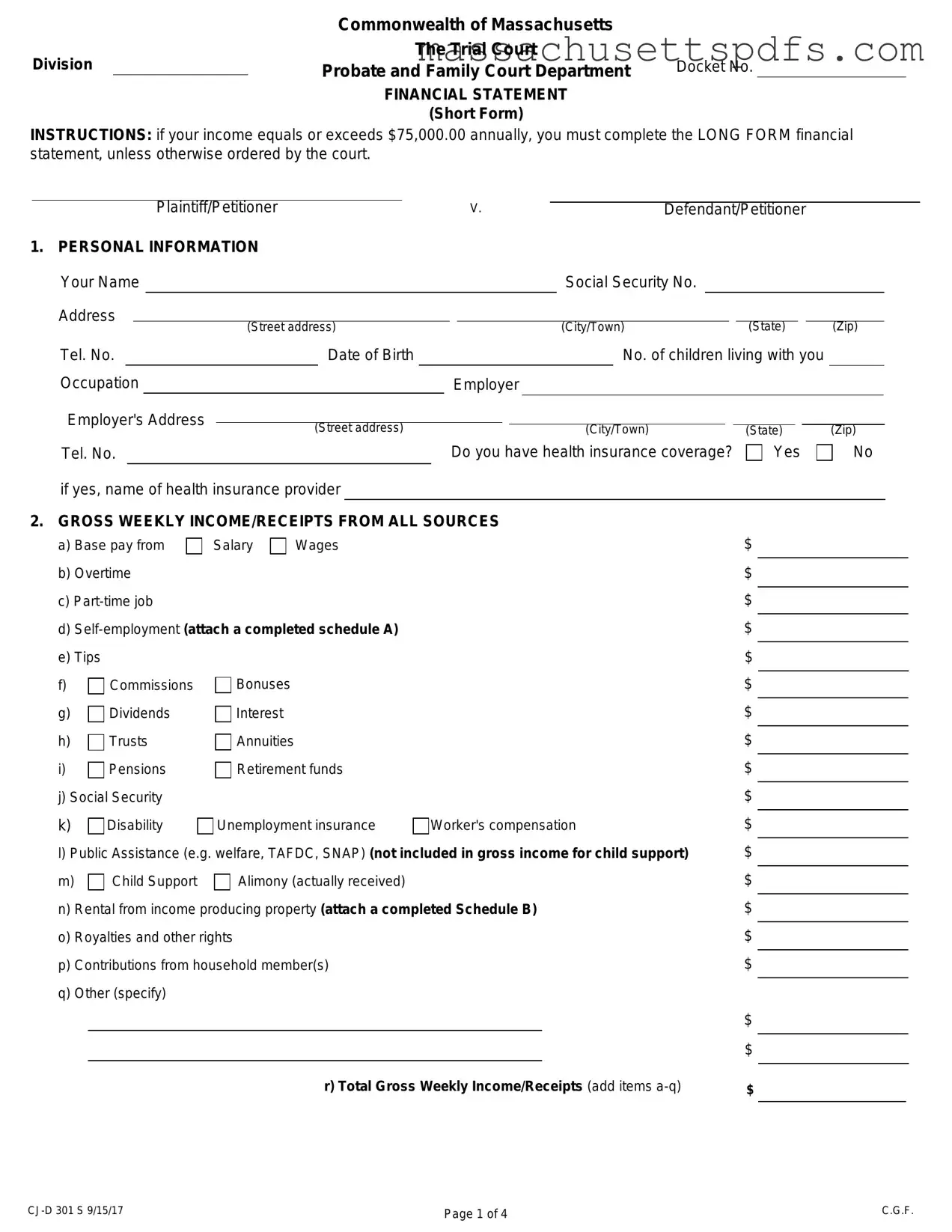

Official Massachusetts Short Financial Statement Template

Key takeaways

When filling out the Massachusetts Short Financial Statement form, it is essential to be thorough and accurate. Here are some key takeaways to consider:

- Eligibility for the Short Form: If your annual income is $75,000 or more, you must complete the Long Form unless the court has directed otherwise. Ensure you meet the criteria before proceeding.

- Personal Information: Fill in all personal details completely. This includes your name, Social Security number, address, and occupation. Incomplete information can lead to delays in processing.

- Income and Expenses: Be precise when reporting your gross weekly income and itemized deductions. Include all sources of income, such as wages, self-employment earnings, and any public assistance. Similarly, list all weekly expenses accurately to provide a clear picture of your financial situation.

- Certification of Accuracy: Before submitting the form, you must certify that the information provided is true and complete. This certification is crucial, as false information can have legal consequences.

Documents used along the form

The Massachusetts Short Financial Statement form is often accompanied by several other documents that provide additional financial information. Each of these forms plays a crucial role in ensuring that the court has a comprehensive understanding of an individual's financial situation.

- Long Financial Statement: This document is required if an individual's annual income is $75,000 or more. It provides a more detailed overview of finances, including various sources of income, expenses, and assets.

- Schedule A: This attachment is used for reporting income from self-employment. It includes details about business income and expenses, helping to clarify an individual's financial standing.

- Schedule B: This form is needed when reporting rental income from properties. It outlines income generated from rental properties and any associated expenses.

- RV Bill of Sale: Essential for recording the sale of a recreational vehicle in California, this document ensures compliance with state laws and includes crucial details. For more information, visit californiapdf.com/editable-rv-bill-of-sale/.

- W-2 Forms: These forms are provided by employers and summarize an individual's earnings and tax withholdings for the previous year. They are essential for verifying income.

- 1099 Forms: These documents report various types of income received, such as freelance work or interest income. They complement the W-2 forms by covering additional income sources.

- Statement by Attorney: This document is completed by the attorney representing a party. It certifies that the information provided in the financial statement is accurate to the best of the attorney's knowledge.

These documents, along with the Massachusetts Short Financial Statement, help create a clearer picture of an individual's financial circumstances, which is vital for court proceedings.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts Short Financial Statement is used to provide a simplified overview of a person's financial situation in family law cases. |

| Income Threshold | If a person's annual income is $75,000 or more, they must complete the Long Form financial statement unless the court directs otherwise. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 208 and Chapter 209. |

| Submission Requirement | Parties must submit this form to the Probate and Family Court when filing for divorce, child support, or custody modifications. |

| Certification | The individual completing the form must certify that the information provided is true and accurate under penalty of perjury. |

| Attachments | Additional documentation, such as W-2 and 1099 forms from the prior year, must be attached to support the reported income. |

Popular PDF Forms

Massachusetts Hiring Laws - This form must be filled out by employers when an employee has been injured on the job.

A New York Bill of Sale form serves as a legal document that proves the transfer of ownership for personal property from one individual to another. This form not only provides essential details about the transaction but also offers protection for both the buyer and the seller. To ensure a smooth and secure transfer of ownership, consider filling out the form by clicking the button below or explore additional options through PDF Templates.

Mass Probate Forms - It requests the defendant to comply with a parenting time arrangement as per court order.

Rmv Hearing Request - The Massachusetts Bureau of Special Education Appeals (BSEA) manages the hearing process.

Guide to Writing Massachusetts Short Financial Statement

Filling out the Massachusetts Short Financial Statement form is an important step in your legal process. This form requires you to provide detailed information about your financial situation. Be prepared to gather necessary documents and ensure all information is accurate before submission.

- Personal Information: Fill in your name, Social Security number, address, telephone number, date of birth, number of children living with you, occupation, and employer's details. Indicate if you have health insurance and provide the name of the provider if applicable.

- Gross Weekly Income/Receipts: Report all sources of income, including salary, overtime, self-employment, tips, commissions, and any other income. Add all amounts to find your total gross weekly income.

- Itemized Deductions: List your federal and state income tax deductions, F.I.C.A. and Medicare, medical insurance, and union dues. Calculate the total deductions.

- Adjusted Net Weekly Income: Subtract the total deductions from your gross weekly income.

- Other Deductions: Include deductions for credit union loans, savings, retirement contributions, and any other specified deductions. Total these amounts.

- Net Weekly Income: Subtract the total deductions from salary/wages from your adjusted net weekly income.

- Gross Yearly Income: Provide your gross income from the prior year and attach copies of all W-2 and 1099 forms.

- Weekly Expenses: Itemize all your weekly expenses, including rent, utilities, food, insurance, and any other necessary expenses. Total these expenses.

- Counsel Fees: Enter the retainer amount paid to your attorney, any legal fees incurred, and anticipated legal expenses for your case.

- Assets: List all assets, including real estate, vehicles, retirement accounts, and savings. Calculate the total value of all assets.

- Liabilities: Document your debts, including the creditor, nature of the debt, date incurred, amount due, and weekly payment. Total your liabilities.

- Certification: Sign and date the form, certifying that all information provided is complete and accurate.

Once you have completed the form, review it carefully for accuracy. Make copies for your records before submitting it to the appropriate court. Ensure that any required attachments are included, as incomplete submissions may delay your case.

Similar forms

- Long Financial Statement: This document is similar in that it also collects detailed financial information. However, it is required for individuals whose income exceeds $75,000 annually, ensuring comprehensive financial disclosure for the court.

- Divorce Settlement Agreement Form: To facilitate a smooth divorce process, the comprehensive Divorce Settlement Agreement document outlines vital terms between spouses regarding asset distribution and custody arrangements.

- Affidavit of Financial Disclosure: This affidavit serves a similar purpose by providing a sworn statement of an individual’s financial situation. It is often used in divorce and child support cases, emphasizing transparency in financial matters.

- Income and Expense Declaration: Commonly used in family law cases, this declaration outlines an individual’s income and expenses. Like the Short Financial Statement, it aims to provide the court with an accurate picture of financial circumstances.

- Financial Affidavit: This document is a sworn statement detailing an individual's financial status. It is similar in structure and intent, as it requires disclosure of income, expenses, assets, and liabilities to assist the court in making informed decisions.

- Bankruptcy Schedules: In bankruptcy proceedings, individuals must complete schedules that list their assets, liabilities, income, and expenses. This is akin to the Short Financial Statement, as both require a thorough examination of an individual's financial health.