Attorney-Approved Massachusetts Quitclaim Deed Document

Key takeaways

- Understand the Purpose: A Quitclaim Deed transfers ownership of property without guaranteeing that the title is clear. It’s often used between family members or in divorce settlements.

- Gather Necessary Information: Before filling out the form, collect details such as the names of the grantor (seller) and grantee (buyer), property description, and the date of the transfer.

- Use Accurate Property Descriptions: Clearly describe the property being transferred. This includes the address and any relevant parcel numbers to avoid confusion.

- Signatures Are Essential: Both the grantor and a witness must sign the deed. In some cases, notarization may also be required to validate the document.

- File the Deed Properly: After completing the Quitclaim Deed, it must be filed with the appropriate county registry of deeds. This step is crucial for the transfer to be legally recognized.

- Check for Local Requirements: Different counties may have specific rules or additional forms needed when filing a Quitclaim Deed. Research local regulations to ensure compliance.

- Consider Tax Implications: Transferring property may have tax consequences. Consult a tax professional to understand any potential liabilities or benefits associated with the transfer.

Documents used along the form

When transferring property in Massachusetts, the Quitclaim Deed is a commonly used document. However, several other forms and documents often accompany it to ensure a smooth transaction. Below are four important documents that are frequently used alongside the Quitclaim Deed.

- Property Transfer Tax Declaration: This document is required to report the sale price of the property and calculate any applicable transfer taxes. It provides the state with essential information regarding the transaction.

- Affidavit of Title: This sworn statement affirms that the seller holds clear title to the property. It helps protect the buyer by confirming that there are no undisclosed liens or claims against the property.

- Statement of Information: Often requested by title companies, this form gathers personal information about the parties involved in the transaction. It assists in identifying any potential issues with the title and ensures that all parties are properly documented.

- Divorce Settlement Agreement: To ensure a clear understanding of asset division, refer to the comprehensive Divorce Settlement Agreement resources that outline essential terms and conditions.

- Mortgage or Loan Documents: If the buyer is financing the purchase, these documents outline the terms of the loan. They include details about the amount borrowed, interest rates, and repayment schedules, which are crucial for both the lender and the buyer.

Each of these documents plays a vital role in the property transfer process. They help clarify the transaction, protect the interests of both parties, and ensure compliance with state laws. Understanding their importance can lead to a smoother and more secure real estate transaction.

Form Characteristics

| Fact Name | Description |

|---|---|

| Definition | A Quitclaim Deed is a legal document used to transfer ownership of real estate without guaranteeing the title's validity. |

| Governing Law | Massachusetts General Laws, Chapter 183, Section 5 governs the use of Quitclaim Deeds in Massachusetts. |

| Parties Involved | The deed involves two parties: the grantor (seller) and the grantee (buyer). |

| No Warranty | The Quitclaim Deed offers no warranties regarding the title, meaning the grantee accepts the property "as-is." |

| Common Uses | It is often used in situations like transferring property between family members or clearing up title issues. |

| Recording Requirement | The deed must be recorded at the local Registry of Deeds to provide public notice of the property transfer. |

| Signature Requirement | The grantor must sign the deed in the presence of a notary public for it to be valid. |

| Tax Implications | While there may be no tax implications for the transfer itself, it is advisable to check local laws for potential fees. |

Other Common Massachusetts Forms

Massachusetts Boat Bill of Sale - A Motor Vehicle Bill of Sale is a legal document recording the sale of a vehicle between a buyer and a seller.

In order to facilitate a smooth transaction for your boat sale, it's essential to use the appropriate documentation, such as the PDF Templates, which provide a comprehensive and legally sound Boat Bill of Sale form tailored for New York, ensuring that all necessary details are accounted for in the transfer process.

Living Will Massachusetts - This document emphasizes the importance of informed consent in healthcare decision-making.

Massachusetts Prenuptial Contract - Having a prenup can provide peace of mind as couples plan their future together.

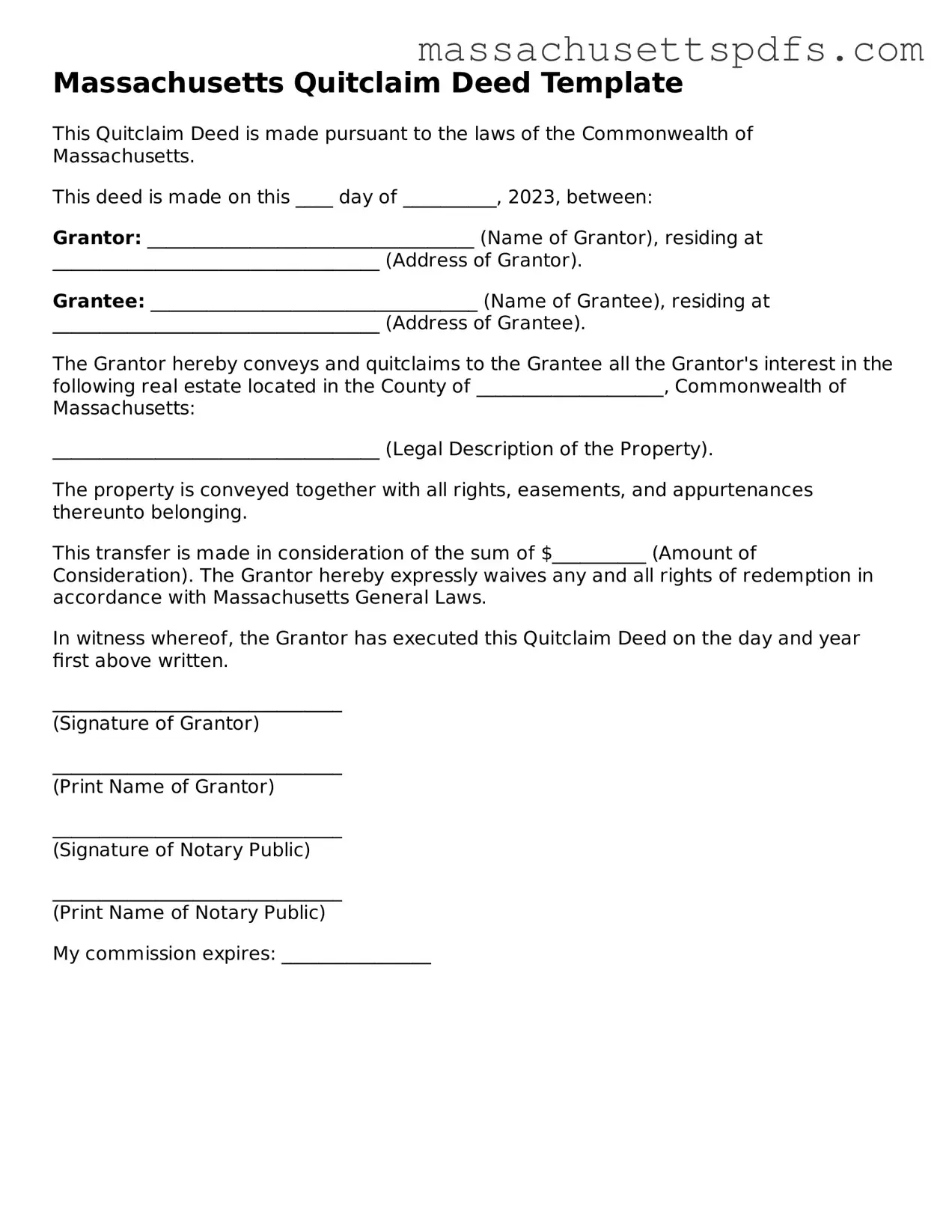

Guide to Writing Massachusetts Quitclaim Deed

Once you have the Massachusetts Quitclaim Deed form in hand, it's time to fill it out accurately. Completing this form requires careful attention to detail, as it involves essential information about the property and the parties involved. After you fill it out, you will need to sign it in front of a notary public before recording it with the appropriate local authority.

- Obtain the form: Download the Massachusetts Quitclaim Deed form from a reliable source or request a hard copy from your local registry of deeds.

- Identify the Grantor: In the first section, write the full name and address of the person transferring the property. This individual is known as the grantor.

- Identify the Grantee: In the next section, enter the full name and address of the person receiving the property. This individual is referred to as the grantee.

- Provide property details: Clearly describe the property being transferred. Include the address and any relevant identifying information, such as the parcel number or legal description.

- Consideration amount: Indicate the amount of money or other consideration being exchanged for the property. This is often a nominal amount, such as $1, unless otherwise specified.

- Sign the document: The grantor must sign the form in the designated area. Ensure the signature matches the name provided earlier.

- Notarization: Have the signature notarized by a licensed notary public. The notary will verify the identity of the grantor and witness the signing of the document.

- Record the deed: Finally, take the completed and notarized Quitclaim Deed to the local registry of deeds to record it. There may be a small fee for recording the document.

Similar forms

When dealing with property transfers, the Quitclaim Deed is just one of several documents that serve similar purposes. Understanding these documents can help you navigate real estate transactions more effectively. Here’s a list of ten documents that share similarities with the Quitclaim Deed:

- Warranty Deed: This document guarantees that the seller holds clear title to the property and has the right to sell it. Unlike a Quitclaim Deed, it offers more protection to the buyer.

- Grant Deed: A Grant Deed conveys property and includes assurances that the property has not been sold to anyone else and is free from undisclosed encumbrances.

- Durable Power of Attorney: This legal document grants a chosen person or entity the authority to manage your affairs if you become unable to do so yourself, making it crucial for ensuring your wishes are honored, especially in times of unexpected incapacity. For more information, consider the Durable Power of Attorney form.

- Deed of Trust: This document is used in real estate transactions where a borrower conveys property to a trustee as security for a loan. It outlines the terms of the loan and can lead to foreclosure if the borrower defaults.

- Lease Agreement: While primarily for renting, a lease can transfer rights to use a property temporarily. It’s not a transfer of ownership but involves similar legal considerations.

- Bill of Sale: This document transfers ownership of personal property, similar to how a Quitclaim Deed transfers real property. It provides proof of the transaction.

- Affidavit of Title: This sworn statement assures the buyer that the seller has clear title to the property. It is often used in conjunction with other deeds.

- Power of Attorney: This legal document allows one person to act on behalf of another in property transactions. It can facilitate the transfer of property rights, similar to a Quitclaim Deed.

- Property Transfer Tax Affidavit: Required in many states, this document details the transfer of property and may be necessary for tax purposes, akin to the record-keeping function of a Quitclaim Deed.

- Partition Deed: Used when co-owners of property decide to divide their interests, this document outlines how the property will be split, similar to how a Quitclaim Deed transfers interests among parties.

- Revocable Living Trust: This document allows individuals to manage their assets during their lifetime and can facilitate the transfer of property upon death, serving a similar purpose to a Quitclaim Deed.

Understanding these documents can empower you to make informed decisions in property transactions. Each serves its own purpose but shares the common goal of facilitating the transfer of property rights.