Official Massachusetts St 13 Template

Key takeaways

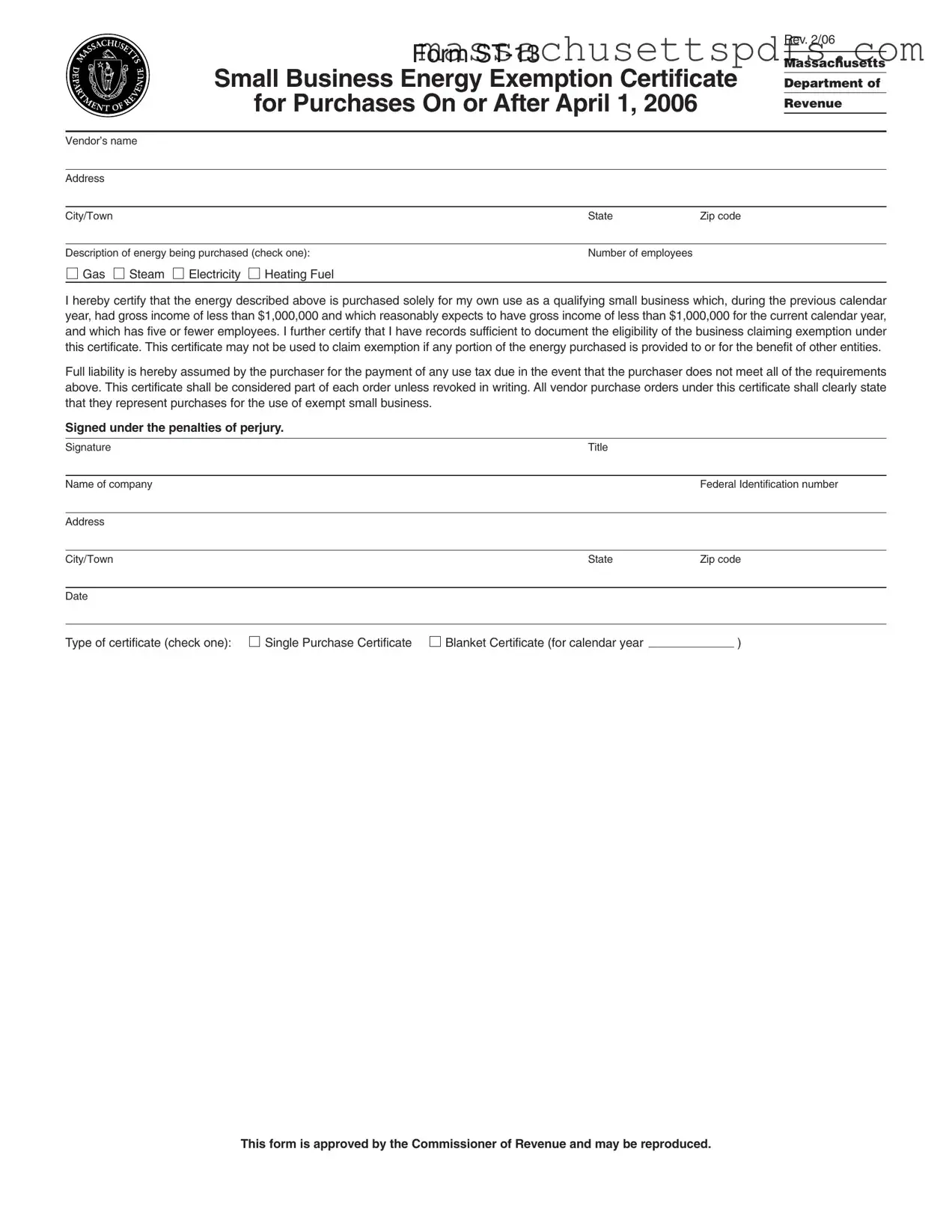

Form ST-13 is designed for small businesses in Massachusetts, allowing them to claim a sales tax exemption on energy purchases.

To qualify, a business must have gross income of less than $1,000,000 in the previous year and expect to earn less than that in the current year, with five or fewer employees.

The completed form must be presented to the vendor to claim the exemption, and it applies only to purchases made after the form is signed and submitted.

Vendors are responsible for keeping accurate records of the exempt sales, including the business's name, address, federal identification number, and a copy of the ST-13 form.

If a business no longer qualifies for the exemption, it must notify the vendor in writing to avoid liability for any use tax that may apply.

Misuse of the ST-13 form can lead to serious consequences, including criminal penalties and significant fines.

Documents used along the form

The Massachusetts ST-13 form, known as the Small Business Energy Exemption Certificate, is an important document for small businesses seeking to exempt certain energy purchases from sales tax. However, there are other forms and documents that often accompany the ST-13 to ensure compliance and proper documentation. Here’s a brief overview of some of these related documents.

- Form ST-2: This is the Sales Tax Resale Certificate. Businesses use this form when purchasing items for resale. It allows them to buy goods without paying sales tax upfront, provided they will sell those goods to customers later.

- Form ST-5: The Sales Tax Exempt Use Certificate is used by organizations that are exempt from sales tax, such as certain nonprofits or government entities. This form certifies that the purchase is for exempt purposes.

- RV Bill of Sale: When dealing with recreational vehicles, obtaining a proper californiapdf.com/editable-rv-bill-of-sale/ is crucial to ensure that all transaction details are documented and legally binding.

- Form ST-4: This is the Sales Tax Exempt Purchaser Certificate. It’s typically used by certain qualified buyers, like educational institutions or religious organizations, to claim sales tax exemptions on their purchases.

- Vendor Purchase Orders: These are documents issued by the buyer to the seller, specifying the goods or services ordered. They should clearly indicate that the purchase is being made under the small business exemption to comply with tax regulations.

Using these forms alongside the ST-13 helps small businesses navigate tax exemptions more effectively. Proper documentation is key to ensuring compliance and avoiding potential tax liabilities. Always consult with a tax professional or legal consultant to ensure you are using the correct forms for your specific situation.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The ST-13 form serves as a Small Business Energy Exemption Certificate, allowing qualifying small businesses to purchase energy without paying sales tax. |

| Eligibility Criteria | To qualify, a business must have gross income of less than $1,000,000 in the previous year and expect the same for the current year, with five or fewer employees. |

| Record Keeping | Vendors must maintain records of the small business's name, address, federal identification number, sales price, and a copy of the ST-13 form for each exempt sale. |

| Submission Requirement | The completed ST-13 form must be submitted to the vendor before the first purchase of taxable fuel in each calendar year to claim the exemption. |

| Governing Law | This form is governed by Massachusetts Regulation 830 CMR 64H.6.11 and Technical Information Release 06-2. |

Popular PDF Forms

Masshealth Pca Family Member - The form allows modifications to the consumer’s address, phone number, or PCA details.

Massachusetts Harassment Prevention Order - Upon review, the judge may issue an order that restricts the defendant’s movements and conduct.

For those interested in the transaction process, understanding the importance of having a valid ATV Bill of Sale is vital for both sellers and buyers, ensuring a smooth ownership transfer. You can find more information on how to properly draft this document at key ATV Bill of Sale procedures.

Massachusetts Aca 1202 - Physicians should be aware of the potential for penalties if information is disputed.

Guide to Writing Massachusetts St 13

Completing the Massachusetts ST-13 form requires careful attention to detail. This form serves as a certificate for small businesses to claim an exemption from sales tax on certain energy purchases. Once filled out, the form must be submitted to the vendor to ensure the exemption is applied correctly.

- Obtain a copy of the Massachusetts ST-13 form.

- Fill in the vendor’s name, address, city or town, state, and zip code at the top of the form.

- In the section labeled "Description of energy being purchased," check the appropriate box for the type of energy: Gas, Steam, Electricity, or Heating Fuel.

- Indicate the number of employees your business has.

- Read the certification statement carefully. Ensure your business meets the criteria of having gross income of less than $1,000,000 in the previous year and reasonably expecting the same for the current year, as well as having five or fewer employees.

- Sign the form in the designated area, including your title and the name of your company.

- Provide your Federal Identification number, business address, city or town, state, and zip code.

- Enter the date of signing the form.

- Choose the type of certificate by checking either "Single Purchase Certificate" or "Blanket Certificate (for calendar year)." Make sure to select one option.

- Make a copy of the completed form for your records before submitting it to the vendor.

Similar forms

The Massachusetts ST-13 form is an important document for small businesses seeking an energy exemption. Several other forms serve similar purposes in different contexts. Here are six documents that share similarities with the ST-13 form:

- Form ST-2: This is a Sales Tax Resale Certificate. Like the ST-13, it allows businesses to purchase items without paying sales tax, provided those items are intended for resale rather than personal use.

- Form ST-5: This is a Sales Tax Exempt Use Certificate. It is similar to the ST-13 in that it allows for tax exemption, but it applies to items purchased for specific exempt purposes, such as manufacturing or research and development.

- Form ST-4: This is a Sales Tax Exempt Organization Certificate. Non-profit organizations use this form to claim exemption from sales tax on purchases, much like small businesses do with the ST-13.

- Form ST-12: This is a Sales Tax Exemption Certificate for Government Entities. Government agencies can use this form to make tax-exempt purchases, similar to how small businesses use the ST-13 for energy purchases.

New York ATV Bill of Sale: This form is crucial for both buyers and sellers of all-terrain vehicles in New York, facilitating accurate documentation of the transaction. To obtain the form, visit PDF Templates.

- Form ST-13C: This is a Certificate of Exemption for Certain Purchases. It is used for specific types of purchases that qualify for exemption, akin to the criteria set forth in the ST-13 for small businesses.

- Form ST-5C: This is a Certificate of Exemption for Charitable Organizations. Like the ST-13, it allows certain organizations to purchase items without sales tax, based on their qualifying status.