Attorney-Approved Massachusetts Transfer-on-Death Deed Document

Key takeaways

When considering the Massachusetts Transfer-on-Death Deed form, it’s important to understand its purpose and how to use it effectively. Here are some key takeaways:

- The Transfer-on-Death Deed allows property owners to designate beneficiaries who will inherit their property upon their death.

- This deed does not require the property to go through probate, simplifying the transfer process for heirs.

- Property owners can revoke or change the deed at any time during their lifetime, providing flexibility.

- To be valid, the deed must be signed by the property owner and recorded with the local registry of deeds.

- It’s crucial to include a legal description of the property to avoid any confusion regarding what is being transferred.

- Beneficiaries named in the deed do not have any rights to the property until the owner passes away.

- Consulting with a legal professional can help ensure that the deed is filled out correctly and meets all legal requirements.

- Once recorded, the deed becomes a public document, so privacy regarding property ownership may be affected.

Documents used along the form

The Massachusetts Transfer-on-Death Deed allows individuals to transfer property to beneficiaries upon their death without going through probate. This deed is often used in conjunction with several other forms and documents to ensure a smooth transfer of assets. Below is a list of common documents that may be needed alongside the Transfer-on-Death Deed.

- Will: A legal document that outlines how a person wishes their assets to be distributed after death. It can complement the Transfer-on-Death Deed by addressing any assets not covered by the deed.

- Beneficiary Designation Forms: These forms are used for accounts like life insurance or retirement plans. They specify who will receive the assets directly, bypassing probate.

- Real Estate Purchase Agreement: This document outlines the terms of a real estate sale. It is important if the property being transferred is sold before the owner’s death.

- Dirt Bike Bill of Sale: This form is crucial for transferring ownership of dirt bikes in New York. It not only protects both parties during the transaction but also ensures all relevant details are documented. You can find more information and download the necessary PDF Templates to assist in this process.

- Affidavit of Heirship: This document helps establish the heirs of a deceased person. It can be useful if there are questions about who is entitled to inherit property.

- Power of Attorney: A legal document that grants someone the authority to act on another’s behalf. This can be important for managing property before the owner’s death.

- Property Tax Records: These documents provide information about property taxes owed on the real estate. They can be important for beneficiaries to understand their responsibilities.

- Title Insurance Policy: This policy protects against losses from defects in the title to the property. It is essential to have clear title before transferring ownership.

Using these documents together with the Transfer-on-Death Deed can help ensure that property transfers smoothly and according to the owner’s wishes. It is advisable to consult with a legal professional to ensure all necessary documents are in order.

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The Massachusetts Transfer-on-Death Deed allows property owners to transfer real estate to a designated beneficiary upon their death, avoiding probate. |

| Governing Law | This deed is governed by Massachusetts General Laws Chapter 190B, Section 2-401. |

| Execution Requirements | The deed must be signed by the property owner in the presence of a notary public and recorded with the appropriate registry of deeds. |

| Revocation | Property owners can revoke the Transfer-on-Death Deed at any time before their death, provided the revocation is executed and recorded. |

| Beneficiary Rights | The designated beneficiary has no rights to the property until the owner's death, ensuring the owner retains full control during their lifetime. |

Other Common Massachusetts Forms

Last Will and Testament Form Massachusetts - Writing a will can provide peace of mind for both you and your loved ones.

The Motor Vehicle Bill of Sale document is a critical asset when transferring ownership, often detailed in a comprehensive guide to protect buyers and sellers alike. For further information on its structure and importance, refer to this useful motor vehicle bill of sale template.

Limited Power of Attorney for Motor Vehicle - Allows someone to troubleshoot vehicle issues and resolve paperwork for you.

Buying a House in Massachusetts - Indicates whether the property is sold "as-is" or with repairs required.

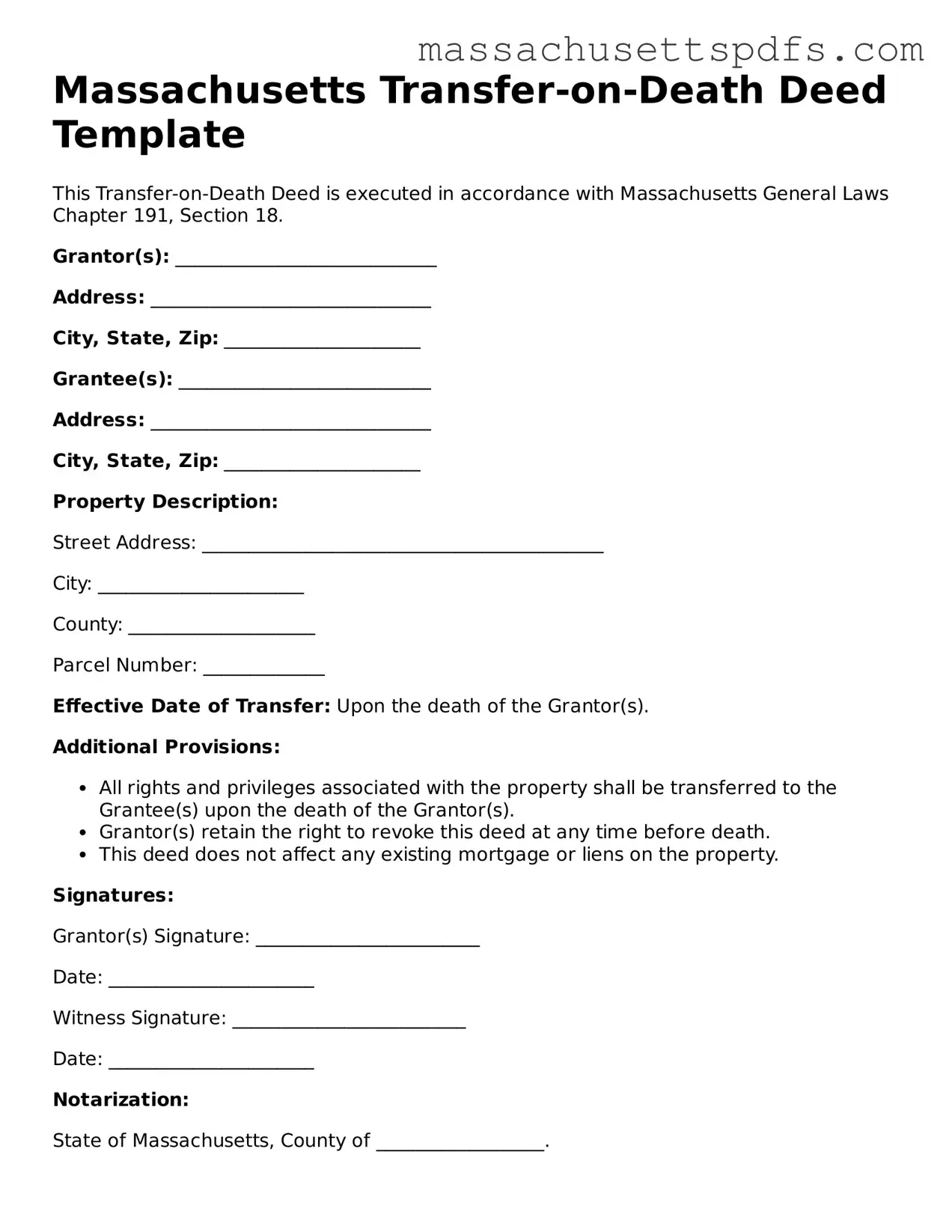

Guide to Writing Massachusetts Transfer-on-Death Deed

After completing the Massachusetts Transfer-on-Death Deed form, you will need to file it with the appropriate registry of deeds in your county. This step ensures that your intentions regarding the transfer of property are officially recorded and recognized. Following these steps will help you accurately fill out the form.

- Begin by downloading the Massachusetts Transfer-on-Death Deed form from the official state website or obtaining a physical copy from your local registry of deeds.

- Fill in your name as the transferor. This is the person who currently owns the property.

- Provide your address. This should be the address where you currently reside.

- Next, enter the name of the beneficiary. This is the person who will receive the property upon your passing.

- Include the beneficiary's address to ensure they can be properly identified.

- Identify the property being transferred. This includes a description of the property, such as the address and any relevant details that clearly define the property boundaries.

- Sign and date the form. Your signature indicates your agreement to the terms of the deed.

- Have the form notarized. A notary public must witness your signature to validate the document.

- Finally, submit the completed form to the registry of deeds in your county. Be sure to keep a copy for your records.

Similar forms

The Transfer-on-Death Deed (TOD Deed) is a unique legal instrument that allows individuals to transfer real property to beneficiaries upon their death without the need for probate. Several other documents serve similar purposes or share characteristics with the TOD Deed. Below is a list of eight such documents, highlighting their similarities.

- Will: A will outlines how a person's assets will be distributed after their death. Like a TOD Deed, it allows for the transfer of property but typically requires probate, which can be a lengthy process.

- Living Trust: A living trust allows individuals to manage their assets during their lifetime and specify how those assets should be distributed after death. Both documents facilitate the transfer of property without going through probate.

- Beneficiary Designation: Commonly used for financial accounts and insurance policies, this document allows individuals to designate beneficiaries who will receive assets directly upon their death, similar to the TOD Deed's direct transfer of real estate.

- Joint Tenancy with Right of Survivorship: This property ownership arrangement allows co-owners to automatically inherit the property upon the death of one owner. Like the TOD Deed, it bypasses probate, ensuring a smooth transition of ownership.

- Transfer-on-Death Registration for Securities: This form allows individuals to designate beneficiaries for their investment accounts. Similar to the TOD Deed, it enables the direct transfer of assets without probate.

- Life Estate Deed: A life estate deed grants someone the right to live in or use a property during their lifetime, with the property passing to a designated beneficiary after their death. It shares the aspect of predetermined transfers after death with the TOD Deed.

- Payable-on-Death Accounts: These accounts allow individuals to name beneficiaries who will receive funds directly upon their death, similar to how a TOD Deed allows for the transfer of real property.

- Employment Verification Form: Essential for confirming an individual’s job status, the Employee Verification for smooth processing provides lenders and agencies with crucial employment details.

- Durable Power of Attorney: While primarily a tool for managing someone's affairs during their lifetime, a durable power of attorney can also facilitate the transfer of property upon death, particularly when combined with other estate planning documents.