Attorney-Approved Massachusetts Small Estate Affidavit Document

Key takeaways

When dealing with the Massachusetts Small Estate Affidavit form, it’s essential to understand its purpose and how to fill it out correctly. Here are some key takeaways:

- The Small Estate Affidavit is used to transfer assets of a deceased person when the total value is under $25,000.

- Only certain individuals, such as heirs or beneficiaries, can file this affidavit.

- All debts and funeral expenses must be settled before using the affidavit to claim assets.

- The form must be notarized, ensuring that all signatures are verified.

- It is important to provide accurate information about the deceased, including their full name and date of death.

- Attach a copy of the death certificate to the affidavit when submitting it.

- Once filed, the affidavit serves as proof of ownership for the assets listed.

- Filing the affidavit does not require court involvement, making the process quicker and less expensive.

Documents used along the form

When navigating the process of settling a small estate in Massachusetts, several forms and documents may be necessary alongside the Massachusetts Small Estate Affidavit. Each of these documents plays a crucial role in ensuring that the estate is handled properly and efficiently. Below is a list of commonly used forms that may accompany the Small Estate Affidavit.

- Death Certificate: This official document confirms the passing of the individual whose estate is being settled. It is essential for proving the person's death and is often required by financial institutions and courts.

- Will: If the deceased left a will, it outlines their wishes regarding the distribution of assets. While not always necessary for small estates, it can provide clarity on the decedent's intentions.

- List of Assets: A comprehensive inventory of the deceased's assets helps to establish the value of the estate. This document may include bank accounts, real estate, personal property, and other valuables.

- Affidavit of Heirship: This document identifies the heirs of the estate. It is particularly useful if there are questions about who is entitled to inherit, especially in cases where the deceased did not leave a will.

- Non-disclosure Agreement: It's crucial to consider a https://nydocuments.com/ when handling sensitive information within the estate settlement process to protect confidentiality.

- Creditors' Claims: A record of any debts or claims against the estate is necessary for settling outstanding obligations. This document ensures that all creditors are accounted for before distributing the remaining assets.

- Tax Returns: Copies of the deceased's final tax returns may be required to ensure that all tax obligations are met. This helps avoid potential issues with the IRS or state tax authorities.

- Notice to Creditors: This document is often published to inform potential creditors of the estate's administration. It serves to protect the estate from future claims by ensuring that all creditors have an opportunity to come forward.

- Petition for Settlement: In some cases, a formal petition may be required to request the court's approval for the distribution of assets. This document outlines the proposed distribution and seeks legal confirmation.

Understanding these documents can help streamline the process of settling a small estate. Being prepared with the necessary paperwork can alleviate stress and ensure that the estate is managed in accordance with the law. Always consider seeking professional guidance to navigate this important process effectively.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts Small Estate Affidavit allows heirs to claim assets of a deceased person without going through formal probate if the estate is below a certain value. |

| Eligibility | To use this affidavit, the total value of the estate must be less than $25,000, excluding real estate. |

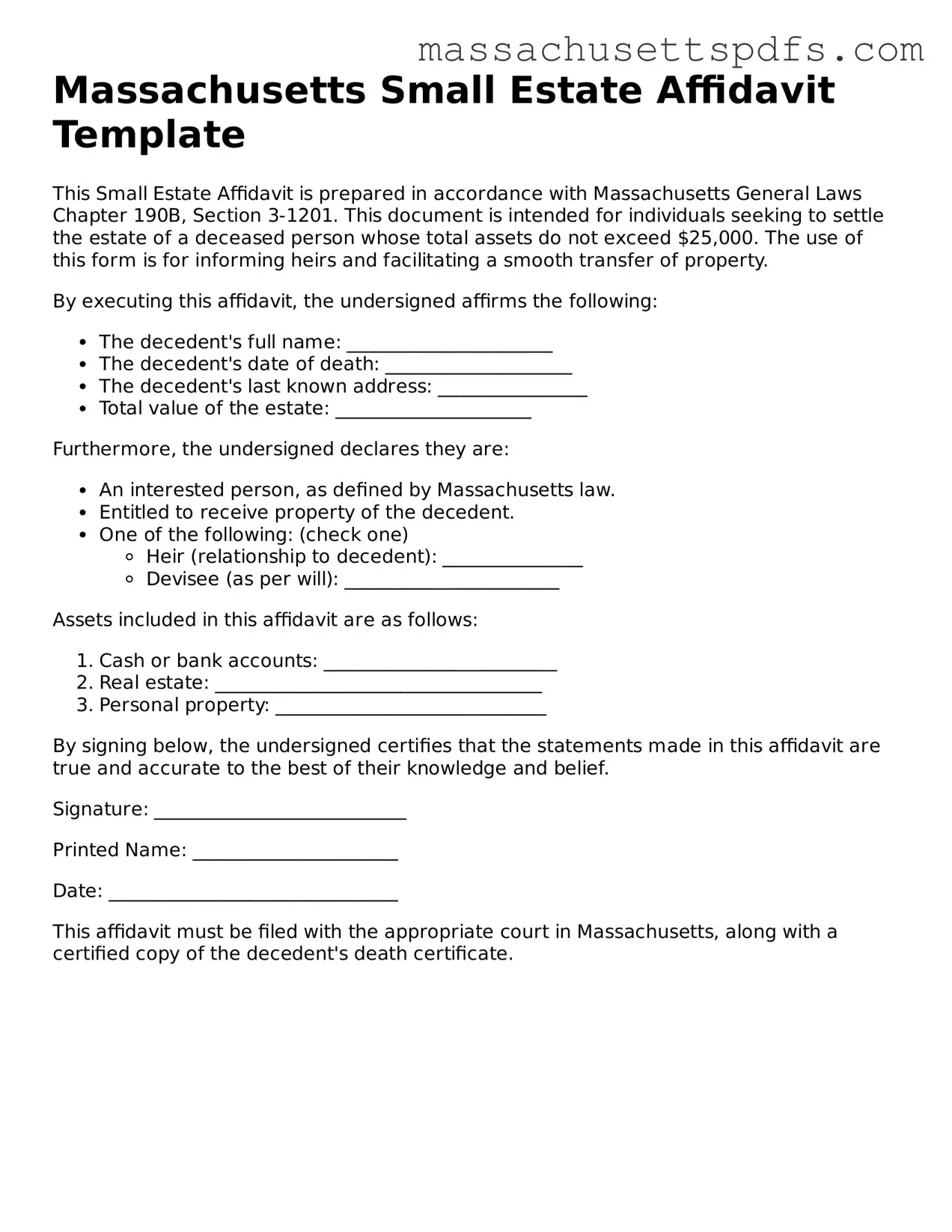

| Governing Law | The Small Estate Affidavit is governed by Massachusetts General Laws, Chapter 190B, Section 3-1201. |

| Required Information | The affidavit must include details about the deceased, the heirs, and a list of assets being claimed. |

| Filing Process | Heirs must complete the affidavit and present it to the financial institution or entity holding the deceased's assets to claim them. |

Other Common Massachusetts Forms

Last Will and Testament Form Massachusetts - It can be beneficial to consult an attorney when drafting your Last Will and Testament.

When purchasing an RV, it's vital to have the appropriate documents in place to guarantee a smooth transaction. The California RV Bill of Sale form not only captures crucial details of the sale but also serves as a protective measure for both the buyer and seller. For those looking for a reliable source to obtain this document, you can visit californiapdf.com/editable-rv-bill-of-sale to access an editable version that meets legal requirements.

Bill of Sale Massachusetts Rmv - Allows for clearer communication of trailer details between parties.

Living Will Massachusetts - This document can provide peace of mind for both the individual and their family during difficult times.

Guide to Writing Massachusetts Small Estate Affidavit

Once you have the Massachusetts Small Estate Affidavit form, you can begin the process of completing it. This form allows you to claim assets of a deceased person without going through probate. Follow these steps to ensure you fill it out correctly.

- Gather necessary information about the deceased, including their full name, date of death, and last known address.

- Identify the assets you are claiming. Make a list of all the assets that fall under the small estate limit.

- Fill in your personal information as the affiant. This includes your name, address, and relationship to the deceased.

- Complete the section detailing the deceased’s debts. List any known debts or indicate if there are none.

- Sign the affidavit in front of a notary public. Ensure that the notary witnesses your signature and stamps the document.

- Make copies of the completed affidavit for your records and any parties involved.

- Submit the affidavit to the appropriate institution or entity holding the deceased's assets, such as a bank or financial institution.

Similar forms

- Last Will and Testament: This document outlines an individual’s wishes regarding the distribution of their assets after death. Like the Small Estate Affidavit, it serves to facilitate the transfer of property, but it typically requires probate proceedings to validate the will.

- Bill of Sale: This document legally transfers ownership of personal property, ensuring both parties' interests are protected. For a convenient template, check out PDF Templates.

- Trust Agreement: A trust agreement establishes a legal entity to hold and manage assets on behalf of beneficiaries. Similar to the Small Estate Affidavit, it allows for the direct transfer of property without the need for probate, thus simplifying the process of asset distribution.

- Letters of Administration: This document is issued by a court to appoint an administrator for a deceased person's estate when there is no will. While the Small Estate Affidavit allows for a simplified process, Letters of Administration initiate a more formal probate process to manage the estate.

- Power of Attorney: A power of attorney grants an individual the authority to act on another's behalf in financial or legal matters. While it is used during a person's lifetime, it shares similarities with the Small Estate Affidavit in that both documents can streamline the management of assets and facilitate transactions.