Official Massachusetts St 6 Template

Key takeaways

Here are some key takeaways about filling out and using the Massachusetts ST-6 form:

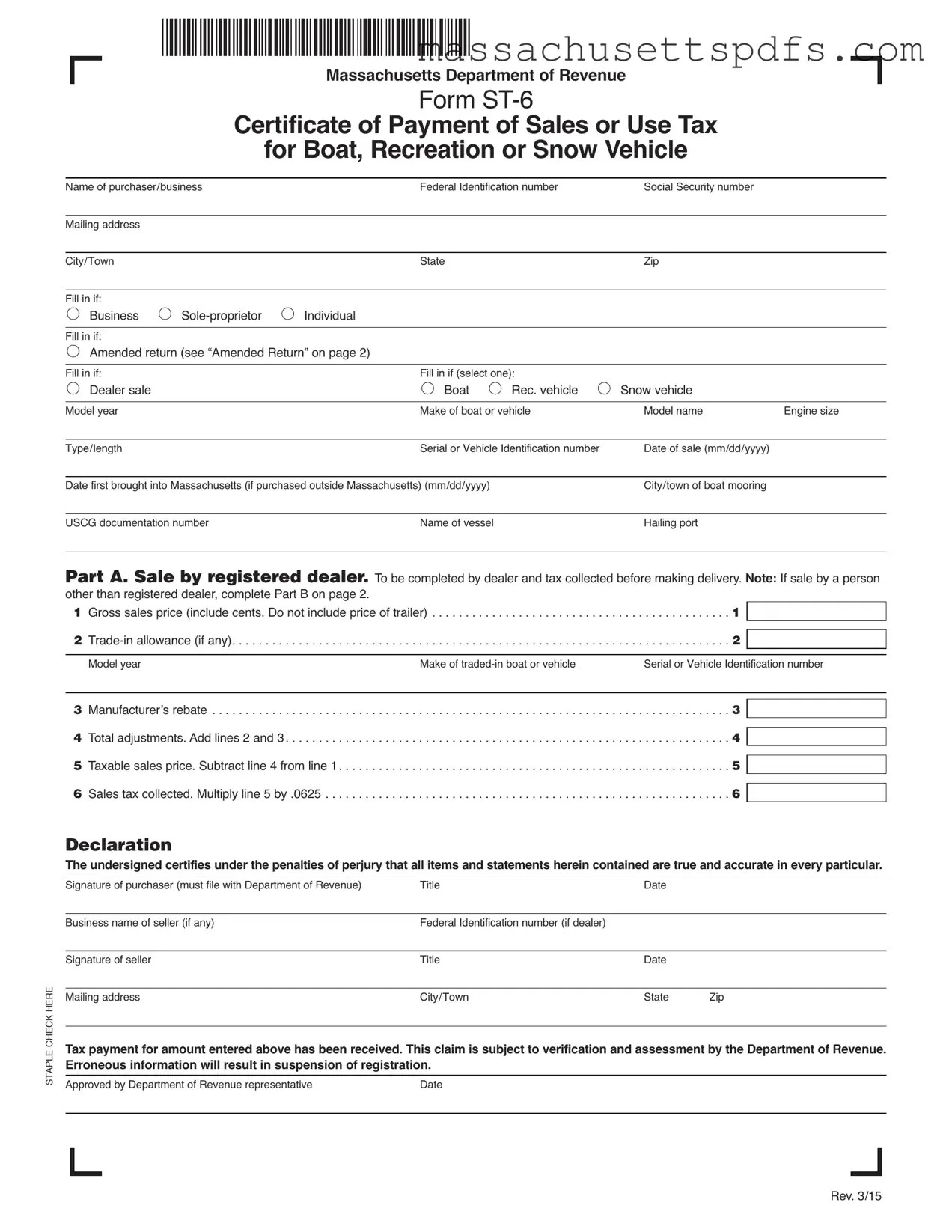

- Purpose: The ST-6 form certifies payment of sales or use tax for boats, recreational vehicles, or snow vehicles.

- Who Needs It: This form is required for transactions involving registered dealers and individuals selling these types of vehicles.

- Part A and Part B: The form has two sections: Part A for sales by registered dealers and Part B for sales by individuals not registered as dealers.

- Accurate Information: All information on the form must be true and accurate. Incorrect details can lead to penalties.

- Tax Payment Verification: The Department of Revenue will verify tax payments. Ensure that the payment is processed before submitting the form.

- Declaration: A declaration at the end of the form requires the signer to certify that all statements are correct under penalty of perjury.

- Consequences of Errors: Providing erroneous information can result in the suspension of registration, so double-check entries before submission.

Documents used along the form

The Massachusetts ST-6 form is a critical document used to certify the payment of sales or use tax for boats, recreational vehicles, or snow vehicles. When filing this form, individuals may also need to submit additional documents to ensure compliance with state regulations. Below are four commonly associated forms and documents that may be required alongside the ST-6.

- Form ST-2: This form is used to apply for a sales tax exemption. It is typically completed by organizations or individuals who qualify for tax-exempt status, such as non-profits or government entities. The ST-2 certifies that the purchase is exempt from sales tax under Massachusetts law.

- Vehicle Purchase Agreement: It is vital for both parties to have a clear understanding of the terms of the sale. For more information, you can refer to My PDF Forms.

- Form ST-5: The ST-5 form serves as a sales tax exemption certificate for certain purchases made by exempt organizations. It is essential for entities that regularly engage in tax-exempt transactions, allowing them to make purchases without incurring sales tax.

- Form ST-7: This document is a resale certificate that allows businesses to purchase goods intended for resale without paying sales tax at the point of sale. The ST-7 form is crucial for retailers who need to maintain their inventory without upfront tax costs.

- Form ST-6A: This form is a declaration of tax-exempt status for specific types of transactions. It is often used in conjunction with the ST-6 to clarify the nature of the sale and confirm that tax obligations have been met or are not applicable.

Understanding these forms and their purposes is essential for compliance with Massachusetts tax regulations. Proper documentation not only facilitates smoother transactions but also helps avoid potential penalties associated with erroneous filings.

Document Information

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts ST-6 form certifies payment of sales or use tax for boats, recreational vehicles, or snow vehicles. |

| Governing Law | This form is governed by Massachusetts General Laws Chapter 64H and Chapter 64I. |

| Part A | Part A of the form is for sales made by registered dealers. |

| Part B | Part B is used when the sale is made by a person who is not a registered dealer. |

| Verification | All claims made on the form are subject to verification by the Massachusetts Department of Revenue. |

| Penalties | Providing erroneous information may lead to suspension of registration and other penalties. |

Popular PDF Forms

Mass Tax Forms - Use this form if your business is located within a Convention Center Financing District.

When engaging in a sale or purchase of an RV in California, utilizing the RV Bill of Sale form is essential for both parties to safeguard their interests. This form not only captures vital information about the transaction but also ensures compliance with state regulations. To facilitate this process, further details and an editable version of the form can be found here: https://californiapdf.com/editable-rv-bill-of-sale.

Who Is Exempt From Ifta - There are penalties for perjury included, ensuring applicants understand the seriousness of their declarations.

Guide to Writing Massachusetts St 6

After completing the Massachusetts ST-6 form, you will be ready to submit it to the appropriate authorities. Make sure all information is accurate and complete to avoid any delays or issues with your submission. Here’s how to fill out the form step by step:

- Obtain the form: You can download the Massachusetts ST-6 form from the Massachusetts Department of Revenue website or request a physical copy.

- Fill in your business information: Start by entering your business name, address, and the type of business you operate. Ensure that all details are correct.

- Provide seller information: If you are a registered dealer, fill out the seller's name and their registration number. If not, skip to the next section.

- Complete Part A: If the sale is by a registered dealer, fill in the sales price, tax amount, and any other requested information in Part A.

- Complete Part B: If the sale is made by a person other than a registered dealer, provide the necessary details in Part B, including sales price and tax information.

- Review your entries: Double-check all the information you have entered to ensure accuracy. Mistakes can lead to delays or penalties.

- Sign the declaration: At the bottom of the form, sign and date the declaration to certify that the information provided is true and accurate.

- Submit the form: Send the completed form to the appropriate address listed on the form. Keep a copy for your records.

Similar forms

The Massachusetts ST-6 form is a certificate of payment for sales or use tax specifically for boats, recreational vehicles, or snow vehicles. This form plays a vital role in ensuring that the appropriate taxes have been paid, facilitating the registration process for these types of vehicles. Several other documents serve similar purposes in various contexts. Here are seven documents that share similarities with the Massachusetts ST-6 form:

- Sales Tax Exemption Certificate: This document allows purchasers to buy items without paying sales tax, provided they meet certain criteria. Like the ST-6, it verifies tax compliance for specific transactions.

- New York Bill of Sale: This form is essential for documenting the transfer of ownership of personal property, protecting both parties involved in the transaction. For further details, you can refer to PDF Templates.

- Form ST-2: This form is used for claiming an exemption from sales tax for certain purchases. It requires the buyer to provide information about the transaction, similar to the ST-6's requirement for proof of tax payment.

- Form ST-5: This is a resale certificate used by businesses to purchase goods intended for resale without paying sales tax. The process of verifying tax status parallels that of the ST-6.

- Form ST-4: This form is utilized for sales tax exemptions related to manufacturing and production. It requires detailed information about the buyer and the intended use of the items, akin to the ST-6's focus on tax payment verification.

- Form ST-7: This document is for claiming a refund of sales tax previously paid. It necessitates proof of payment and eligibility, similar to the ST-6's declaration of tax compliance.

- Form ST-8: This form certifies that a transaction is exempt from sales tax due to specific circumstances. It requires the same level of detail and verification as the ST-6 form.

- Form ST-9: This is an exemption certificate for certain nonprofit organizations. It allows them to make purchases without paying sales tax, paralleling the ST-6's function of confirming tax payment status.

Each of these forms plays a crucial role in the broader tax compliance landscape, ensuring that transactions are properly documented and that tax obligations are met. Understanding their similarities can help individuals and businesses navigate the complexities of tax regulations more effectively.