Official Massachusetts Ta 1 Template

Key takeaways

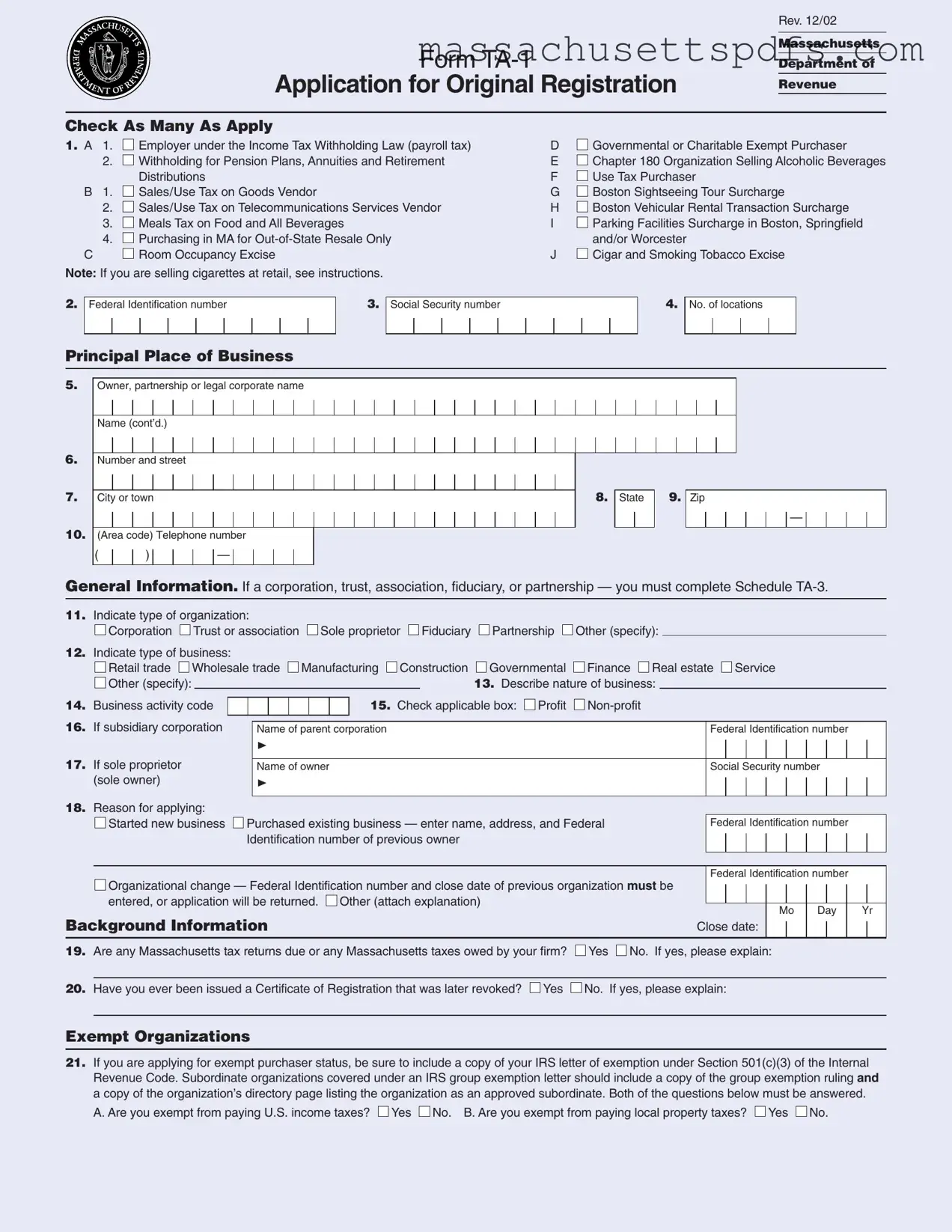

- Understand the Purpose: The Massachusetts TA-1 form is essential for businesses applying for original registration with the Department of Revenue. This includes various tax types such as income tax withholding, sales/use tax, and meals tax.

- Complete Required Sections: Fill out all relevant sections carefully. Include your federal identification number, social security number, and details about your business structure and activities.

- Check Applicable Boxes: Ensure you check all boxes that apply to your business type. This helps the Department of Revenue categorize your business correctly and determine your tax obligations.

- Provide Accurate Information: Double-check the information you provide. Inaccuracies can lead to delays or complications in your registration process.

- Submit on Time: After completing the form, mail it to the appropriate address. Timely submission is crucial to avoid penalties or issues with your business registration.

Documents used along the form

The Massachusetts TA-1 form is essential for businesses applying for original registration with the Department of Revenue. Along with this form, several other documents may be required to ensure compliance with state regulations. Below is a list of commonly used forms and documents that accompany the TA-1 form.

- Schedule TA-3: This form is necessary for corporations, trusts, associations, fiduciaries, or partnerships. It provides additional information about the organization's structure and tax obligations.

- Durable Power of Attorney form: To ensure your affairs are managed according to your wishes in case of incapacity, consider completing a Durable Power of Attorney form.

- IRS Letter of Exemption: Organizations applying for exempt purchaser status must include this letter. It confirms the organization's tax-exempt status under Section 501(c)(3) of the Internal Revenue Code.

- Schedule TA-4: If the business location requires specific tax forms to be sent elsewhere, this schedule must be completed. It allows for customization of tax form delivery.

- Sales Tax Registration Form: Businesses that will collect sales tax need to complete this form to register for a sales tax permit. It provides the state with necessary information about sales tax obligations.

- Employer Identification Number (EIN): This number is issued by the IRS and is required for tax reporting purposes. It is essential for businesses with employees or those structured as partnerships or corporations.

- Business Certificate: Also known as a DBA (Doing Business As) certificate, this document is necessary for businesses operating under a name different from their legal name. It is typically filed at the local level.

- Local Business Licenses: Depending on the type of business and its location, various local permits or licenses may be required. These documents ensure compliance with local regulations.

Gathering these documents along with the Massachusetts TA-1 form is crucial for a smooth registration process. Ensure all forms are completed accurately to avoid delays in approval.

Document Information

| Fact Name | Description |

|---|---|

| Form Purpose | The TA-1 form is used to apply for original registration for various tax purposes in Massachusetts. |

| Governing Law | The form is governed by Massachusetts General Laws, specifically Chapters 62B, 64G, 64H, and 64I. |

| Eligible Applicants | Individuals and entities such as corporations, partnerships, and trusts can apply using this form. |

| Types of Taxes | The form covers various taxes, including income tax withholding, sales/use tax, and meals tax. |

| Exempt Purchaser Status | Applicants seeking exempt purchaser status must provide an IRS letter of exemption under Section 501(c)(3). |

| Filing Requirements | Applicants must indicate whether they have any Massachusetts tax returns due or taxes owed when submitting the form. |

| Seasonal Businesses | Businesses that operate seasonally must check the appropriate box on the form to indicate this status. |

| Certification | By signing the form, applicants certify that the information provided is true and correct under penalty of perjury. |

| Mailing Instructions | The completed form must be mailed to the Massachusetts Department of Revenue, Data Integration Bureau. |

| Contact Information | Applicants must provide their principal place of business address and contact details on the form. |

Popular PDF Forms

Massachusetts Title Application - Specify the mooring or storage location for the vessel.

Mechanical Lien on Property - Correct and current contact information for the owner is needed on the form.

To facilitate a successful transaction, it's important to utilize the appropriate documentation, and the Dirt Bike Bill of Sale form is an essential part of this process in New York. This legal document not only ensures a clear record of ownership transfer but also provides both parties with the necessary protection. For those interested in obtaining the form, you can explore various options at PDF Templates.

Masshealth Pca Family Member - Timely submission of changes can prevent service disruptions.

Guide to Writing Massachusetts Ta 1

Filling out the Massachusetts TA-1 form is a necessary step for businesses seeking registration. Once completed, the form will be submitted to the Massachusetts Department of Revenue. Ensure that all information is accurate and complete to avoid delays in processing.

- Begin by checking all applicable boxes in Section 1. Choose from options such as employer under the Income Tax Withholding Law or sales/use tax vendor.

- Enter your Federal Identification number in Section 2.

- Provide your Social Security number in Section 3.

- Indicate the number of business locations in Section 4.

- Fill out the Principal Place of Business in Section 5, including the name, address, city or town, and telephone number.

- In Section 6, specify the state and zip code of your business location.

- Identify the type of organization in Section 11 by checking the appropriate box, such as Corporation or Sole Proprietor.

- In Section 12, indicate the type of business, such as Retail trade or Service.

- Describe the nature of your business in Section 13.

- Enter your business activity code in Section 14.

- Check the applicable box for profit or non-profit status in Section 15.

- If applicable, provide the name and Federal Identification number of the parent corporation in Section 16.

- For sole proprietors, fill in the owner's name and Social Security number in Section 17.

- State the reason for applying in Section 18, such as starting a new business or purchasing an existing one.

- Answer the questions in Section 19 regarding any Massachusetts tax returns due or previously revoked registration.

- If applying for exempt purchaser status, include necessary documentation as mentioned in Section 21.

- Complete the business location details in Sections 22-26, ensuring the address is accurate.

- Indicate where to send the certificate and tax forms in Sections 28 and 29.

- Check the appropriate boxes in Sections 30-33 regarding your business location and filing frequencies.

- Provide the date you were first required to withhold taxes in Section 34 and complete the subsequent sections with relevant dates.

- Finally, sign and date the form, certifying that the information provided is accurate.

Similar forms

- Form TA-3: This form is required for corporations, trusts, associations, fiduciaries, or partnerships. Similar to the TA-1, it gathers information necessary for tax registration but focuses on specific organizational details.

- Form ST-2: The Sales Tax Resale Certificate allows businesses to purchase goods tax-free if they intend to resell them. Like the TA-1, it is used to identify the purchaser's tax obligations.

- Form W-9: This IRS form is used to provide taxpayer identification information. Both the W-9 and TA-1 require the submission of a Federal Identification Number or Social Security Number for tax purposes.

- Form 941: This is the Employer's Quarterly Federal Tax Return. It is similar in that it reports payroll taxes withheld from employees, just as the TA-1 addresses withholding for income tax.

- Do Not Resuscitate Order Form: To ensure your medical preferences are respected, review the critical Do Not Resuscitate Order guidelines that outline your choices regarding resuscitation efforts.

- Form 1099: This form is used to report various types of income other than wages. Both the 1099 and TA-1 require accurate reporting of income for tax compliance.

- Form 990: Nonprofits use this form to report their financial activities. Similar to the TA-1, it includes information about the organization's tax-exempt status and financial details.