Attorney-Approved Massachusetts Operating Agreement Document

Key takeaways

When filling out and using the Massachusetts Operating Agreement form, keep the following key takeaways in mind:

- Understand the purpose of the Operating Agreement. It outlines the management structure and operational procedures for your business.

- Ensure all members of the business are included. Each member’s rights and responsibilities should be clearly defined.

- Specify the ownership percentages. This information is crucial for profit sharing and decision-making.

- Include provisions for adding or removing members. This allows for flexibility as the business evolves.

- Detail the decision-making process. Outline how decisions will be made and what constitutes a quorum for meetings.

- Consider dispute resolution methods. Having a plan in place can help avoid conflicts among members.

- Review the agreement regularly. Changes in the business or membership may require updates to the document.

- Consult with a legal professional if needed. They can provide guidance to ensure compliance with Massachusetts laws.

Documents used along the form

When forming a limited liability company (LLC) in Massachusetts, the Operating Agreement is a crucial document. However, several other forms and documents are often needed to ensure compliance with state laws and to facilitate smooth business operations. Below is a list of some common documents that accompany the Massachusetts Operating Agreement.

- Articles of Organization: This document is filed with the Massachusetts Secretary of the Commonwealth to officially create the LLC. It includes basic information about the company, such as its name, address, and the names of its members.

- Employer Identification Number (EIN): Obtained from the IRS, the EIN is necessary for tax purposes. It allows the LLC to hire employees, open a business bank account, and file tax returns.

- Initial Member/Manager Resolutions: These resolutions document the decisions made by the members or managers at the formation of the LLC. They may include the appointment of officers or the approval of bank accounts.

- Georgia Bill of Sale Form: To ensure accurate asset transfer, refer to our detailed Georgia bill of sale form instructions for all necessary legal documentation.

- Business Licenses and Permits: Depending on the nature of the business, various local, state, or federal licenses may be required. These ensure that the LLC operates legally within its industry.

- Operating Procedures Manual: While not always required, this manual outlines the day-to-day operations of the LLC. It can help clarify roles and responsibilities among members and streamline processes.

- Membership Certificates: These certificates serve as proof of ownership in the LLC. They can be issued to members to signify their stake in the company.

Having these documents in order can help ensure that the LLC operates smoothly and remains compliant with legal requirements. Each document plays a role in establishing the structure and governance of the business, making them essential for any new LLC in Massachusetts.

Form Characteristics

| Fact Name | Details |

|---|---|

| Definition | The Massachusetts Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | The agreement is governed by Massachusetts General Laws, Chapter 156C, which pertains to limited liability companies. |

| Purpose | It serves to define the rights and responsibilities of members and managers, providing clarity on how the LLC will operate. |

| Member Contributions | The agreement typically specifies the initial contributions made by each member, which can be in the form of cash, property, or services. |

| Voting Rights | Voting rights and procedures are often detailed in the agreement, allowing members to understand how decisions will be made. |

| Profit Distribution | It outlines how profits and losses will be allocated among members, which can differ from ownership percentages. |

| Amendments | The document usually includes provisions for how the agreement can be amended, ensuring flexibility as the business evolves. |

| Dispute Resolution | Many agreements incorporate methods for resolving disputes among members, such as mediation or arbitration, to avoid costly litigation. |

| Duration | The agreement can specify the duration of the LLC, whether it is perpetual or for a set period, depending on the members' preferences. |

| Compliance | While not required by law, having an operating agreement is highly recommended for compliance and to establish credibility with banks and investors. |

Other Common Massachusetts Forms

Ma Annual Report Filing - Upon approval, the Articles become public records and are accessible to anyone.

Sample Separation Agreement Massachusetts - The Divorce Settlement Agreement is crucial for ensuring all parties are on the same page.

To facilitate a smooth transaction, it is advisable to use the PDF Templates which provide a reliable format for the New York Boat Bill of Sale, ensuring all necessary details are included and legal requirements are met for both the buyer and seller.

Mass Gun Portal Transfer - The Firearm Bill of Sale helps clarify the terms of the sale to both parties.

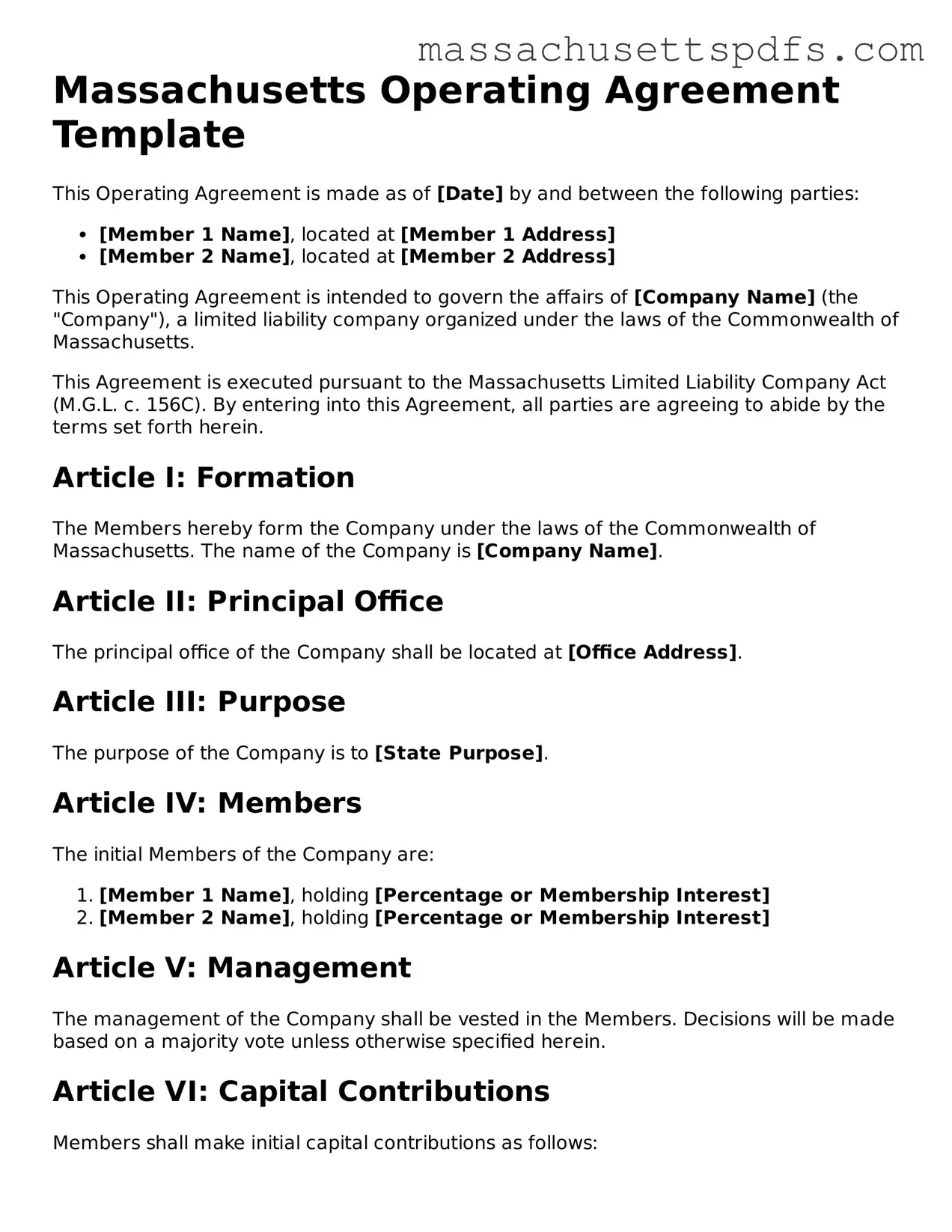

Guide to Writing Massachusetts Operating Agreement

Completing the Massachusetts Operating Agreement form is an important step for organizing your business. After filling out the form, you will need to ensure that all members of the business understand their roles and responsibilities. This agreement will serve as a foundational document for your business operations.

- Begin by downloading the Massachusetts Operating Agreement form from the appropriate state website or legal resource.

- Fill in the name of your business at the top of the form. Make sure it matches the name registered with the state.

- Provide the principal office address of the business. This should be a physical address, not a P.O. Box.

- List the names and addresses of all members involved in the business. Ensure that each member’s information is accurate.

- Specify the purpose of the business. This should be a clear and concise statement outlining what the business will do.

- Indicate the duration of the business. If it is intended to exist indefinitely, you can state that as well.

- Detail the management structure. Indicate whether the business will be managed by its members or by appointed managers.

- Outline the capital contributions of each member. This includes initial investments and any future financial commitments.

- Describe how profits and losses will be allocated among members. Specify the percentage or method of distribution.

- Include any additional provisions that may be relevant to your business, such as voting rights or procedures for adding new members.

- Review the completed form for accuracy and completeness. Make any necessary corrections before finalizing.

- Have all members sign and date the form to indicate their agreement to the terms outlined.

- Keep a copy of the signed agreement for your records and distribute copies to all members.

Similar forms

The Operating Agreement is a vital document for any limited liability company (LLC), outlining the management structure and operational guidelines. Several other documents share similarities with the Operating Agreement, each serving a unique purpose in the realm of business governance and organization. Here are nine such documents:

- Bylaws: Like an Operating Agreement, bylaws govern the internal management of a corporation. They detail the roles and responsibilities of officers and directors, similar to how an Operating Agreement outlines the duties of members in an LLC.

- Divorce Settlement Agreement: To ensure clear terms during divorce proceedings, utilize our Colorado Divorce Settlement Agreement resources, which outline the essential aspects of asset division and custody arrangements.

- Partnership Agreement: This document establishes the terms of a partnership, including profit sharing and decision-making processes. Both agreements aim to clarify the relationship between parties involved and provide a framework for resolving disputes.

- Shareholder Agreement: A shareholder agreement is essential for corporations with multiple shareholders. It outlines the rights and obligations of shareholders, akin to how an Operating Agreement details the rights of LLC members.

- Articles of Incorporation: This foundational document is filed with the state to legally establish a corporation. While it provides basic information about the business, the Operating Agreement goes further by detailing operational procedures.

- Operating Plan: An operating plan outlines the day-to-day functions and strategies of a business. Like an Operating Agreement, it provides guidance on how the business should operate, though it may focus more on tactical aspects.

- Non-Disclosure Agreement (NDA): While primarily focused on confidentiality, an NDA can complement an Operating Agreement by protecting sensitive information shared among members, ensuring that proprietary information remains secure.

- Employment Agreement: This document outlines the terms of employment for individuals within the organization. Similar to an Operating Agreement, it defines roles and responsibilities, ensuring clarity in expectations.

- Membership Certificate: This certificate serves as proof of ownership in an LLC, much like shares in a corporation. It is often referenced in the Operating Agreement to identify members and their respective ownership stakes.

- Business Plan: While primarily focused on the vision and strategy for the business, a business plan can work in tandem with an Operating Agreement by providing context for the operational guidelines established within the agreement.

Understanding these documents and their similarities can help business owners navigate the complexities of forming and managing their enterprises more effectively.