Attorney-Approved Massachusetts Promissory Note Document

Key takeaways

When filling out and using the Massachusetts Promissory Note form, consider the following key takeaways:

- Understand the Purpose: A promissory note is a written promise to pay a specified amount of money to a designated person at a certain time.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Specify the Amount: Clearly write the loan amount in both numbers and words. This reduces the chance of any misunderstandings.

- Set the Interest Rate: If applicable, specify the interest rate. Be aware that Massachusetts has laws regarding maximum interest rates.

- Determine the Repayment Schedule: Outline how and when payments will be made. This can include monthly payments, a lump sum, or any other arrangement.

- Include Late Fees: If late fees apply, specify the amount and the conditions under which they will be charged.

- Signatures Are Essential: Ensure that both parties sign the document. This validates the agreement and makes it legally binding.

- Keep Copies: After the note is signed, both parties should keep a copy for their records. This helps in case of any disputes.

- Consult Legal Help if Needed: If there are any uncertainties, consider seeking legal advice. This can help clarify obligations and rights.

Documents used along the form

When entering into a financial agreement involving a promissory note in Massachusetts, several other forms and documents may be utilized to ensure clarity and legal compliance. Each of these documents serves a unique purpose in the transaction, helping to protect the interests of all parties involved.

- Loan Agreement: This document outlines the terms of the loan, including the amount borrowed, interest rate, repayment schedule, and any collateral involved. It provides a comprehensive framework for the lending relationship.

- Security Agreement: If the loan is secured by collateral, this agreement specifies the assets that back the loan. It details the rights of the lender in case of default and the procedures for reclaiming the collateral.

- Personal Guarantee: In situations where a business is borrowing money, a personal guarantee may be required from the business owner. This document holds the individual personally responsible for the debt if the business defaults.

- Disclosure Statement: This form provides essential information about the loan terms, including any fees and the total cost of the loan. It ensures that borrowers fully understand their obligations before signing.

- Amortization Schedule: This document breaks down the repayment plan into regular installments, showing how much of each payment goes toward principal and interest. It helps borrowers plan their finances effectively.

- Notice of Default: Should the borrower fail to meet the repayment terms, this document serves as a formal notification of default. It outlines the consequences and any actions the lender may take.

- Boat Bill of Sale: To facilitate the transfer of boat ownership, it's crucial to utilize the PDF Templates which provide a clear structure for documenting the transaction. This form protects both parties’ rights and clarifies expectations.

- Release of Liability: Once the loan is paid in full, this document formally releases the borrower from any further obligations under the promissory note, providing peace of mind and legal closure.

Understanding these accompanying documents can enhance the borrowing experience and provide necessary protections for both lenders and borrowers. Each form plays a crucial role in establishing a clear, transparent, and legally binding agreement.

Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money to a designated person or entity at a specified time. |

| Governing Law | The Massachusetts Uniform Commercial Code (UCC), specifically Chapter 106, governs promissory notes in Massachusetts. |

| Parties Involved | The two main parties are the maker (the person who promises to pay) and the payee (the person to whom the payment is owed). |

| Interest Rate | The note may specify an interest rate. If not, Massachusetts law allows for a default rate of 6% per year. |

| Payment Terms | Payment terms should be clearly stated, including the due date and any installment plans if applicable. |

| Enforceability | A properly executed promissory note is enforceable in court, provided it meets all legal requirements. |

| Signature Requirement | The maker's signature is required for the note to be valid. A witness or notary is not mandatory but can add credibility. |

Other Common Massachusetts Forms

Lady Bird Deed Massachusetts - Discussing your plan with family can help avoid surprises later on.

The Colorado Divorce Settlement Agreement is vital for couples navigating the complex landscape of divorce. For more insights on this critical process, explore our informative guide on the important aspects of Divorce Settlement Agreement documentation. This type of form lays out the framework for asset division and custody arrangements, ensuring both parties have a clear understanding of their responsibilities.

Mass Bill of Sale Car - This document can help track the history of ownership for collectibles or valuable items.

Guide to Writing Massachusetts Promissory Note

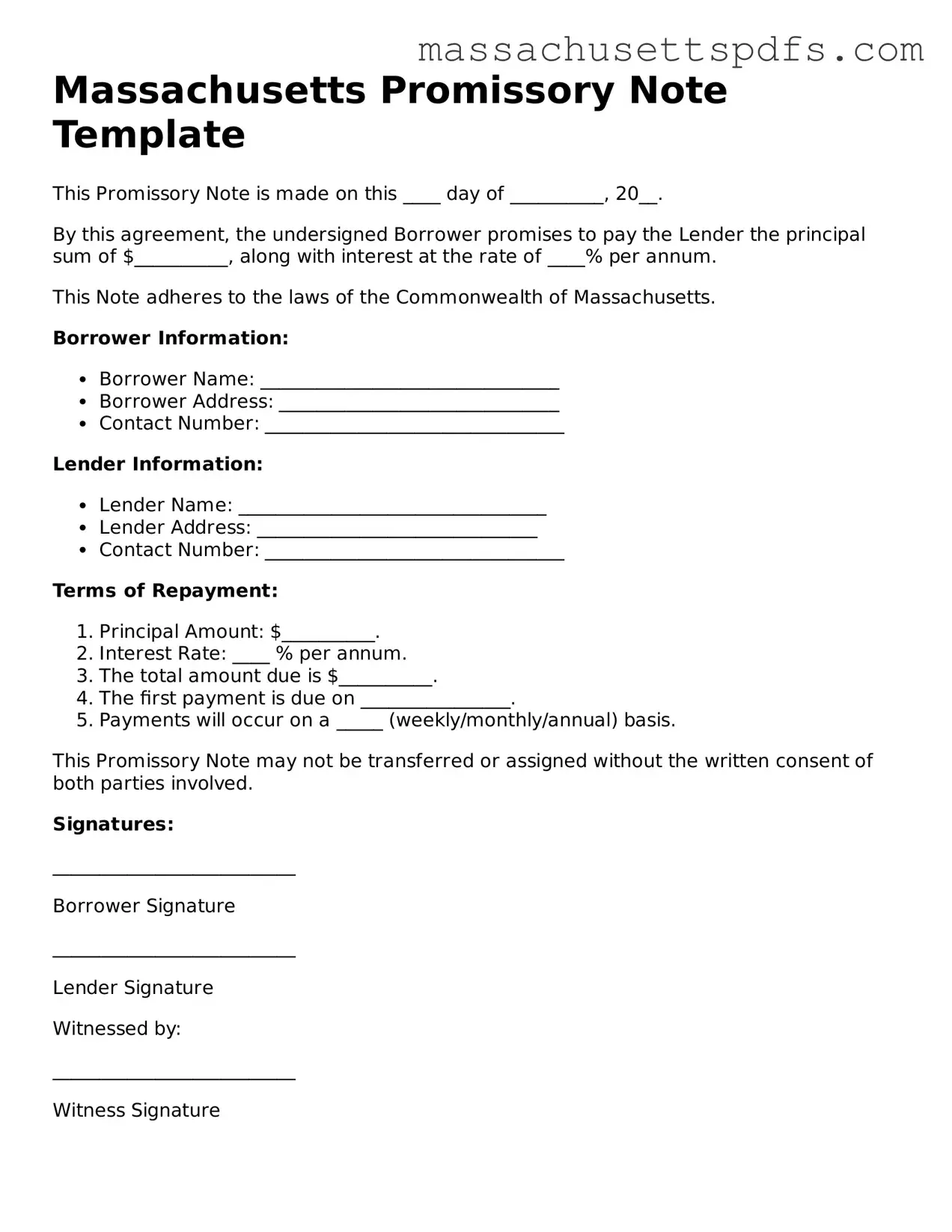

Once you have the Massachusetts Promissory Note form in front of you, it’s important to fill it out accurately to ensure all parties are protected. Follow these steps carefully to complete the form correctly.

- Begin by entering the date at the top of the form.

- Provide the name and address of the borrower in the designated section.

- Next, enter the name and address of the lender.

- Clearly state the principal amount being borrowed in the specified area.

- Indicate the interest rate, if applicable, and specify whether it is fixed or variable.

- Fill in the repayment terms, including the due date and payment schedule.

- Include any late fees or penalties for missed payments.

- Sign the document where indicated, ensuring that the signature matches the name provided.

- If applicable, have a witness sign the form as well.

- Make copies for both the borrower and lender for their records.

Similar forms

The Promissory Note is a crucial financial document, but it shares similarities with several other documents in the realm of finance and lending. Below is a list of ten documents that resemble a Promissory Note, highlighting their similarities.

- Loan Agreement: Like a Promissory Note, a loan agreement outlines the terms of a loan, including the repayment schedule and interest rate. Both documents establish a legal obligation for repayment.

- Mortgage: A mortgage secures a loan with real property. Similar to a Promissory Note, it includes terms for repayment and can lead to foreclosure if the borrower defaults.

- Credit Agreement: This document details the terms under which a borrower can access credit. It resembles a Promissory Note by specifying repayment terms and conditions.

- Trailer Bill of Sale: The California Trailer Bill of Sale form is a crucial document for transferring ownership of a trailer, serving as evidence of the transaction and outlining the agreed terms. For more details, visit https://californiapdf.com/editable-trailer-bill-of-sale.

- Installment Agreement: An installment agreement outlines a payment plan for a debt. It shares the same fundamental purpose of a Promissory Note: to ensure repayment over time.

- Security Agreement: This document pledges collateral for a loan. Like a Promissory Note, it establishes the terms under which a borrower must repay the loan.

- Bill of Exchange: A bill of exchange is a written order to pay a specified amount. It functions similarly to a Promissory Note by creating a legal obligation to pay a certain sum.

- Lease Agreement: A lease agreement outlines terms for renting property, including payment obligations. It is similar to a Promissory Note in that it establishes a commitment to make payments over time.

- Personal Guarantee: A personal guarantee is a promise made by an individual to repay a debt if the primary borrower defaults. It resembles a Promissory Note by creating a personal obligation for repayment.

- Debt Settlement Agreement: This document outlines the terms for settling a debt for less than the full amount owed. It shares similarities with a Promissory Note in terms of establishing payment terms.

- Letter of Credit: A letter of credit is a financial document issued by a bank guaranteeing payment to a seller. It resembles a Promissory Note by ensuring that payment will be made under specified conditions.

Understanding these documents can help clarify the obligations and rights involved in financial transactions. Each document serves its purpose but shares common elements with the Promissory Note.