerations.

R109 - Notarization is required for mail applications to ensure the authenticity of the signature.

Guide to Writing Massachusetts Payment Voucher

Once you have gathered the necessary information, you can begin filling out the Massachusetts Payment Voucher form. This form is essential for processing payments accurately. It requires specific details about the transaction, the vendor, and the services or goods provided. Follow the steps below to ensure that you complete the form correctly.

- Locate the Department/Organization Name section at the top of the form and enter the name of the relevant department or organization.

- Fill in the Document ID field with the unique identifier assigned to this payment voucher.

- In the Trans Dept R/Org Number box, input the transaction department or organization number.

- Enter the PV Date which is the date the payment voucher is being filled out.

- Complete the Acctg Prd section by specifying the accounting period for which the payment is being made.

- Provide the Budget FY by indicating the fiscal year for the budget.

- For the PV Action (E), indicate the action being taken, such as an expense or adjustment.

- Fill in the Sch Pay Date to specify the scheduled payment date.

- In the Off Liab Act section, include any off liability account details if applicable.

- Under VENDOR'S CERTIFICATION, write the vendor name and address in the designated area.

- Input the Document Total which is the total amount being requested for payment.

- Enter the Payment Ref Number for your records.

- Provide the Vendor Code that corresponds to the vendor.

- In the Emp Reference section, include any employee reference number if necessary.

- List the Order LN and QTY for each item being billed.

- Fill in the Description, Unit Price, and Amount for each line item.

- Complete the Reference Doc ID for any related documentation.

- In the subsequent sections, provide details such as Trans Dept R/Org Number, Dept Approp, Sub Org, S/Org, Obj, Prog TY, Proj/Cl/Grc, Actv RPTG Fund, and BS Acct as required.

- In the Payment Reference Number section, include any additional reference numbers necessary.

- Specify the Description and any MSA# if applicable.

- Indicate the Line# and Disc Dates of Services for each item.

- Fill in the Quantity and Line Amount for each item.

- Finally, sign the form in ink under VENDOR'S CERTIFICATION to confirm that the goods were shipped or services rendered.

- Complete the Prepared By, Entered By, and Approved By sections with the names, titles, and dates as required.

Similar forms

-

Invoice: An invoice is a document sent by a vendor to request payment for goods or services provided. Like the Massachusetts Payment Voucher, it includes details such as the vendor's information, description of services or goods, and the total amount due. Both documents serve as formal requests for payment and require verification of the services rendered or goods delivered.

-

Purchase Order: A purchase order is issued by a buyer to a seller, indicating the types and quantities of products or services needed. Similar to the Payment Voucher, it outlines specific details about the transaction and serves as a formal agreement between parties. Both documents help ensure clarity and accountability in financial transactions.

-

Expense Report: An expense report is used by employees to request reimbursement for out-of-pocket expenses incurred while performing work duties. Like the Payment Voucher, it requires documentation of the expenses and often includes vendor information and amounts. Both documents ensure proper tracking and approval of expenditures.

-

Contract: A contract is a legally binding agreement between parties outlining the terms of a transaction. Similar to the Payment Voucher, it details the obligations of each party, including payment terms. Both documents are crucial for maintaining transparency and accountability in financial dealings.

-

Receipt: A receipt is a proof of payment for goods or services received. Like the Payment Voucher, it includes details such as the date, amount paid, and vendor information. Both documents serve as important records for accounting and auditing purposes.

- RV Bill of Sale: The RV Bill of Sale is a critical legal document used for the sale and purchase of recreational vehicles in California. It encompasses vital transaction information and ensures adherence to state laws concerning vehicle ownership transfer. For more details, visit californiapdf.com/editable-rv-bill-of-sale/.

-

Grant Application: A grant application is submitted to request funding for specific projects or initiatives. Similar to the Payment Voucher, it requires detailed information about the project, including budget and vendor details. Both documents are essential for ensuring that funds are allocated appropriately and used as intended.